Why a spike in whale sales could drive Bitcoin to $37,000

BTC's recent bullish streak hinges on expectations of a Bitcoin ETF (exchange-traded fund) approval. But now Bitcoin is facing a possible fallout when whales enter the distribution system.

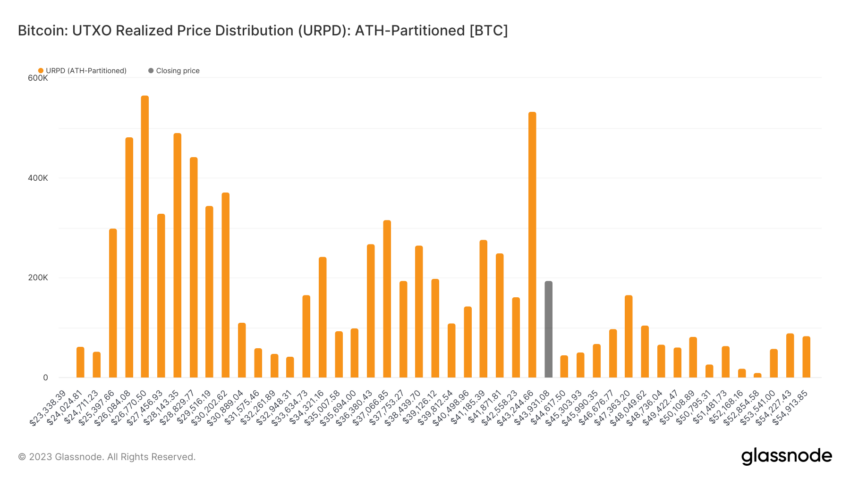

On-chain data suggests that the price of Bitcoin is likely to return to $37,000.

Why Bitcoin Could Fall to $37,000

BeenCrypto's global head of news, Ali Martinez, said the number of entities holding at least 1,000 BTC has dropped by 1.10% over the past three days. This may not constitute a resale. However, it suggests a redistribution system among large bitcoin whales.

The increasing selling pressure may soon affect the price of Bitcoin. Martinez believes that if prices lose the $43,200 support, such an event could stop the recent bull rally. Of course, if this happens, the price of BTC may drop below $40,000.

“[If you are] Awaiting Bitcoin price correction… The first indicator will be a sustained close below $43,200. If this happens, BTC could head towards $37,000, Martinez said.

Similarly, sentiment analysts have advised caution, noting that the current surge in bear market activity is leading to widespread fear of missing out (FOMO) among investors. This is a trend that suggests a cautious approach. Still, Martinez added, as long as Bitcoin continues to hold above the $43,200 support level, “the odds look in favor of the bulls.”

BTC miners are paying from fees.

Given Bitcoin's impressive 164% year-to-date price increase, investors aren't the only ones profiting. Indeed, Bitcoin miners have seen steady growth this year, with their total revenue exceeding $10 billion, according to James Loup, co-founder of CashoDial.

“Bitcoin miners will earn more than $10 billion by 2023, a huge increase from the $57 billion total over the past 15 years. This number assumes that they will instantly sell for fiat, which is certainly not the case – miners are HODLers,” said Lopp.

Read More: Top 7 Platforms to Earn Bitcoin Signup Bonuses in 2024

These high revenues can be attributed to the growth of regular transactions on the Bitcoin network, which has helped push the average transaction fee to new highs.

According to analysts at Caico Research, Bitcoin is “exhibiting all major traditional assets even in risk-adjusted conditions.” It has achieved one of the highest Sharpe Ratios among major assets this year.

In fact, Bitcoin ranks behind semiconductor leader Nvidia, whose share price more than doubled between January and May, fueled by growing excitement around artificial intelligence (AI).

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.