When traders expect a strong trend, the price of PEPE will decrease

The price of PEPE is showing signs of weakening. Key technical indicators show that the recent uptrend is losing steam. As a result, the coin has fallen almost 10% in the last 24 hours.

Additionally, short-term price indicators such as EMA lines remain neutral, indicating that PEPE may test important support levels in the near term. With the potential to go down, a resurgence of bullish momentum could push PEPE to try key defensive measures.

PEPE ADX indicates that the current trend is fading

PEPE's ADX dropped to 17.89, down from a high of 58.52 on September 30, when PEPE traded at $0.00001147. ADX (Average Direction Indicator) is a key technical indicator used to measure the strength of a trend. That measure is regardless of whether it is aggressive or depressed.

When the ADX is above 25, it indicates a strong market trend. This indicates that momentum is driving the price in a clear direction. On the other hand, when the ADX falls below 20, it indicates a weak or nonexistent trend.

That indicates a decision phase where there is no sign of consolidation or clear price action. Currently, with PEPE's ADX at 17.89, this indicates that the market is consolidating without strong directional momentum.

Read more: Pepe (PEPE) Price Prediction 2024/2025/2030

Such a low ADX value indicates that the price may be in a narrow band, neither gaining nor losing much ground. This is consistent with the idea that PEPE is in a period of reduced volatility, being one of the largest meme coins in the market.

A sharp decline in the ADX has faded the strong trend seen at the end of September and confirms that PEPE has no clear directional power. This makes it vulnerable to sideways trading or minor fluctuations until a new trend emerges.

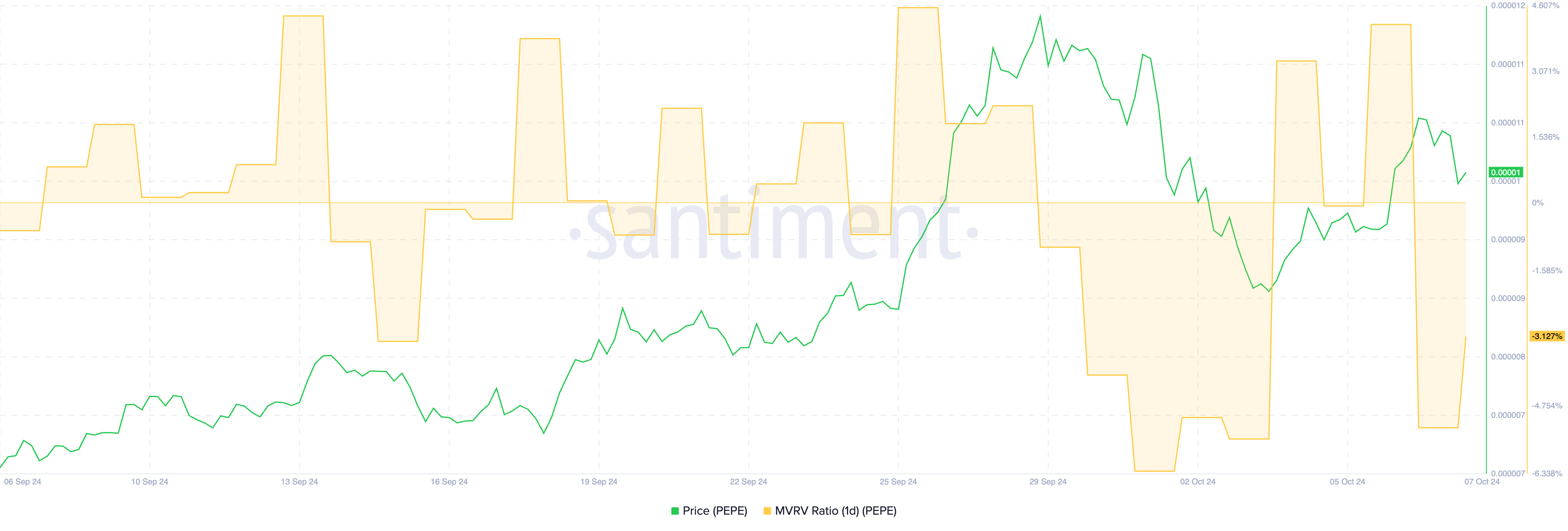

The PEPE MVRV ratio is now negative.

PEPE's 1D MVRV Ratio is currently at -3.12%, indicating that on average, near-term investors are holding PEPE at a loss relative to its current value. The 1D MVRV (Market Value to Realized Value) ratio is a key metric used to measure whether a token is overvalued or undervalued by comparing the market value of an asset to its realized value.

When the MVRV ratio is positive, it indicates that the holders are generally in profit, while a negative ratio indicates that they are in loss. Extremely positive values indicate that a sell-off is imminent as investors may start taking profits.

On the flip side, a negative MVRV ratio, like the current one of -3.12%, suggests that the market is undervalued. This may present a buying opportunity as sellers have mostly exhausted themselves. Dropping from 4.17% to -3.12% in just one day is quite a reversal. This shows that many investors turn from profit to loss in a short period of time.

This sudden change suggests a sudden drop in sales or price, possibly due to market volatility or external factors affecting the PEPE price. This can create more cautious behavior in the market as traders wait for the MVRV to stabilize or reverse upward again.

PEPE Price Forecast: A Future Downtrend?

The PEPE EMA lines are neutral, reflecting the market's decision and not clearly showing an upward or downward trend. EMA (Exponential Moving Average) lines are widely used in technical analysis to smooth price data and identify trends by giving more weight to recent price movements.

Short-term EMA lines react quickly to price changes, while long-term EMA lines give a broader view of the trend. In PEPE's case, the short-term EMAs are still above the long-term. This is generally a bullish sign, but they are starting to go down.

Read more: 5 best PEPE wallets for beginners and experienced users

This downtrend suggests momentum is weakening, and a potential reversal may be on the horizon. If the current price action continues in this neutral and slightly bearish direction, PEPE may test the support level at $0.00000835 in the coming days. If this support fails to hold, the price may drop further, with the next strong support at $0.00000776.

However, if bullish momentum picks up again, PEPE price may challenge the resistance at $0.0000119. Currently, the market is in a state of uncertainty, and traders are waiting for a clearer signal to determine the next move.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.