What Next for Bitcoin Price After the $30,000 Rally

Bitcoin (BTC) price regained $30,000 on October 20th, erasing massive liquidity losses that followed Monday's erroneous Cointelegraph news report. On-chain analysis outlines factors that could propel BTC to the $40,000 milestone.

Bitcoin prices hit $30,000 on Friday as markets reacted to several macro events, including Greyscale's fresh application for the Spot Bitcoin ETF with the US Securities and Exchange Commission. Will the bullish investors wait to recover the $40,000?

Bitcoin's rising dominance could push prices towards $40,000.

Bitcoin price surpassed $30,000 on Friday, bringing its weekly gains to double digits. However, important indicators show that the price of BTC may rise in the coming days.

First, Bitcoin Dominance (BTC.D) has been up for 10 consecutive days since October 10. This is very unusual because historically, after BTC makes huge gains and crosses a critical price level, investors start zooming in and diversifying funds into altcoins. in their strategic development.

However, the gloomy macroeconomic landscape and events surrounding the Middle East crisis make investors reluctant to switch to altcoins at this time.

This recent trend of BTC.D confirms the thesis that Bitcoin's “safe haven” status may further accelerate the next price rally.

The chart below shows that when the crisis erupted on October 7, Bitcoin's crypto market share stood at 51%. After two weeks of heightened tension, Bitcoin gained more ground, with BTC.D rising to 52.71% on October 20.

Bitcoin Dominance (BTC.D) holds the percentage of the total cryptocurrency market value that Bitcoin currently holds. As the Bitcoin market surges amid depressed macro conditions, it shows that investors are showing a lower risk appetite and are increasingly turning to BTC as a safe haven bet.

In the year This event was observed around February 24, 2022, after the outbreak of war between Russia and Ukraine. Bitcoin dominance in the crypto market jumped from 44% to 48% in two weeks.

After the initial price drop from the war FUD, the price of BTC rose from $20,200 to $30,400.

The chart above shows that the current Bitcoin price rally and BTC.D trends are similar to the events that took place after the war between Russia and Ukraine.

If history repeats itself, another 50% bounce could send Bitcoin price above the $40,000 mark in the coming weeks.

Long-term holders have made big purchases since the previous all-time high.

The continuation of large BTC transfers from weak hands to long-term holders is another important on-chain indicator that could further accelerate Bitcoin's price rally.

According to key data points from Glassnode, long-term holders had 11 million BTC, while short-term holders' supply stood at 5 million BTC, with the Bitcoin price peaking at $69,000 in November 2021.

Since then, long-term investors (blue line) have gained more than 3 million BTC, and their balance reached 14.89 million BTC as of October 19. Meanwhile, the supply of short-term traders (red line) has been reduced by more than half, to 2.4 million BTC.

This clearly shows the enormous wealth that has shifted from weak hands to many resilient investors in the last 2 years.

Wallets that hold their crypto assets without moving for more than a year are considered long-term holdings. This long-term increase in BTC volume confirms the continued belief in Bitcoin as a safe haven asset.

With less BTC, it creates artificial market scarcity by dominating short-term traders. Therefore, further increase in Bitcoin dominance and overall market demand could accelerate the price rally towards $40,000.

BTC Price Prediction: The $40,000 target will materialize.

From a chain perspective, increasing market dominance and long-term owner buying could push the price of BTC further towards $40,000.

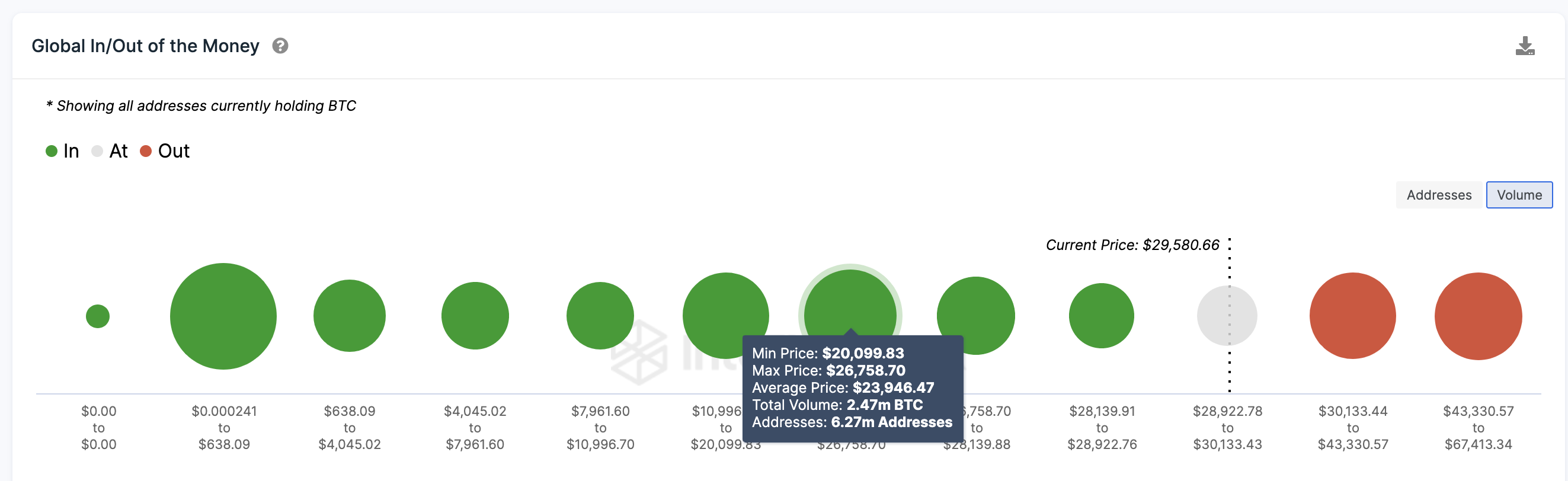

However, global in/out data showing current Bitcoin holders' entry price distribution shows key resistance levels.

BTC's initial resistance around $30,130 shows that it is very important. As shown below, 2.08 million addresses bought 842,330 BTC at an average price of $30,133.

But a critical breakout from $30,200 could open the door to a big rally above $35,000.

Still, bears could undermine this crash forecast if the price of Bitcoin turns below $25,000. However, the chart shows that 6.27 million addresses bought 2.47 million coins at a high of $26,750.

If those wallets continue to HODL, the price of BTC could enter a quick price recovery.

But if the bears support that wall of buying, the long-term price of Bitcoin could fall to around $25,000.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions.