Why aren’t IMX holders selling?

Immutable (IMX), Ethereum's Layer-2 solution, is making headlines today due to its dramatic price increase, making it one of the top-performing altcoins.

Currently at $1.24, IMX has seen an increase of 10.06% in the last 24 hours. This on-chain analysis examines how the token achieved this increase and what to expect in the coming days.

Holders keep an immutable position on the lock, ready to store more tokens

According to Exchange Onchain Market Depth, a metric that measures trading activity on the order books of the top 20 exchanges, IMX is experiencing a strong push in buying.

Data provided by IntoTheBlock shows that market participants are ready to buy around seven million IMX tokens at current prices. On the flip side, the number of tokens for sale is a little over five million.

Typically, when bids exceed asks, it indicates that buying pressure is greater than selling volume. Conversely, if the ask side significantly exceeds the bid side, it suggests that sellers are in control.

Read more: What is an invariant X?

Therefore, the difference between buying and selling is in favor of buyers and if it continues, it can increase the price of IMX. But there is more to consider.

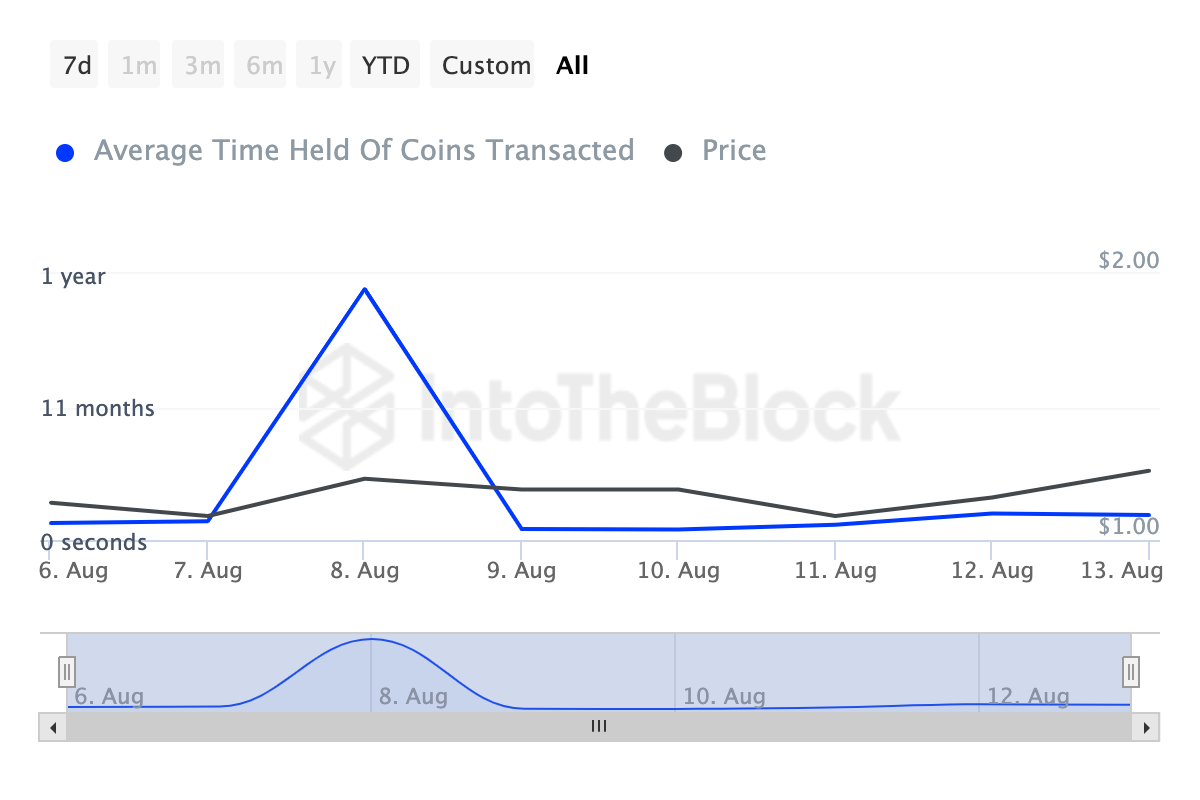

Taking a closer look at the coin's holding period, the number of IMX holders who refrained from selling has increased by 32% over the past 30 days.

Simply put, a decrease in holding time indicates that holders are buying or selling a currency. For IMX, this recent increase in bookings shows growing confidence among owners, and is not limited to the past week.

The data indicates that this trend has continued over the past 30 and 90 days, with a triple-digit increase during this period. The liquidation of holdings is generally a positive sign for cryptocurrencies.

Therefore, if this continues, coupled with buying pressure, IMX's price may extend its recent gains. If confirmed, the development will reduce the loss of IMX owners, which currently stands at 62%.

IMX Price Prediction: It's Not Time To Lock In Gains.

According to the daily chart, IMX is approaching the old support level between $1.26 and $1.30. The last time the token jumped into this range was on July 21, ending with a price increase to $1.70.

Currently, the Awesome oscillator (AO) is showing negative but green histogram bars. AO, a technical analysis tool, measures momentum by comparing short-term and long-term price movements.

When the AO crosses above the zero line, it indicates bullishness, while a reading below it indicates bearish momentum. This indicator is also useful for identifying entry and exit points.

Read more: Layer-2 Crypto Projects for 2024: Top Picks

For IMX, continuous green bars, even in negative territory, indicate the speed of the change from bearish to bullish, which can be used as a buy signal. However, this signal can turn bearish based on demand and supply in the market.

Interest in the IMX issue is increasing, and if it continues or strengthens, the price may see the resistance at $1.51 again. If demand slows down, this forecast may be reversed. If that happens, the price of IMX could drop to $1.07.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.