Why are BTC miners selling coins?

Bitcoin miners have been reducing their holdings in recent weeks as the coin's price hovers above the crucial $100,000 mark. At press time, the leading coin is trading at $98,535, a 1% decline from the high of $99,860 recorded in Friday's session.

As the BTC market begins to turn sideways, miners may be motivated to distribute their holdings for profit or to offset rising mining costs.

Bitcoin miners sell their holdings

According to CryptoQuant data, Bitcoin mining reserves have fallen to their lowest level since the beginning of the year. As of this writing, it sits at 1.81 million BTC.

This metric tracks the number of coins held in miners' wallets. It represents the stock of coins that miners have not yet been able to sell. The decline in BTC mining reserves shows that miners on the Bitcoin network are distributing their coins to make a profit or to cover mining-related expenses.

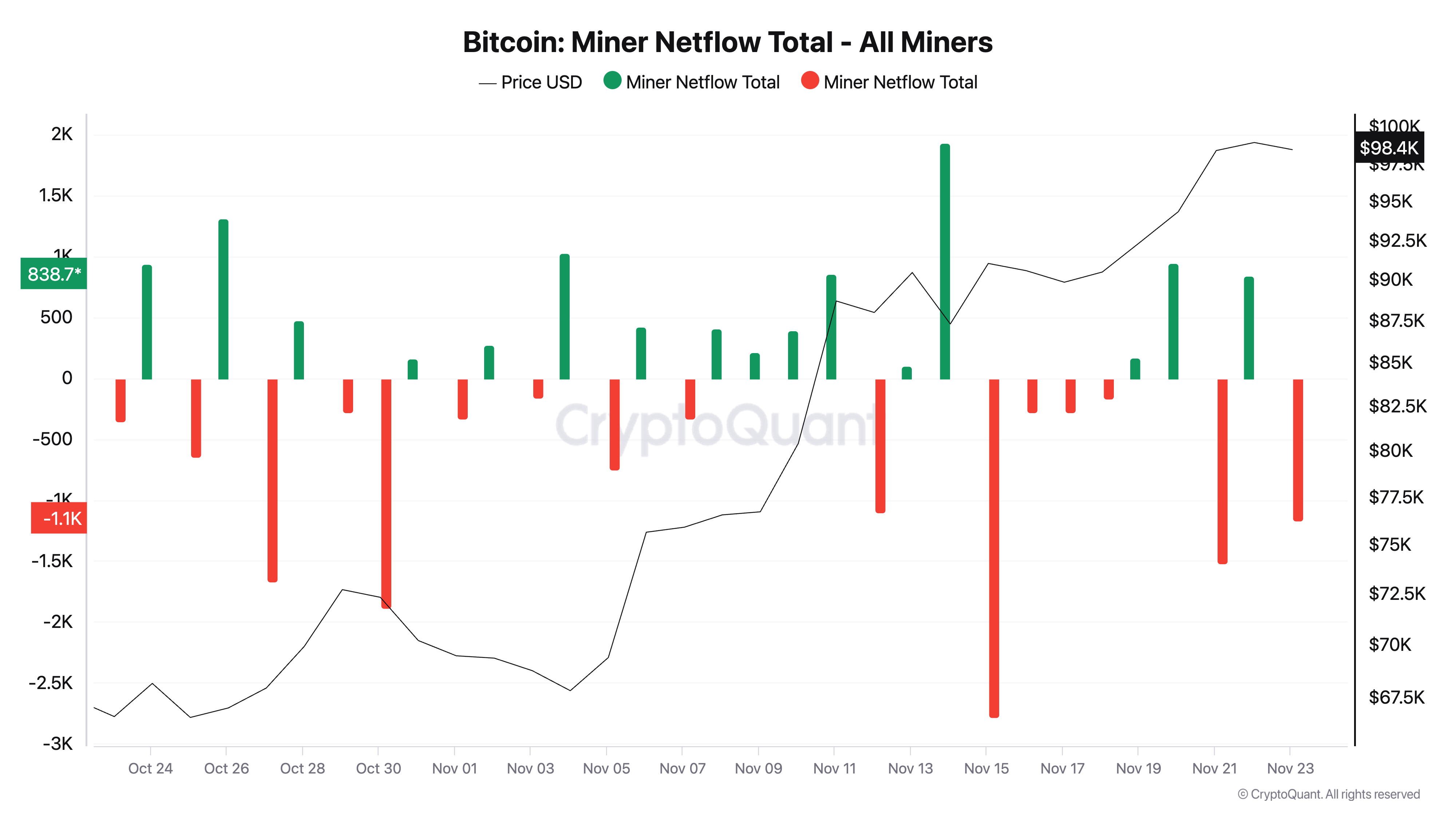

Moreover, the net flow readings from the BTC miner confirm that the daily coin selling trend is done by the network's miners. As of this writing, the benchmark value is negative at -1,172 BTC.

Miner Net Flow refers to the net amount of Bitcoins that miners buy or sell. Bitcoin miners are calculated by subtracting the amount they sell from the amount they buy. When it is negative, it indicates that miners are selling more coins than they are buying. This is usually a short-term downtrend and a sign of a reversal in the coin's value.

BTC Price Prediction: The Bulls Are In Control.

While BTC miners have added to the coin's selling pressure over the past few weeks, the bias towards the king coin is still significant. This is reflected in the position of the dots that form the Parabolic Stop and Reversal (SAR) indicator. As of this writing, these points rest below the BTC price.

Parabolic SAR identifies an asset's trend direction and potential reversal points. When the points are placed under the asset price, it indicates a bullish trend. Traders interpret this as a signal to go long and exit short positions.

If this trend continues, the price of BTC will recover the high of $99,860 and may cross the psychological barrier of $100,000. On the other hand, an increase in profit-making activity undermines this bullish attitude. If the buying pressure weakens, the price of BTC may drop to $88,986.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.