Why Bitcoin’s Declining Effect May Be Fading Now

Bitcoin's expected halving is just two weeks away. Historically, it has signaled the beginning of a price acceleration phase, but analysts at CryptoQuant argue that the impact is waning.

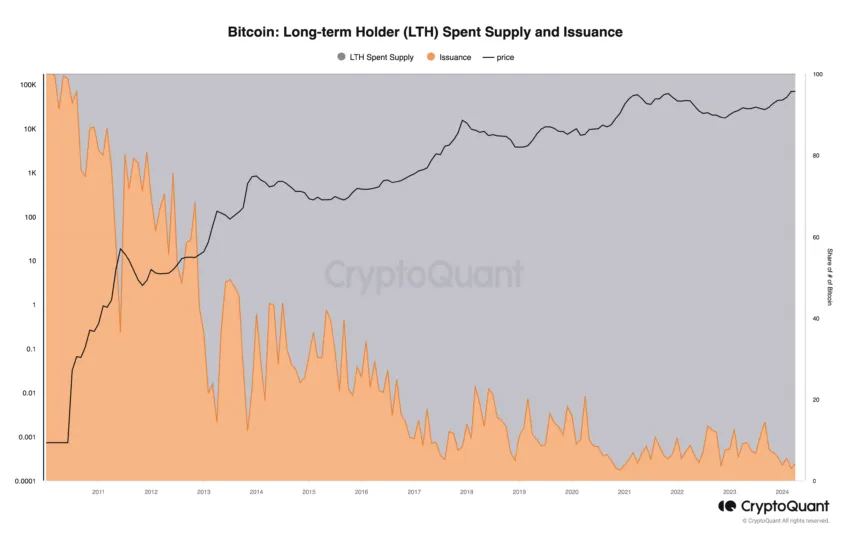

The upcoming halving will reduce the new issue by 14,000 BTC per month, reducing the sales pressure of miners. However, the once-significant halving appears to be having less of an impact on Bitcoin's price as the new issue becomes smaller relative to the total supply available for sale.

The impact of the Bitcoin half in Wanene

Long-term holders (LTH) for sale, for example, spent an average of 417,000 BTC per month last year, covering a monthly payment of 28,000. In contrast, CryptoQuant shows that growth in demand for Bitcoin, particularly from large holders or whales, is emerging as the main driver of higher prices after the halving.

This group of investors is currently experiencing the highest growth in interest, which has historically fueled price rallies.

“In previous cycles, demand for Bitcoin increased from large holders or whales, fueling the price rally. Currently, demand growth is about 11% higher every month.” A CryptoQuant analyst told BeCrypto.

Read more: Bitcoin Half Countdown

Moreover, the demand for Bitcoin from permanent holders has exceeded the release for the first time in history. This will add more fuel to Bitcoin's price rally after the halving.

Permanent holders can now add up to 200,000 BTC to their balances every month. This is significantly higher than the estimated monthly release of 28,000 BTC, which decreased to 14,000 post-halving.

CryptoQuant also noted that monthly Bitcoin sales have decreased to only 4% of the total Bitcoin supply. This is in stark contrast to the periods before the first, second and third half, which represented 69%, 27% and 10% of total supply.

Read more: What Happened in the Last Half of Bitcoin? Predictions for 2024

In summary, as the upcoming Bitcoin halving reduces the new supply of BTC and reduces selling pressure from miners, unprecedented growth in demand from large holders and permanent holders is set to be a key driver after the halving.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.