Why Binance Coin (BNB) Price Rally Will Witness Correction

Over the weekend, Binance Coin (BNB) broke above the downtrend line it has been trading on since August 23rd. While the altcoin is still on the rise, the rally may be short-lived.

A successful attempt at the breakout level is uncertain as the buying momentum in the market seems too weak to sustain the upward movement. Traders are watching closely to see if BNB can hold above this key level or if the gap will be a stumbling block.

Binance Coin Rally at Risk of Decline

In the year After reaching $600 on August 23rd, BNB has experienced a bullish selloff, below the trendline that has been pushing the price down. This bear pattern prevents the asset from breaking above the resistance level during pressure selling.

Last weekend, the selling pressure subsided, allowing the BNB bulls to push the price above the trend line. However, the growth may soon face a correction as the current buying activity appears to be insufficient to sustain the rally.

This is due to the decline in BNB's Chaikin Money Flow (CMF), which tracks the movement of capital in and out of assets. The CMF has dropped below the zero line, indicating a bullish divergence with the coin's value increasing.

This divergence indicates that the buying pressure behind the rally is weakening as the price of BNB rises. This indicates that the initial momentum is slowing down and a price correction or reversal is likely.

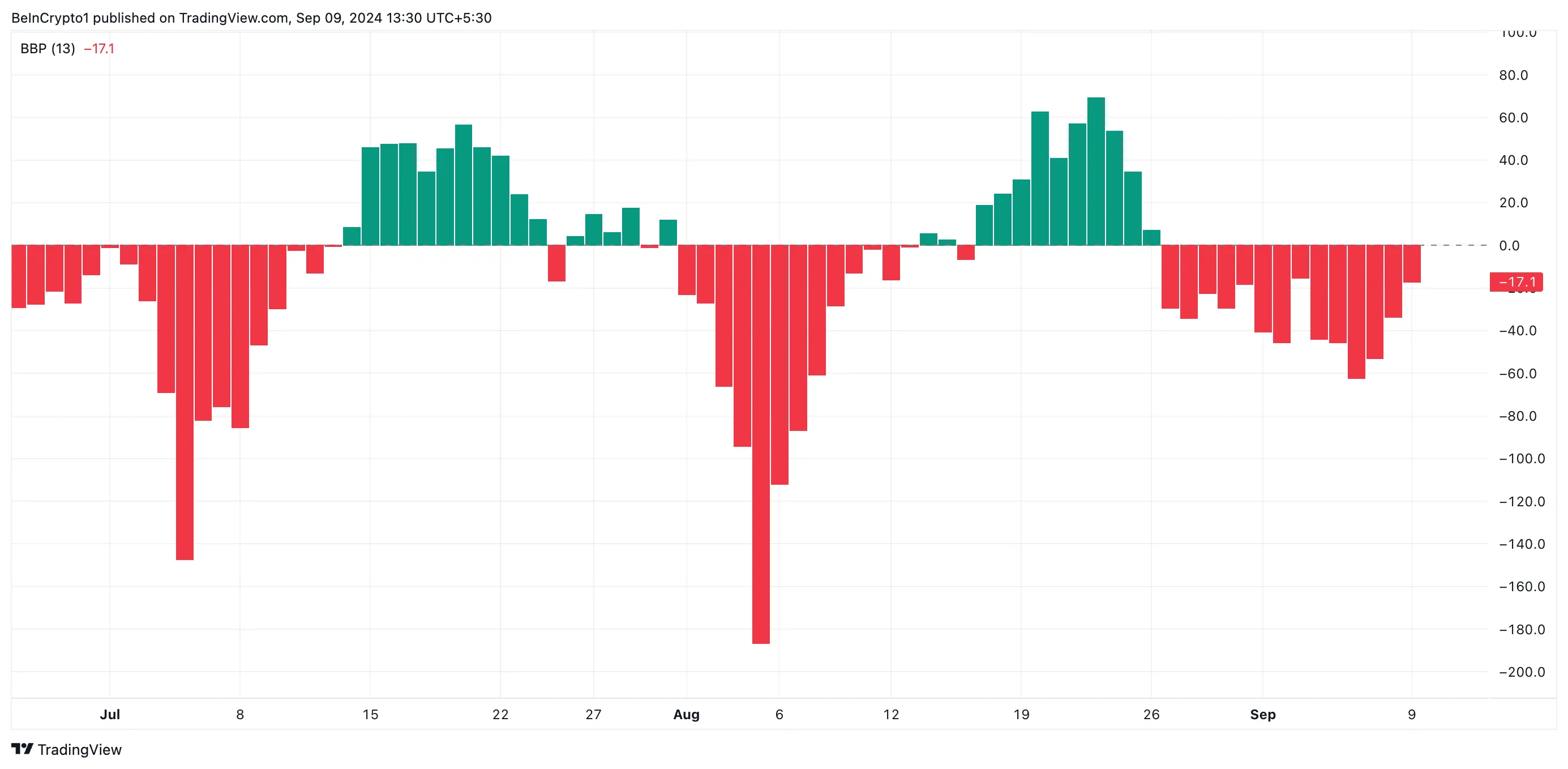

Additionally, Binance Coin's negative bullish bearish power highlights the bearish bias that is limiting the rally. This indicator monitors the balance between buyers and sellers.

A negative reading, such as the current -17.1, indicates that selling pressure is stronger than buying, indicating that the bears are controlling the market.

Read more: How to trade Crypto on Binance Futures: Everything you need to know

BNB Price Prediction: Futures Traders Set Eye on Rally

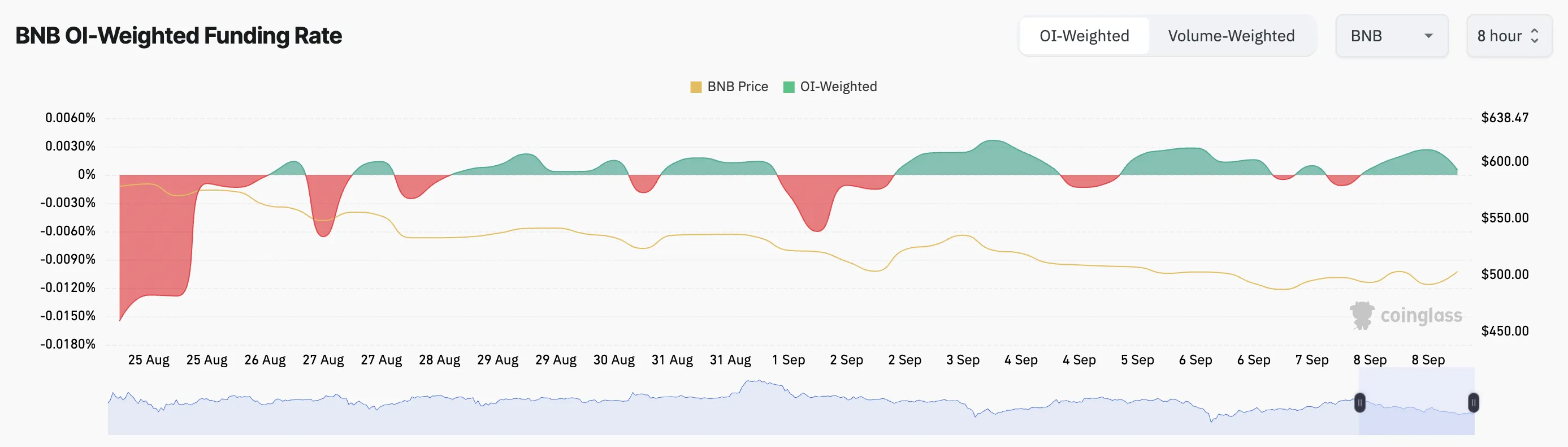

Despite the possibility of BNB shedding recent gains, futures traders remain undeterred. The coin's positive exchange rate indicates that they continue to support long positions.

At the time of publication, the BNB funding rate stands at 0.0005%. A positive funding rate suggests that many traders expect a price rally rather than a decline.

If market sentiment turns from negative to positive and buying pressure increases, these long positions could be profitable, pushing the price of BNB to $522.90, paving the way to the $600 mark.

Read More: Binance Coin (BNB) Price Prediction 2024/2025/2030

However, if the bearish divergence in the CMF leads to a failed test of the breakout line, the price of BNB may drop to $468.90.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.