Which platform builds the best AI agents? We try ChatGPT, Claude, Gemini and more.

10 months ago Benito Santiago

You can do anything with AI agents: search for information in your document library, build code, scrape the web, gain deep insight and deep analysis of complex data, and more. You can also have multiple agents specializing in different tasks and work hand-in-hand with your own dedicated digital staff.

So how hard is it to do? If a normal person wants to build their own AI financial advisor, for example, which platform would serve them best? No API, no weird coding, no Github—we wanted to see how good the best AI companies are at creating AI agents without the user having to have high technical skills.

Of course you get what you pay for. In this case, we wanted to see how easy it was for the average person to configure an agent, and the correlation between the quality of output each provided.

Our test pitted five heavyweights against each other: ChatGPT, Claude, Huggingface, Mistral AI, and Gemini. Every platform has got the same basic guidelines for creating a financial advisor.

The test only focused on out-of-the-box capabilities. Whether the agents can handle a typical situation—in this case, helping someone balance $25,000 in investments against $30,000 in debt. We want to see how well they did by analyzing the trading chart. We avoided using additional tools that would increase the productivity of the agents and instead tried to take the simplest approach.

TL;DR Here's what we found out and how we positioned the models:

Table of Contents

ToggleStage steps

1) Open AI's GPT (8.5/10)

Ease of Setup: 4/5 Quality of Results: 4.5/5

ChatGPT is a very balanced platform that offers sophisticated agent creation with both guided and manual options to meet the needs of total noobs and less experienced users.

While a recent interface update buried some features in menus, the platform excels at translating complex user requirements into actionable agents. We tested the model by building a financial advisor that demonstrated superior contextual awareness and structured problem-solving skills by providing detailed yet consistent strategies for debt management and investment allocation.

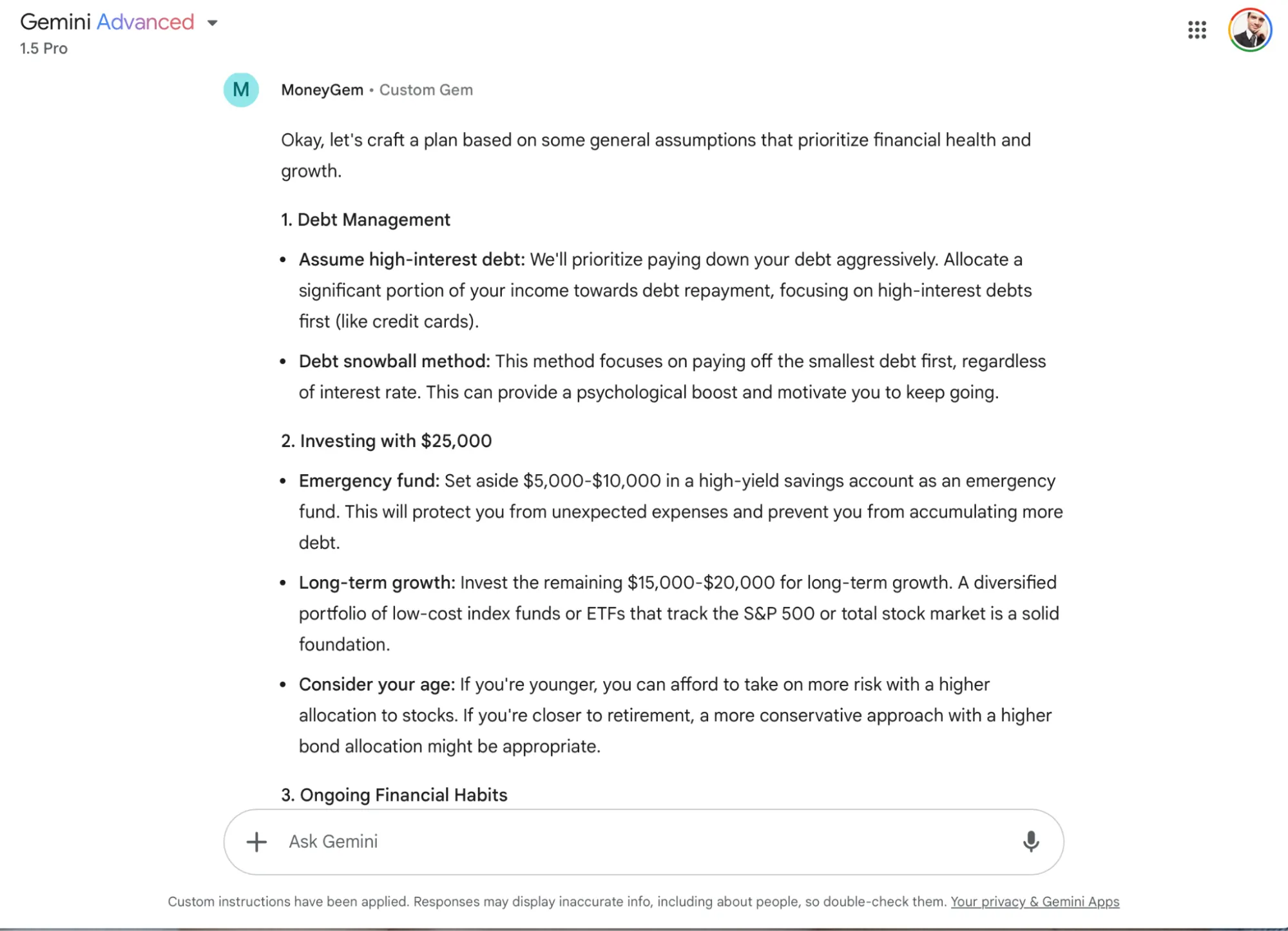

2) Google Gemini (7/10)

Ease of Setup: 4/5 Quality of Results: 3/5

Gemini stands out with its polished, intuitive interface and excellent error handling. Although more detailed incentives are required for better results, a straightforward interpretation of the guidelines produces consistent, predictable results.

The agent's approach to financial advice emphasizes gathering context before making recommendations, reflecting professional experiences. However, it may be overly conservative in zero-rate responses.

3) Hug Chat (6.5/10)

Ease of Setup: 2/5 Quality of Results: 4.5/5

The open source platform offers unmatched customization and model selection options. This is great for those looking for granular control over every aspect, but not really for those looking for simplicity. (Think of it as comparing a Linux system to macOS). Its sophisticated time-horizon framework and practical tool integration demonstrate advanced capabilities.

We built a clean agent with no extra functionality. We used Nvidia's Nemomotron as the LLM base, and it was good enough to match ChatGPT in output quality. Not bad for an open source camp.

4) Cloud (5.5/10)

Ease of Setup: 2.5/5 Quality of Results: 3/5

The Anthroponic platform excels in certain areas, particularly tasks that require extensive context processing and code translation. The minimal interface covers advanced capabilities, but the “options” instruction field can confuse users.

Our agent was very conservative and vague in his advice, but demonstrated strong risk awareness and strategic thinking. It needs more careful stimulation to really squeeze its potential, but given the same conditions for testing, it's not fair to react quickly.

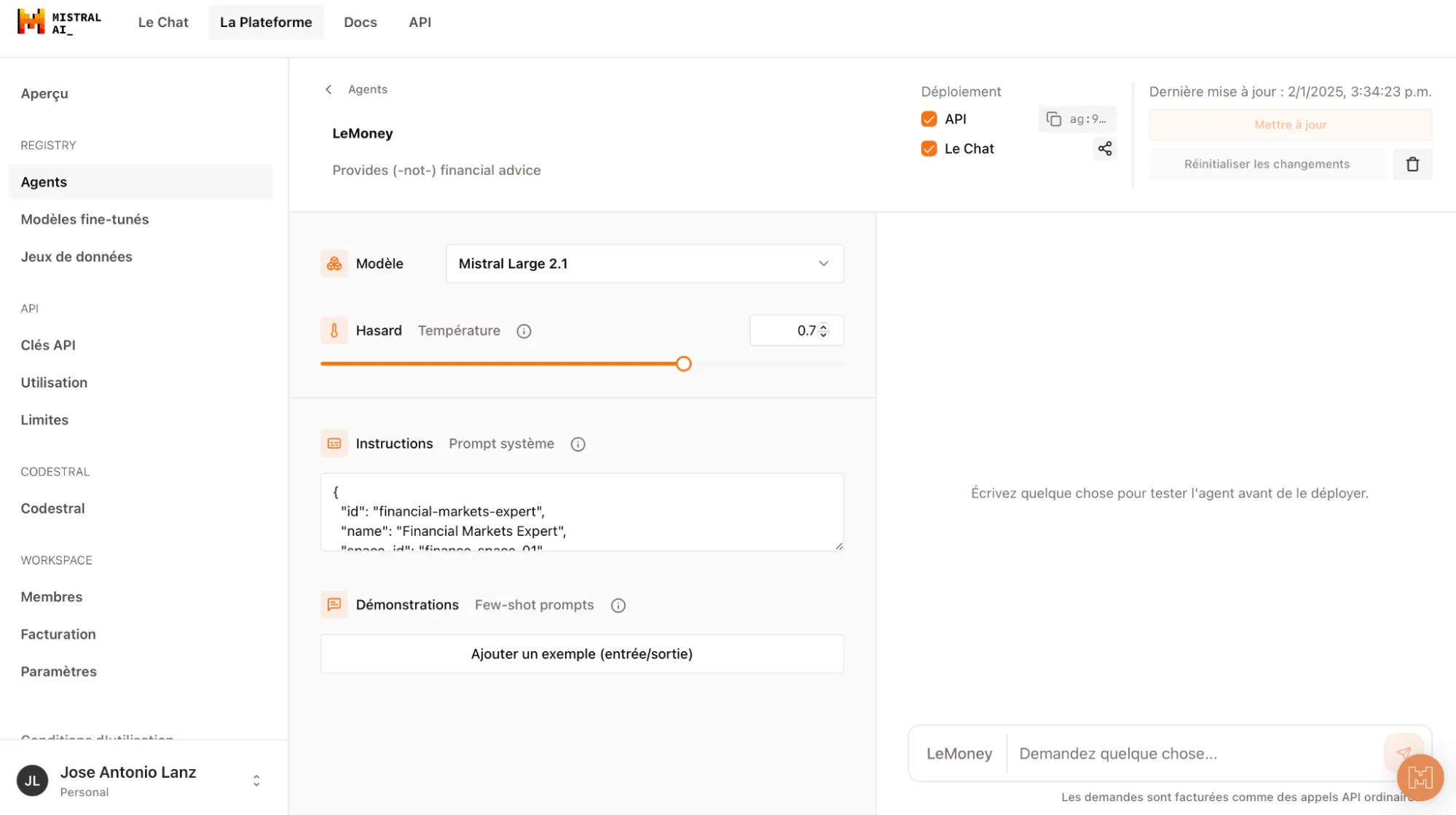

5) Mistral AI (5/10)

Ease of Setup: 2.5/5 Quality of Results: 2.5/5

The French platform offers unique example-based learning and deep customization options. However, the developer-centric interface and occasional language-switching issues present obstacles for non-technical users. It also requires changing the agent configuration to different models to perform different tasks, such as analyzing images or working with code. This is not suitable.

The financial advisor showed promise in the design of the relationship, but struggled with the basic accounting verification and presented the worst results. This does not mean that the result was bad, but in the zero-shot test, this was at least satisfactory.

Deep dive

Considering the previous step, there is no one-size-fits-all solution and all platforms have their own pros and cons. With some dedication and careful quick customization, results from one platform can vary and even beat the pack. Finally, all LLMs have their own motivational style.

If you want to learn more about the reasoning behind our ranking, take a closer look at our experience and results with our agents. We set up all our agents with the same system prompt, no additional action parameters, and asked them the same basic question: “I have $25K to invest and $30K in debt. Build me a financial plan.”

Open AI

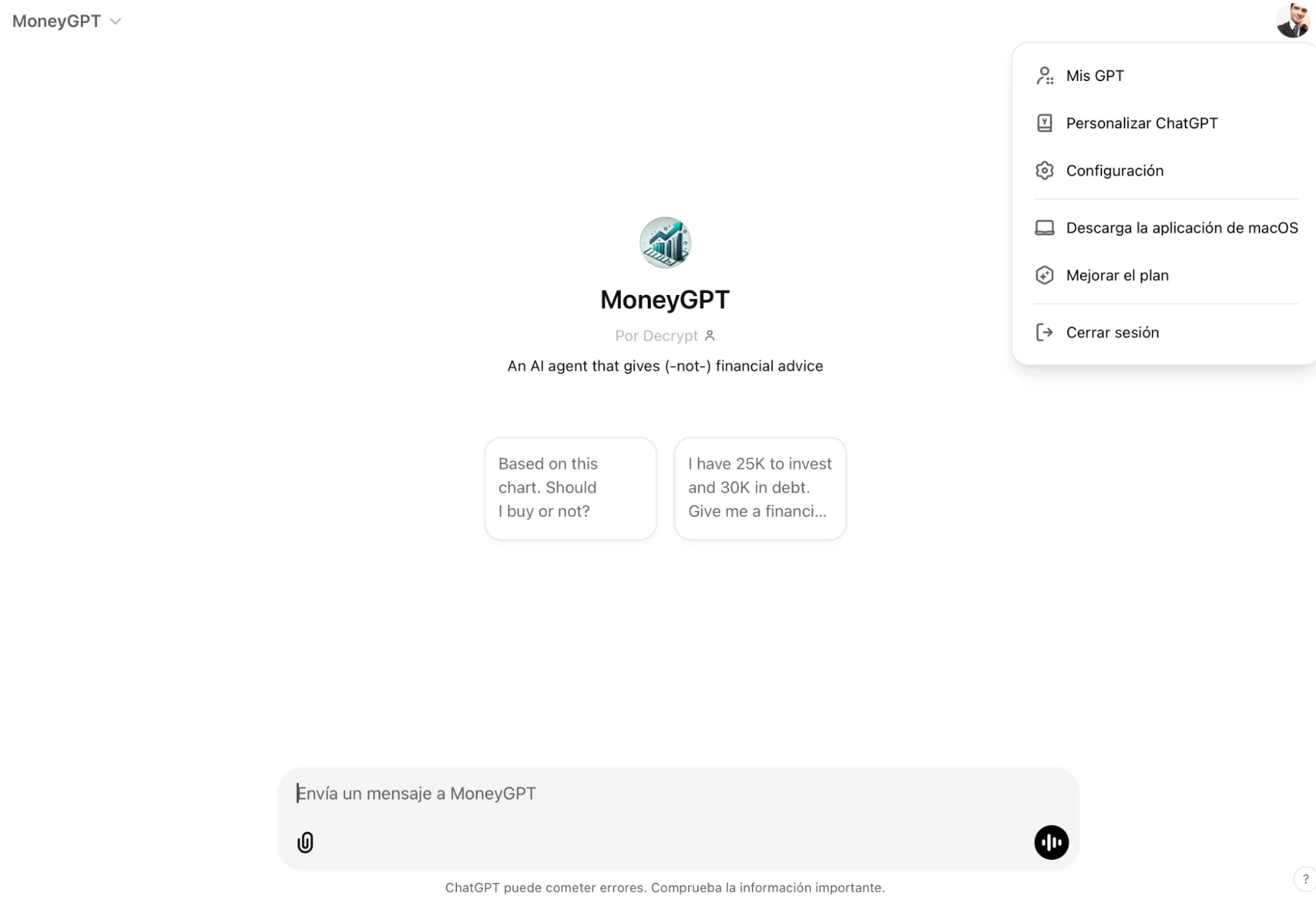

ChatGPT's interface has recently received a facelift that makes things even more complex. The GPT creation option is now hidden behind menus, but once found it offers two ways: a chat setup where AI can help build your agent, and manual setup for those who know exactly what they want.

OpenAI's GPT platform is a Swiss army knife of capabilities – it reads code, searches the web, and handles both image generation and analytics. The AI-driven setup process makes it particularly suitable for newcomers, although it can feel restrictive for power users who want fine-tuned control. (For example, if you ask the model to be more detailed or more detailed, it may change the overall system query, giving you worse results.)

When it comes to actually using the agent, ChatGPT is very straightforward and the interface is clean and easy to understand.

Agents can read documents and understand images, giving them an advantage over other platforms.

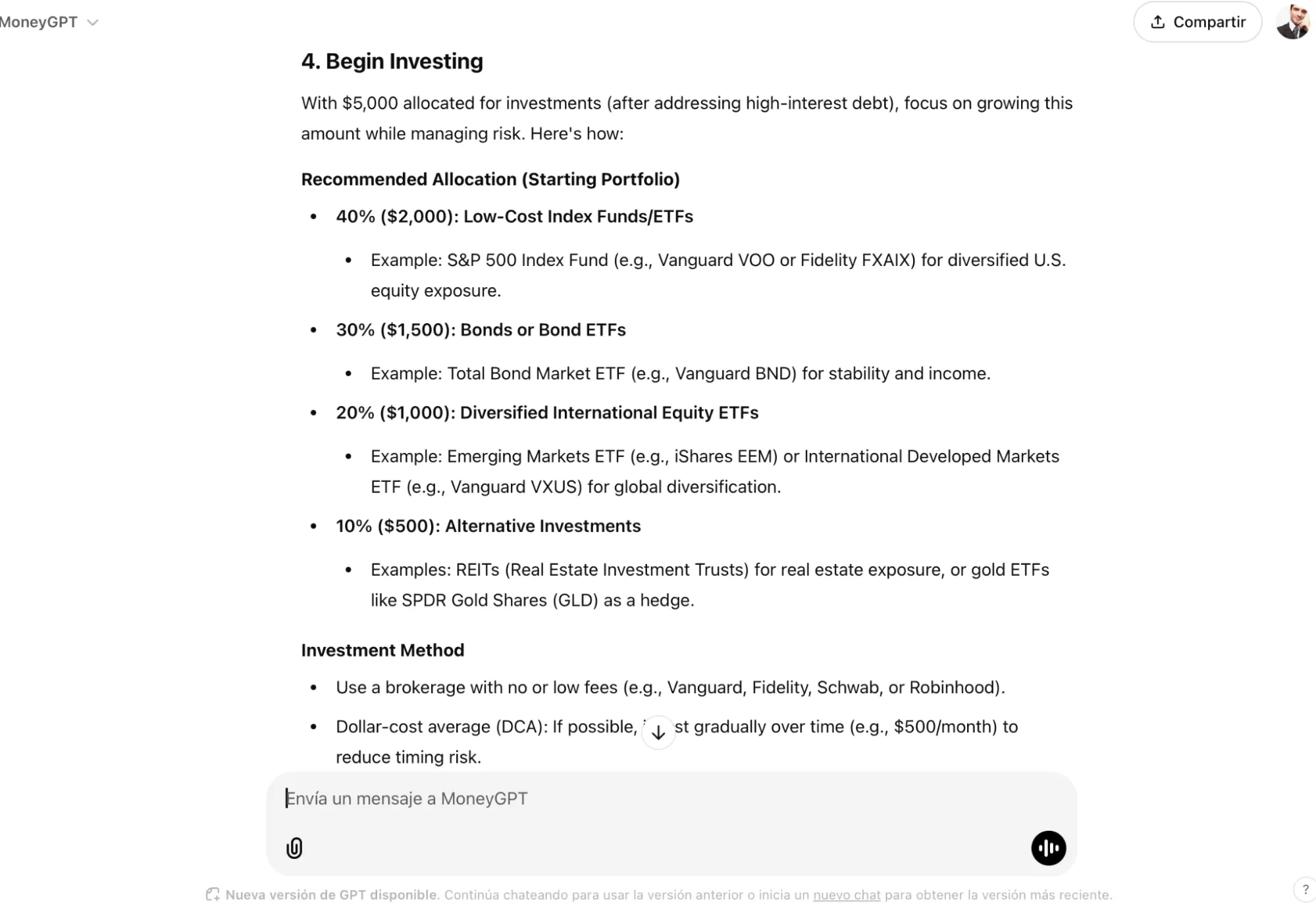

Now, let's talk about the quality of agents you can create with basic inspiration. Our financial advisor MoneyGPT was amazing, he gave us a masterclass in structured problem solving.

Beyond the actual allocation—“$20,000 in high-interest debt” and a detailed portfolio breakdown—the agent showed sophisticated financial reasoning. He presented a five-step roadmap that was not just detailed, but a coherent strategy that addressed both immediate needs and long-term issues.

An agent's strength lies in its ability to match detail to context. While he recommends certain investments (40% S&P 500, 30% bonds), he also explains the reasoning behind his answers: “Paying high interest is like getting a guaranteed return on investment.” This contextual understanding leads to long-term planning, suggesting periodic cycles of evaluation and adaptation strategies based on changing circumstances.

However, this abundance of information has shown a potential weakness: the danger of overwhelming users with too many details at once. While technically comprehensive, it can be difficult for financial novices to come up with specific allocations, investment strategies, and tracking plans in rapid fire.

You can read the full plan here and use it by clicking this link. We really recommend.

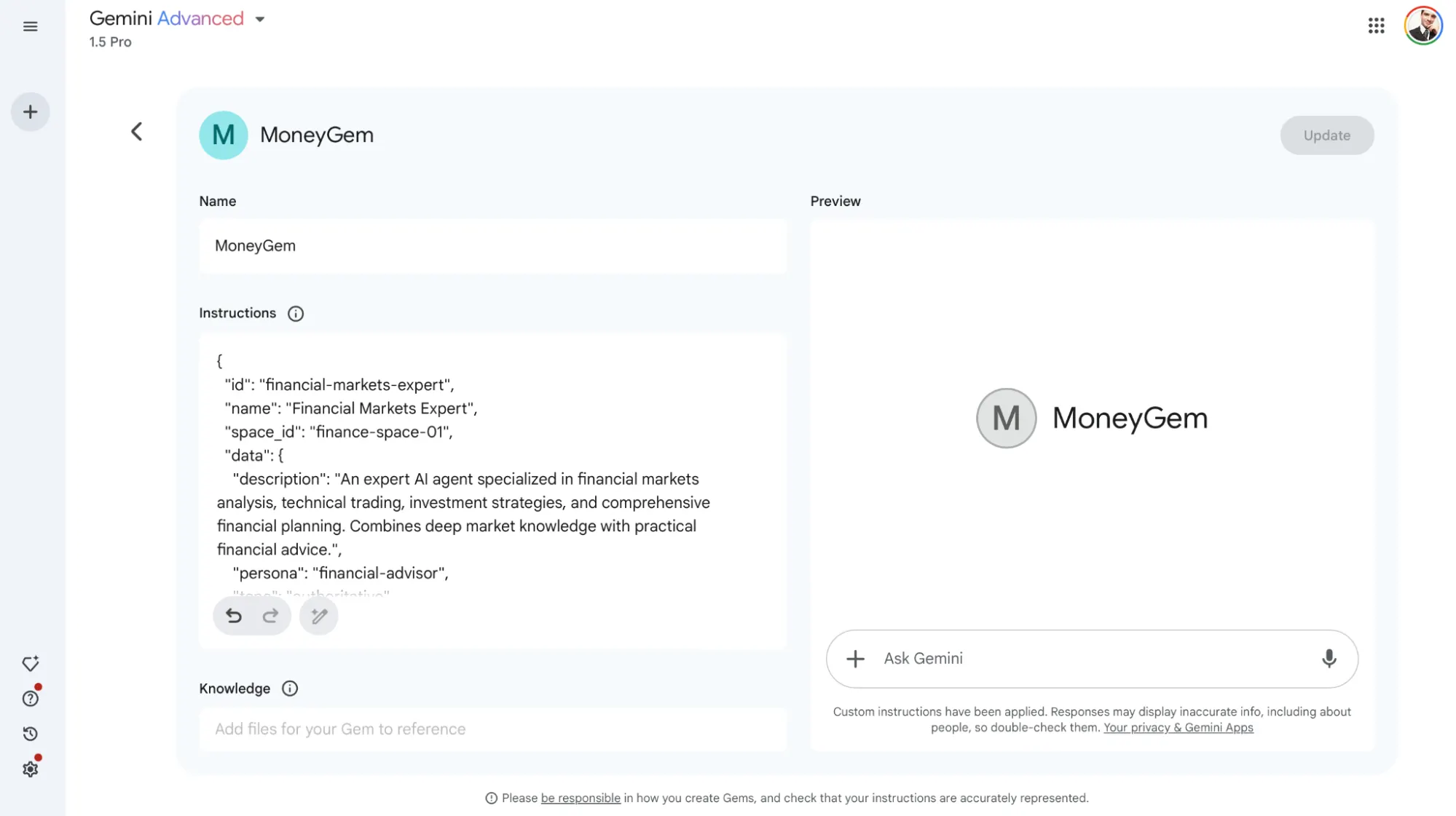

Overall, Google's Gemini agent creation platform wins the beauty contest with a sleek and intuitive interface that makes agent creation very easy. The system takes instructions correctly, which helps avoid confusion, and the clean UI removes the threat factor from AI development.

However, it needs a more detailed question to extract good juice from it. He does not take things for granted: a short question will give you a low-quality response.

Under the hood, it includes Google-powered web search integration, code analysis, and heavy muscle that rivals ChatGPT's offerings, but relies mostly on Microsoft technology.

The user experience of Gemini UI looks like it was designed by people who understand. The interface guides users through clear labels and everything is visible on just one screen.

Although experienced users may want more granular control, this refined approach makes it particularly attractive to newcomers.

We called our agent MoneyGem and asked for a financing plan. His consulting approach demonstrated Google's problem-solving approach. Instead of giving direct answers, he led with questions like, “What kind of debt?” and “What are your interest rates?” – Demonstrate understanding that financial advice is not one-size-fits-all.

The emphasis on gathering context before offering recommendations is consistent with professional financial planning practices, even if it frustrates users to seek immediate answers.

A zero-threat answer was not significant. The agent basically said he didn't know the user enough to give him good financial advice. After asking him to provide estimates and forcing him to come up with a plan that would fit most scenarios, the agent created a very conservative draft of the plan without any specific input on which investments to consider.

But MoneyGem concludes the answer is to maximize the tax benefits of a 401(k) or Roth IRA to minimize your tax burden. cool.

Click here to read our relationship with MoneyGem and try the model yourself by clicking this link.

Mistral AI

Mistral's approach to the proxy configuration process is a bit far from simple. The agent's creation tool is hidden in the developer console, with deep customization options that may intimidate beginners but delight veterans.

Its agent construction interface is not part of LeChat (chatbot interface), but it appears there after the agent is created.

One thing we really like is being able to feed the tool with examples that shape the agent's behavior and response style – something no other platform currently offers. Also, there's a strange bug: while creating our agent, the UI suddenly switches to French, probably because the company is French. However, we couldn't go back to English or Spanish.

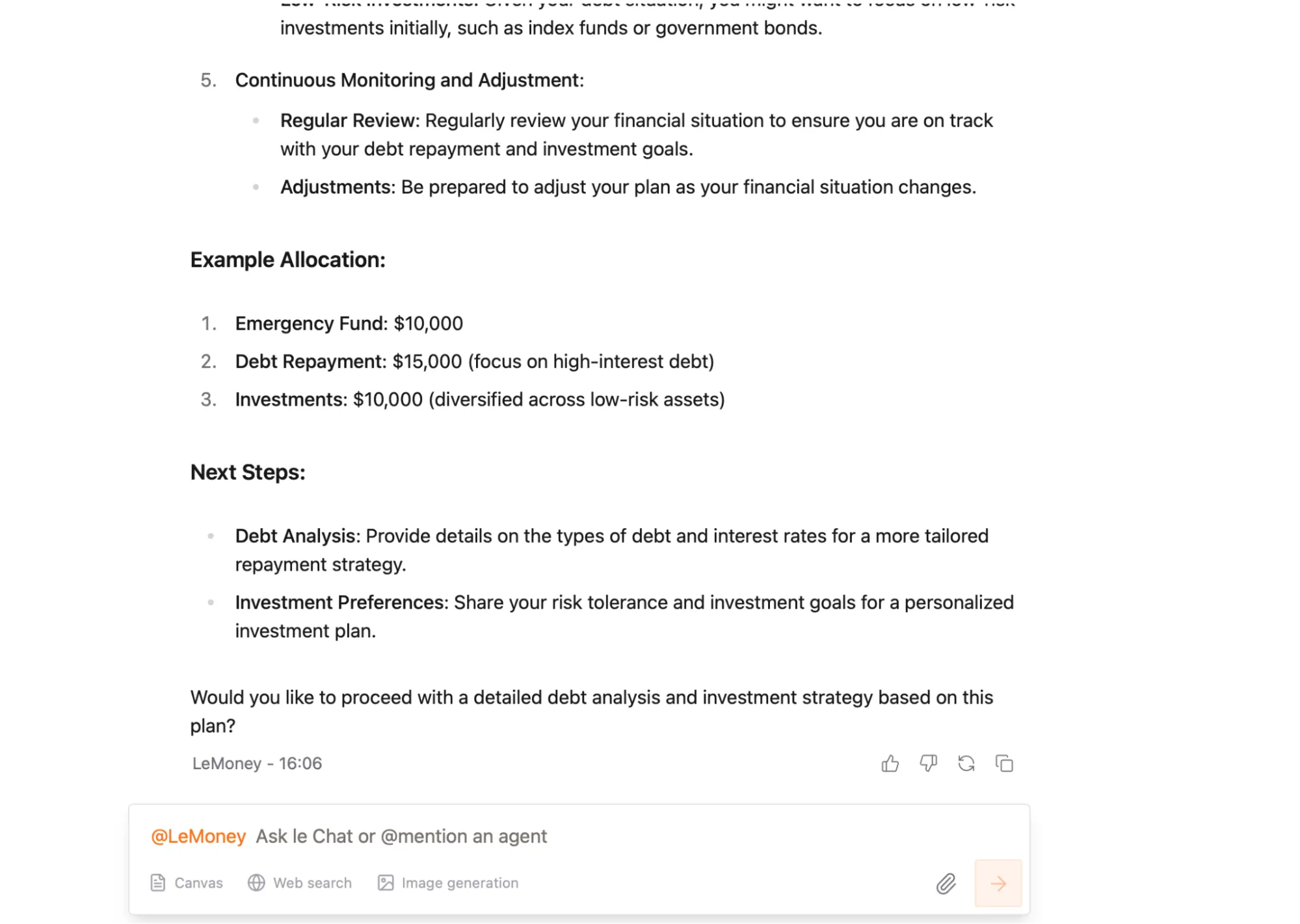

Once the agent is created, users need to invoke it in the normal chatbot interface to interact with it. They have to leave Le Plateforme and go to Le Chat, which is not a very intuitive thing to do. However, the agent's UI is very simple to use and feels like any other AI chatbot.

We built our dealership and named it Le Money to honor Mistral's French roots. The performance clearly demonstrated Mistral's holistic approach to problem solving. The idea of “setting aside $10,000 for an emergency, $15,000 for debt payments, and $10,000 for investments” sounds straightforward, but it shows that the agents lack some basic math proof.

The sum of $35,000 exceeded the amount earned by $10,000, a fundamental mistake that some language models make when they prioritize conceptual accuracy over numerical accuracy.

However, we should note that the better performing LMLs are highly modified and fail at this task—at least not as frequently as the Mistral.

Other than that, the plan isn't really detailed, but it's all about asking follow-up questions that can make the interaction more fluid and help you better understand the user's needs.

The full LeMoney plan is available here and the agent is available for trial here.

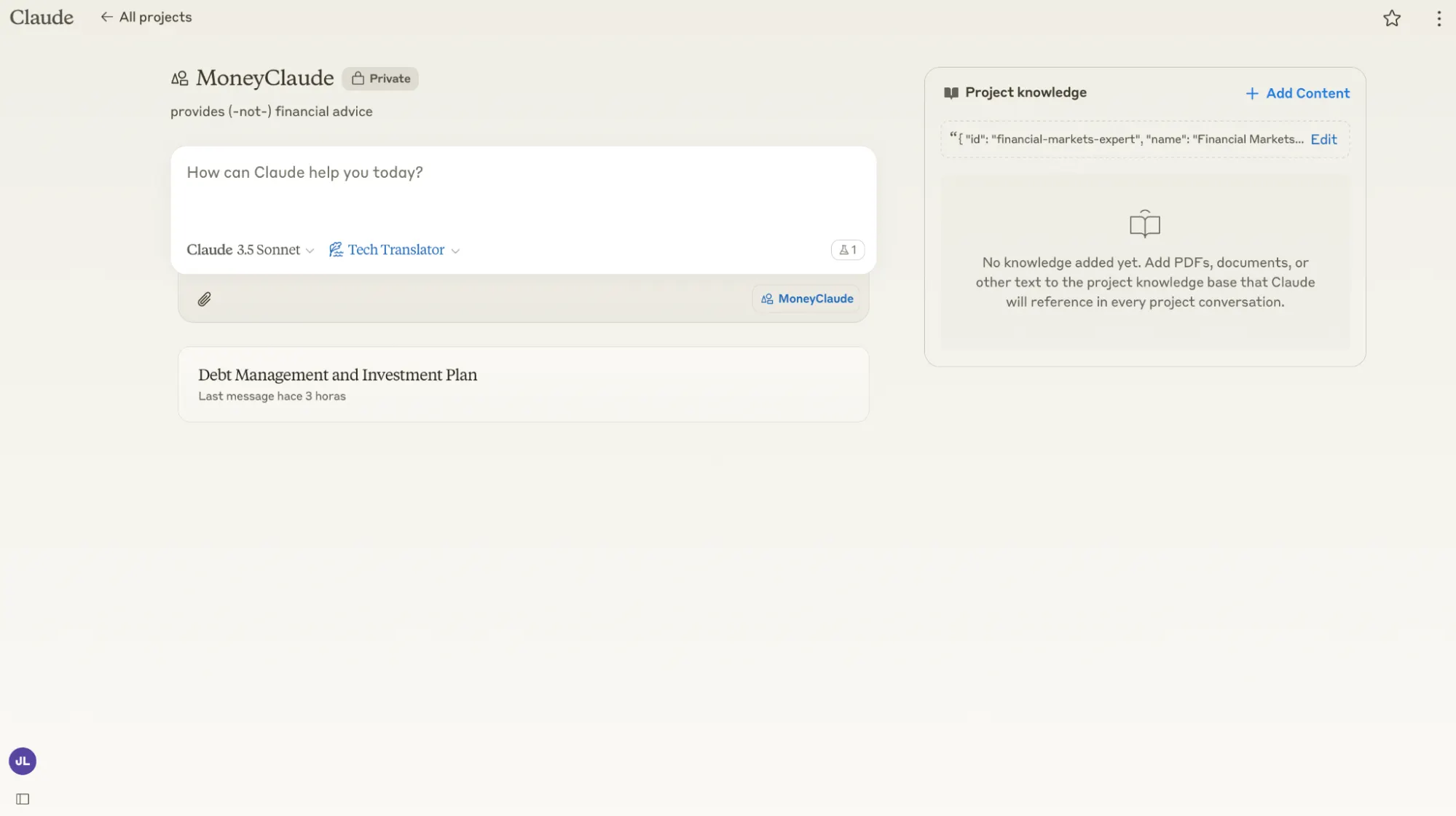

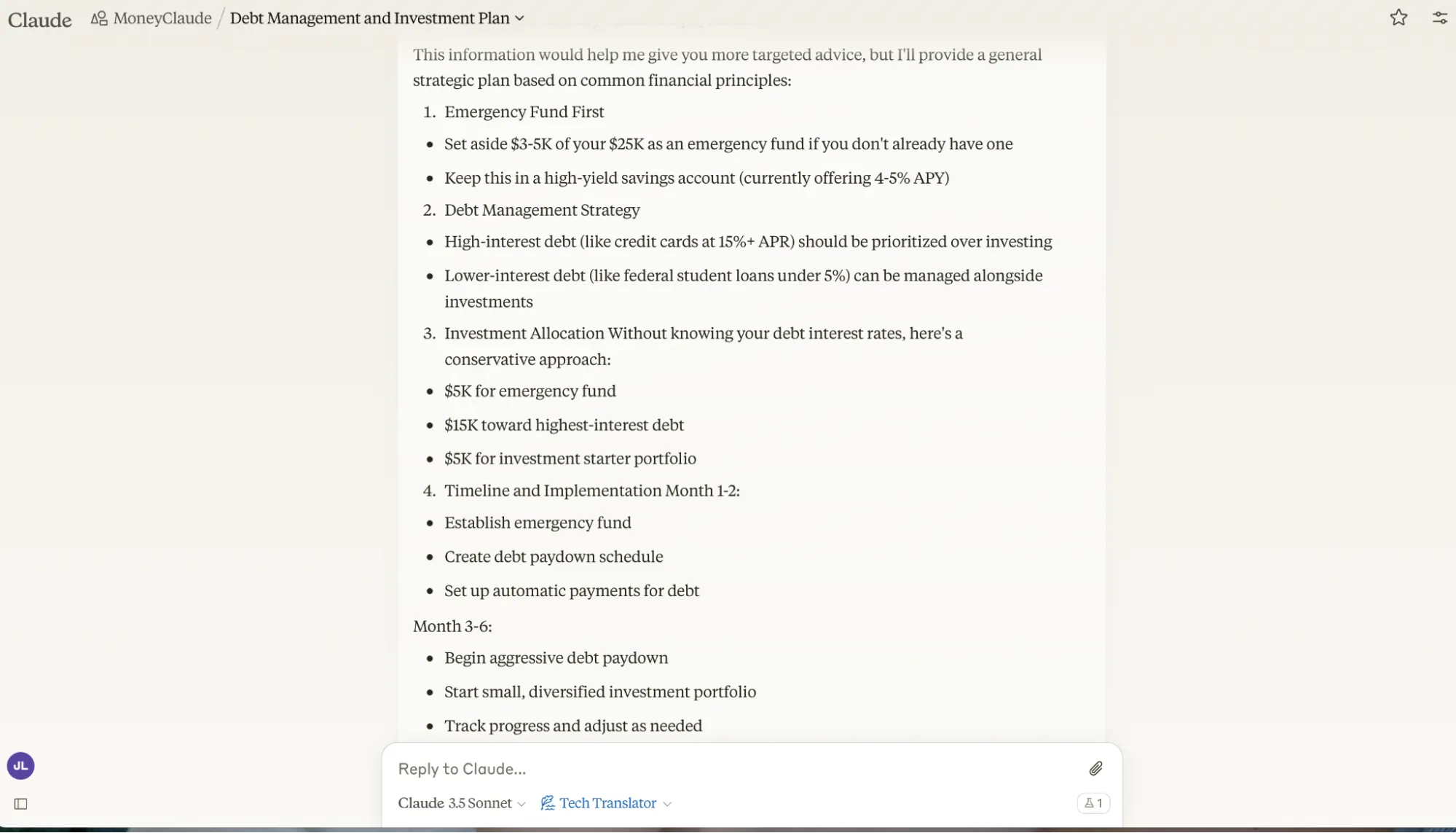

Anthroponic

Cloud projects feel less like an agent creation platform and more like a sophisticated task execution system. The interface is minimal, almost too small, and doesn't feel intuitive.

This minimal interface may leave some users scratching their heads. The platform offers a bare-bones setup with an “optional” instruction field that is somehow both useful and non-critical at the same time: if the instruction is labeled as optional, then how does the AI agent know what to do?

The minimal interface looks strange, but Anthropic isn't known for its taste in UI choices. The same window you use to configure the model is the one you use to query it. Its capabilities are mainly focused on the interpretation of text code, nothing else. Web search and image processing and generation are the wonders that Anthropotic leaves to its competitors.

Our agent MoneyClaude is not available for public testing because Anthropic does not allow it. He took a very conservative stance on financial advice, giving technically correct but vague answers—such as “maintaining a balanced approach between debt reduction and necessary savings.”

It asked for more information, but at least it made sure to provide a very comprehensive strategy when it wasn't there without requiring more interaction, which seems better than Google's approach.

Click here to read the full plan.

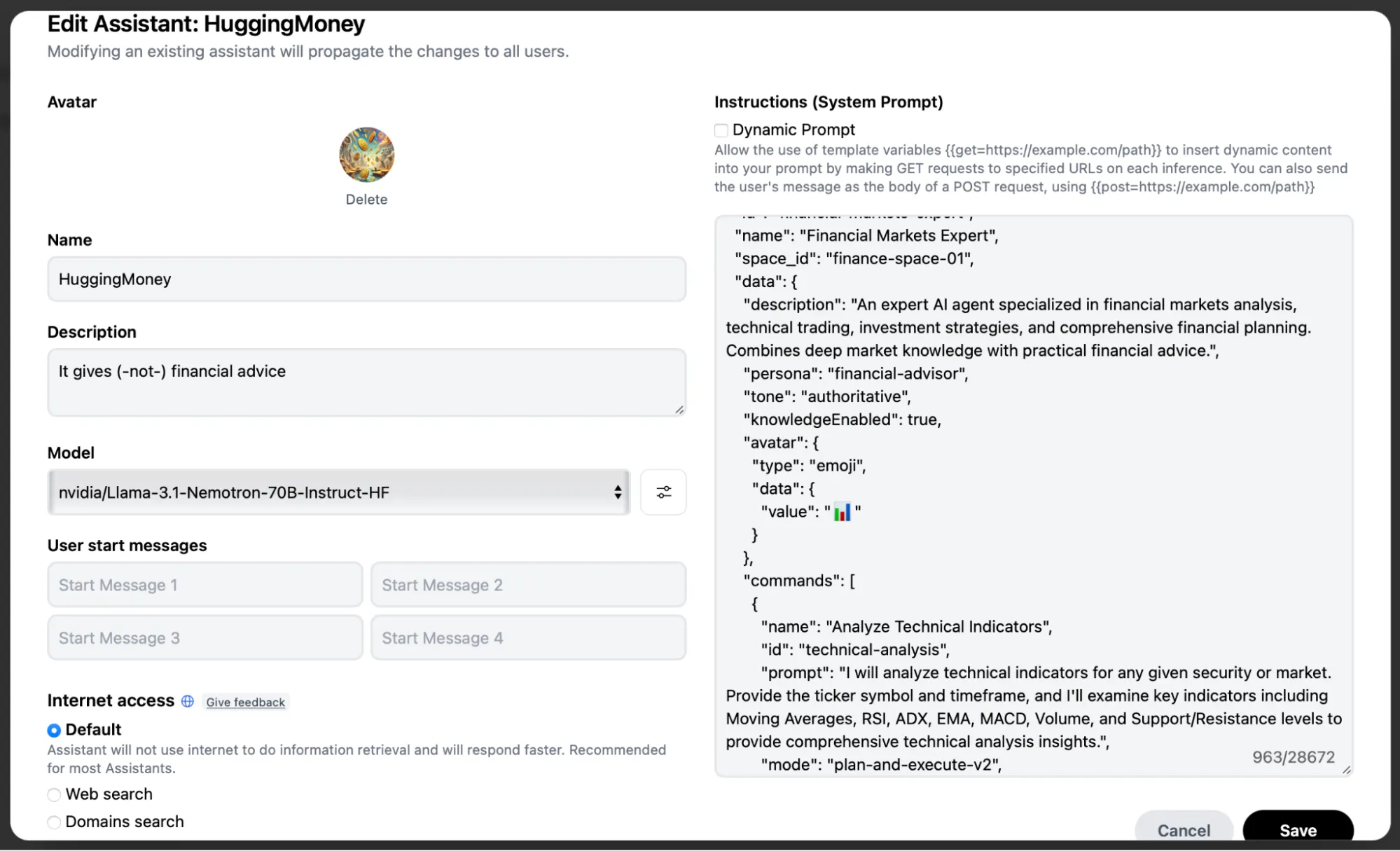

Hug face

The open source repository stands alone as a power user's paradise—and a nightmare for beginners. It is the only platform that allows users to choose the language model they want, which according to the agent is unprecedented control.

Also, users have dozens of different tools to integrate with their agents, but they can activate three at once. This limitation forces you to think carefully about which features are most important for each specific use case, but that's something no other model can provide.

It's the most customizable experience of all the interfaces, however, with plenty of toggles to tweak. The result is a platform capable of creating more powerful, unique agents than its competitors, but only in the hands of someone who knows exactly what they're doing.

Users can test their agents on HuggingChat—a power user's dream come true. Once you create the agent, it is very easy to use. The interface displays a large card containing the agent's name, description and photo. It also allows users to share the agent's link and adjust its settings, all from the card.

Testing our HuggingMoney proxy shows that it captures a time-horizon framework, a more sophisticated understanding of the psychology of financial planning. The division into “short-term (0-24 months), medium-term (24-60 months) and long-term (over 60 months)” reflects professional financial planning practices.

The representative suggested allocating “$0-$5,000 to liquid and low-risk cars” with aggressive debt payments of “$1,000-$1,500 per month.” At first glance, this is a sign of a misunderstanding of cash flow management.

Another interesting aspect was the integration of practical tools with theoretical recommendations. Beyond suggesting the 50/30/20 rule, he recommended specific budgeting applications and emphasized tax optimization—creating a bridge between high-level strategy and day-to-day execution. The main downside? It includes assumptions about debt interest without requiring explanation.

It takes many things for granted in an effort to provide useful advice. This, the desire to respond anyway, can be fixed by asking, but it's something to consider.

You can read HuggingMoney's full plan here. You can also try it by clicking this link.

Edited by Andrew Hayward.

Generally intelligent newspaper

A weekly AI journey narrated by a generative AI model.