When Solana crash warning support falls, eye on $200

Solana (SOL), the world's fifth largest cryptocurrency by market value, is set for a lower momentum as its daily chart flashes a warning sign. On December 3, 2024, sentiment across the cryptocurrency landscape appears bleak, with assets struggling to gain momentum.

Solana (SOL) technical analysis and upcoming levels

In the middle of the price correction phase, Solana (SOL) failed to hold the critical support level and fell below the $227 mark. According to expert technical analysis, after hitting the all-time high, SOL entered a consolidation phase, forming a bearish head and shoulders price action pattern.

In today's bear or rather price-correction, position, SOL broke the neckline of the bear pattern and tried to close the daily candle below it. Based on the recent price action and historical progress, if SOL closes the daily candle below the $226 level, there is a strong possibility that it will drop by 10% to reach the $200 mark in the coming days.

On the positive side, SOL is trading above the 200 Exponential Moving Average (EMA) on the daily time frame, indicating an uptrend. Meanwhile, the Relative Strength Index (RSI) suggests a possible rally in the coming days, as the price is near the oversold zone.

The cost of 159 million dollars

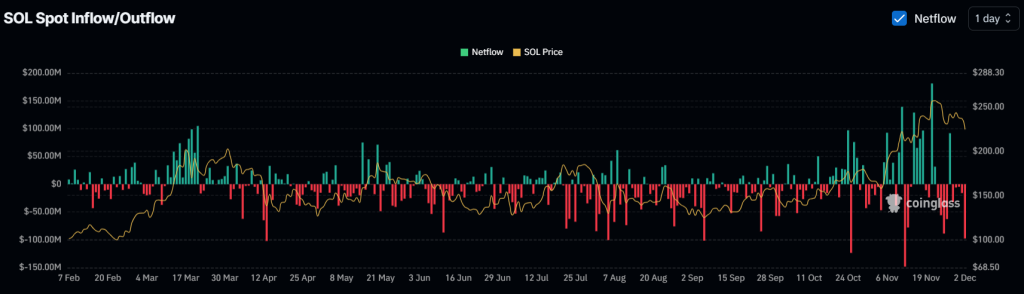

Despite the perspective, whales and institutions have shown strong faith and interest in the altcoin, according to on-chain analysis company Coinglass. SOL spot entry/exit data shows that in the last four days, the exchange has seen a huge SOL withdrawal of $159 million.

In the context of cryptocurrency, a breakout refers to whales withdrawing tokens from exchanges to their wallets, which is considered a bullish sign and suggests a possible upside rally in the coming days.

Considering the outflow, SOL investors can take advantage of the current market sentiment and lower prices by acquiring additional assets.

Current price momentum

At press time, SOL is trading near $222, having gained 6.55% in price over the past 24 hours. At the same time, the trading volume increased by 101 percent, which shows that the participation of traders and investors is higher compared to the previous day.