Why BTC price hits $1 million after approval of Bitcoin ETF

The cryptocurrency market awaits the approval of a Bitcoin ETF (exchange-traded fund), which has sparked discussions among experts and enthusiasts. This development could bring huge amounts of capital into Bitcoin, potentially changing the industry.

Some proponents, such as Samson Mou and Raul Pal, foresee the price of Bitcoin increasing by an unprecedented $1 million.

Bitcoin ETFs trigger high capital flows

In a recent interview, JAN3 CEO Samson Mou predicted a significant rally in the price of Bitcoin, which could reach $1 million. He argued that the ongoing crypto bull market is fundamentally different from its predecessors, breaking the usual four-year cycle pattern.

According to Mou, the unprecedented price increase is driven by supply, demand and price volatility.

“That's all it seems [Bitcoin] ETFs are approved on the same day… [What this does is] There is a very limited supply of bitcoins on the exchanges that are available to buy with a strike and a flood of funds. So, basically the supply shock is multiplied by the demand shock. And this will give you a price shock. That's why [Bitcoin] It can be very high at one time. Mow said.

Mou highlighted that the approval of spot ETFs would be a critical moment, opening up US institutional capital to Bitcoin. This migration of billions in a short period of time could lead to rapid inflation.

“i don't think so. [the current] A procession is a very special procession. This is an ant parade. When is the actual parade? [Bitcoin goes] About 1 million dollars, and the place is then [Bitcoin] EFAs have been approved, and we have tens of billions, maybe hundreds of dollars flowing into Bitcoin in a short period of time,” Mou said.

Read more: How to prepare for a Bitcoin ETF: A step-by-step approach

Mou's forecast is based on the belief that Bitcoin has a limited supply. When hit by massive capital inflows, it results in dramatic price increases similar to the 20x increase seen in 2016-2017.

BTC price projects “unusual set of numbers”

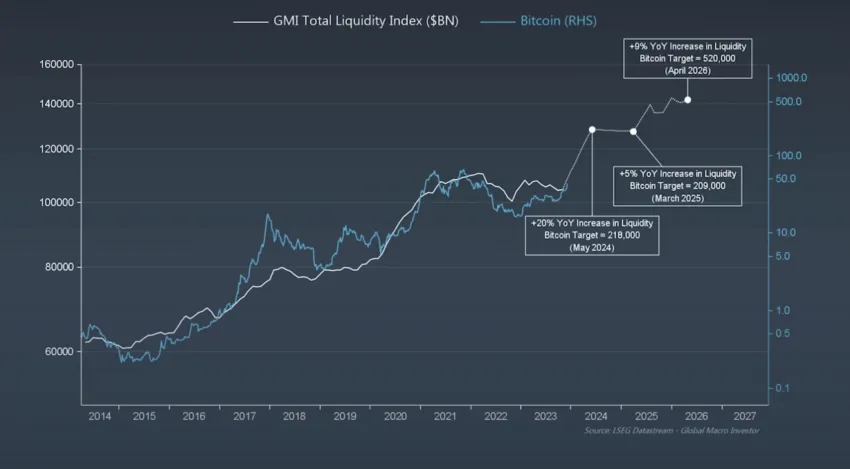

Raoul Pal, co-founder and CEO of Real Vision, also provided a macroeconomic perspective on Bitcoin's potential growth. He identified two major global trends – the business cycle and financial conditions – that have a significant impact on asset prices. Pal suggested that Bitcoin could reach $500,000 to $1 million by the end of 2025.

“These cycles can be crazy and this feels a lot more like the 2017 cycle than the last cycle. And, that cycle didn't have a lot of central bankers printing … central banks' balance sheets. [are now] took off . We've seen 20% growth and what happened to Liquidity, crypto absolutely exploded. I feel that is the case now,” Pal emphasized.

In the year Analyzing Bitcoin relative to the S&P 500 since 2013, Pal notes an 88% annual gain, solidifying Bitcoin as a major asset in the financial market. They emphasize the high risk-adjusted returns in crypto compared to other investment options, due to the asset's high correlation with global liquidity trends.

“[Bitcoin] It's a horse that I give back the most. He is the fastest horse in the race. Better risk-adjusted returns, higher correlations with this global liquidity index, which is our code for everything. So when we use our proprietary frameworks, we know how the asset's value works, which gives us a competitive advantage,” added Pal.

Pal also discussed Bitcoin's semi-cyclical effect and its correlation with global debt restructuring cycles and election cycles. These macro factors, combined with ETF expectations, could propel Bitcoin to new highs, he said.

Read more: BTC price prediction for 2024 after confirmation of Bitcoin ETFs

The approval of Bitcoin ETFs is seen as a game changer. It provides a streamlined and simple way for institutional investors to gain exposure to Bitcoin, thereby increasing demand and lowering barriers to entry. This in turn can lead to significant price increases as new capital floods the market.

“[Bitcoin] It gives us a weird set of numbers… it gives us crazy numbers like $218,000 in May. That's after noon and after the ETF. It also gives you a goal of half a million bucks by 2026, which is in line with [logarithmic] trend, so it's possible,” says Pal.

The road to $1 million awaits a major producer.

Mou and Pal both highlighted the critical role of institutional investors in driving Bitcoin's value. The entry of big players like BlackRock shows the growing acceptance of Bitcoin as a legitimate investment vehicle. These institutional revenues are expected to increase significantly following the approval of the Bitcoin ETF.

The arguments presented by Mow and Pal point to a time of change for Bitcoin. In fact, a potential ETF approval could act as a catalyst for an unprecedented price rally.

Read more: Full list of Bitcoin ETFs approved in January 2024 and expiration dates

While past performance does not guarantee future results, the combination of limited supply, institutional demand, and favorable macroeconomic conditions is a case in point for Bitcoin's potential to grow to $1 million.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.