What to expect from Bitcoin (BTC) after the January merger?

After falling to a low of $38,505 on January 23, the price of Bitcoin (BTC) has risen over the past two weeks.

Despite the increase, BTC is moving slightly below the critical horizontal and Fib resistance levels. Will it rise or fall?

Bitcoin struggles with long-term resistance

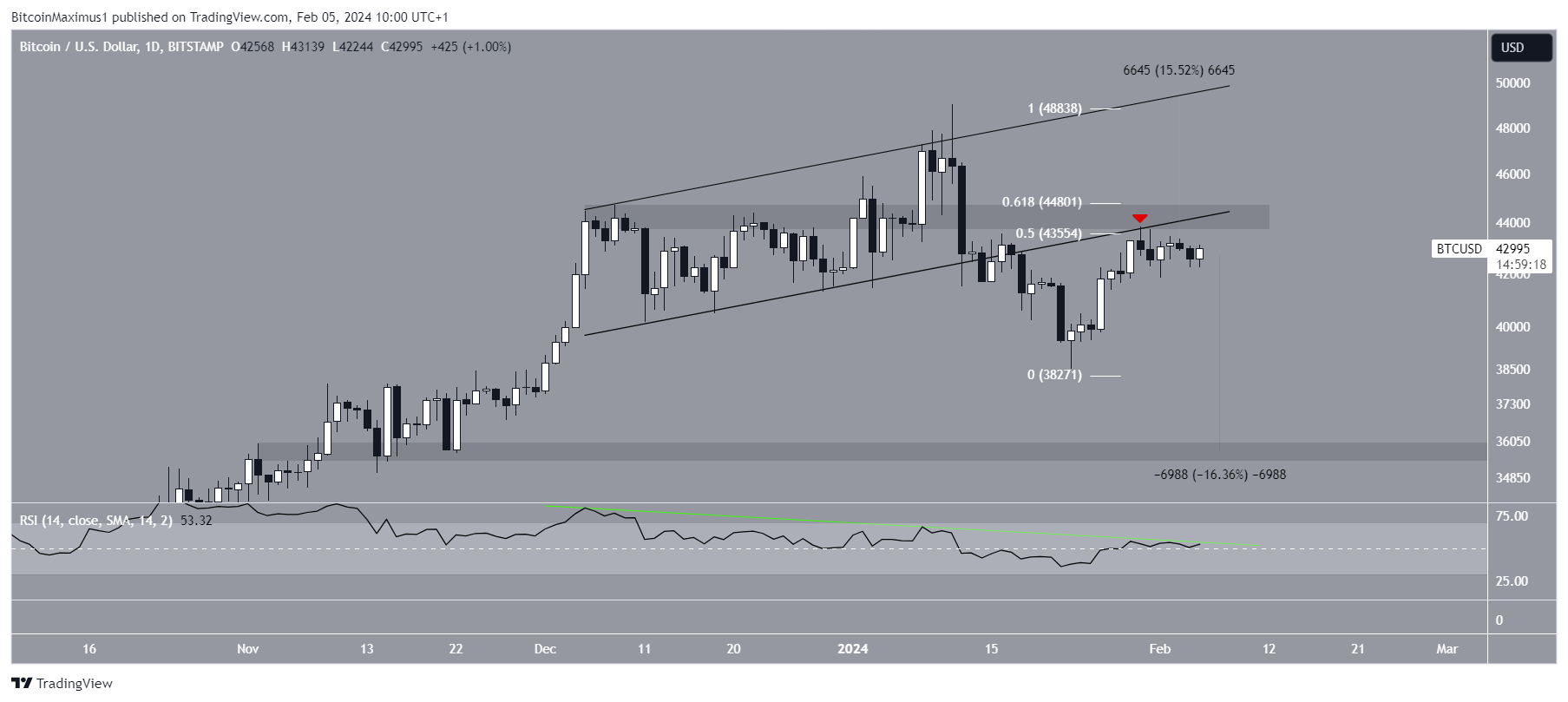

The weekly time frame technical analysis shows that the price of Bitcoin has declined after reaching a high of $49,050 in January. The high was made right at the 0.618 Fib retracement resistance level.

That same week, Bitcoin formed a bearish weekly candle (red icon) and has since fallen. While BTC has rallied slightly over the past two weeks, it is still trading at the 0.5 Fib retracement resistance level.

The weekly Relative Strength Index (RSI) provides a dull reading. Market traders use the RSI as a momentum indicator to identify overbought or oversold conditions and decide whether to stock or sell the asset.

A reading above 50 and an upward trend indicates that bulls still have an advantage, while readings below 50 indicate the opposite. After reaching overbought territory, the weekly RSI fell below 70 (red circle), signaling a bearish trend.

Read more: Where to trade Bitcoin futures

What do analysts say?

Cryptocurrency traders and analysts at X have a mixed view of future BTC trends. CryptoMichNL believes that the price will rise to $50,000 before the correction.

Fred Krueger suggests it will hit a new all-time high before halving, which will be in April. He tweeted:

GBTC selling pressure on BTC price is mostly over. The 1 billion sold in Gemini will be returned as a coin, so that's market neutral. On the other hand, the new9 is constantly accumulating. A total of 175 thousand coins are worth 7.5 billion. This in 18 trading sessions. In the next 30 to 60 days, there are 20 to 40 trading sessions. I estimate that this will generate between 4 and 6 billion new dollars in revenue. With a market cap of 850 billion this is pretty easy to see.

XForceGlobal believes that BTC will first clear the highs and descend to the lows. BluntzCapital has the same idea, and they both use Elliott Wave Theory to come to this conclusion.

Read more: Who will have the most Bitcoins in 2024?

BTC Price Prediction: Is The Correction Over?

The technical analysis of the daily timeframe shows that the price of BTC will move below the critical convergence of the resistance levels between $43,600 and $44,800.

The resistance is formed by the 0.5-0.618 Fib retracement resistance levels, the horizontal resistance area and the support trend line of the ascending parallel channel. The daily RSI legitimizes this resistance position. The indicator has reached the bearish divergence trend line (green line) that preceded the overall downward movement.

Read more: What is a Bitcoin ETF?

Therefore, the trend of BTC is considered to be bearish unless the price rises and the $43,600-$44,800 resistance is closed. In this case, a 16% drop to the nearest support at $35,500 is expected.

Despite this bearish Bitcoin price forecast, a breakout from the area at $49,500 could lead to a 16% rise to the channel's resistance trendline.

Click here for BeInCrypto's latest crypto market analysis.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.