Why Bitcoin (BTC) price can hit 66,000 dollars again

Bitcoin (BTC) price could reach $66,000 in a week or two, according to Chain Data. According to the metrics analyzed, the coin, which has recently gone through tough times, is showing signs of a rebound.

As of this writing, BTC is trading at $63,903 after initially closing at $65,000. However, the recent pullback may not stop the potential move.

Hot liquid continues to flow into Bitcoin

A review of Glassnode data shows that Bitcoin's 14-day market-confirmed gradient is at 1.17. This gradient uses the price at which each coin last moved to determine the expected length of the uptrend or downtrend.

A steep decline in the 14-day market-confirmed trend indicates a fall in fresh capital flows into the cryptocurrency. When this happens, BTC will experience a price drop. However, at the time of press release, the increase indicates that Bitcoin has attracted significant capital, which could lead to significant value growth.

From the chart above, Bitcoin price reached $66,805 last time it was in the same range. So, if the pattern rhymes, the price of the cryptocurrency could hit or exceed $66,000 in the next two weeks.

Read more: What is a Bitcoin ETF?

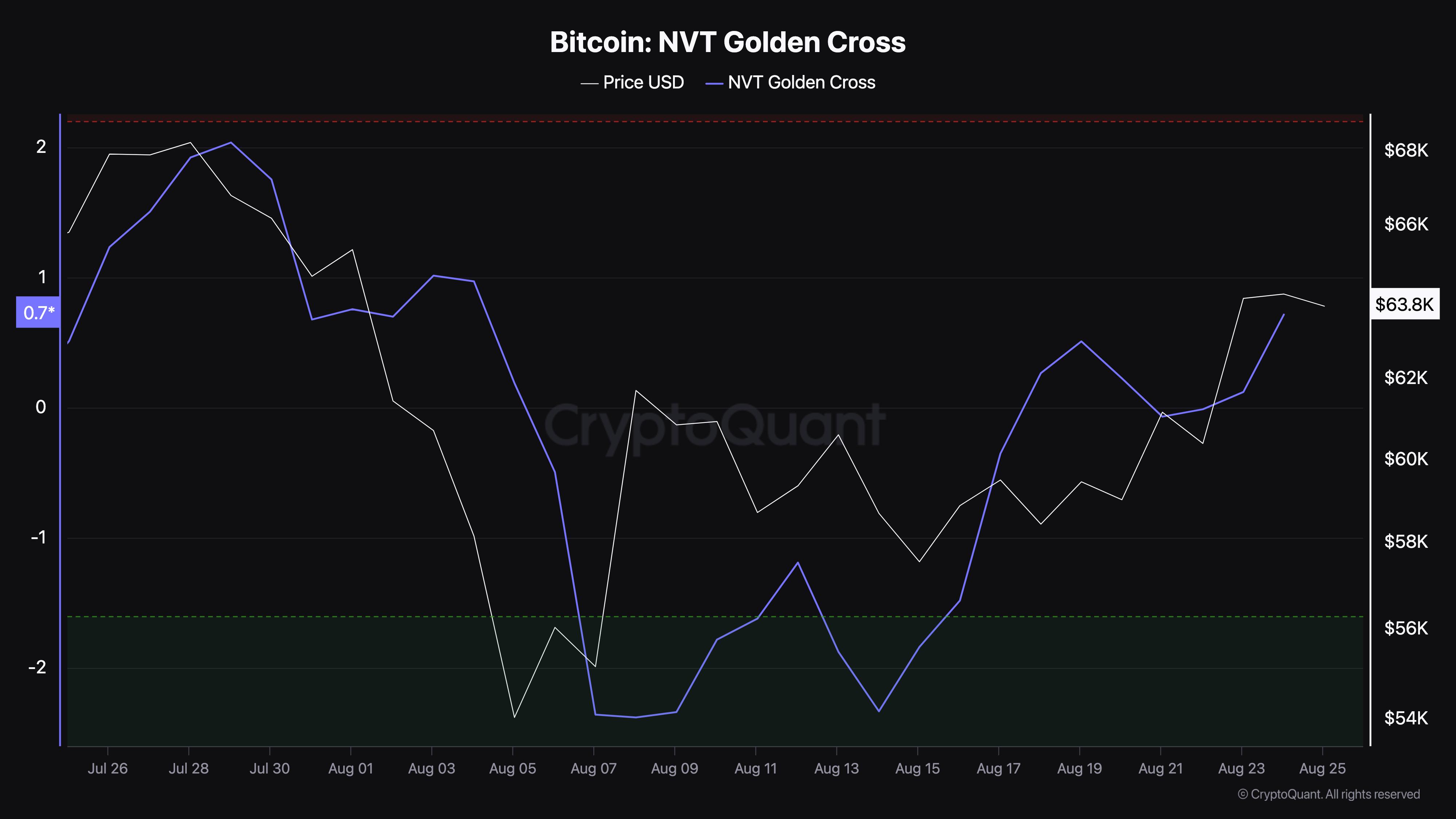

Additionally, Network Value to Transaction (NVT) Golden Cross appears to support a similar bias. For context, this metric measures whether a crypto's price is near the bottom or near the top.

When the reading is below -1.6, the price is at the bottom, and the upward pressure may be high. However, values above 2.2 indicate that the crypto is overbought and may undergo a major correction.

In Bitcoin, the NVT golden cross is 0.71, indicating that the coin has broken above but remains in a major buy zone. Therefore, if the increase continues, so will the price of BTC.

Interestingly, Hardy, a crypto trader on X, seems to have the same idea. According to Hardy, Bitcoin is finally breaking out of its consolidation phase and has extended its targets above the above price.

“The real moves will happen during the week. Next week looks good; still riding this long to the top of the range. Eye on $70k,” the trader posted.

BTC Price Prediction: Sellers Can't Resist Buying Pressure

According to the daily chart, Bitcoin has formed an inverse head and shoulders pattern. This technical analysis pattern predicts a bearish to bullish reversal and is critical to confirming a bullish signal.

As shown below, the pattern consists of three parts: the first shoulder, representing selling pressure and reversal; head, which indicates a downward trend and a strong return; And finally, the second shoulder, which shows that buying pressure is not worth the sellers' attempts to lower BTC.

At the press conference, Bitcoin broke above the neckline at $61,024, which was previously a defensive level. This crash increases the chance of the coin hitting a higher price. However, there is another resistance at $64,562.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

If Bitcoin were to breach this point, the price of the cryptocurrency could reach $66,849. However, if BTC is rejected at $64,000, the price may decline at $60,000, which will negate the bullish bias.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.