Why do analysts predict that Bitcoin will never reach $40,000 again?

Bitcoin (BTC) continues to capture the attention of investors and analysts. Amid volatile market conditions, bold predictions have been made by prominent market analysts.

One suggests that Bitcoin will never drop below $40,000 again, while others expect a parabolic move on the horizon.

The price of Bitcoin will not drop below $40,000.

A well-known Bitcoin analyst known by the name Planby has given an optimistic view based on the consecutive price gains. This metric reflects the average price at which Bitcoin has traded in the past.

According to Planby, the price of certified Bitcoin has shown consistent growth, now at $23,000 for the past month, $32,000 for two years, and especially $40,000 for the five-month period. When Bitcoin trades above these parameters at approximately $42,000, PlanB interprets this as a strong bullish signal.

He pointed out that any changes to the five-month confirmed $40,000 price could represent a lower bound for Bitcoin's future value.

“All these realized prices are going up and Bitcoin is at the top and that's a very scary sign. We see at the beginning of every bull market… they all go up, and Bitcoin stays at the top… so that might mean there's no guarantee, but that doesn't mean Bitcoin will ever go below $40,000 again,” Planby said.

Parabolic movement in the midst of high BTC concentration

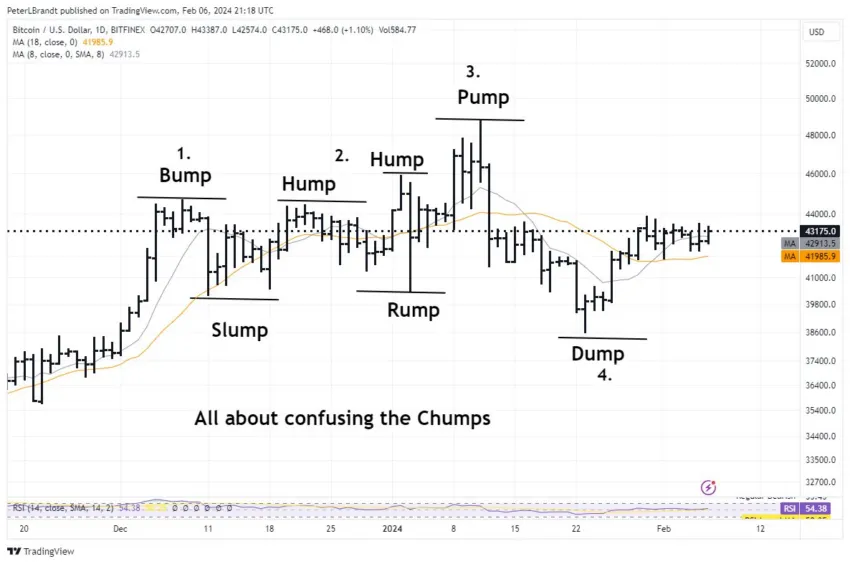

Echoing this bullish sentiment, trading veteran Peter Brandt suggested that another parabolic run in Bitcoin's price might be in the offing. Inspired by Elliott Wave Theory, Brandt's analysis identifies market patterns of peaks and troughs that indicate investor psychology and significant price movements.

The sequence he identifies — bump, bump, bump, and pump — has historically preceded significant increases in Bitcoin's price. Brandt's latest observations indicate that Bitcoin may be on the verge of entering a “pump” phase, poised for further growth if it successfully overcomes key resistance levels.

“Is history repeating itself? As Yogi Berra once said, ‘It's like deja vu all over again,' Brandt said.

Read more: Bitcoin price prediction for 2024/2025/2030

Backing up the bullish sentiment, Ali Martinez, Head of Global News at BeinCrypto, noted a significant trend in Bitcoin stocks.

According to him, Bitcoin is experiencing one of its “most significant rally periods in 3 years”. Martinez pointed to the Accumulation Trend Score, which has remained close to 1 for the past four months. This shows a strong confidence in the market, large entities invest significantly in Bitcoin.

The convergence of these analyzes shows a compelling case for Bitcoin's future direction. Planby's insight into real prices, Brandt's interpretation of market patterns, and Martinez's observation of bitcoin stocks underscore a market sentiment ripe with optimism.

As Bitcoin hovers above impressive price thresholds, the possibility of a dip below $40,000 becomes more plausible again. So, they paint a picture of a digital currency on the brink of another historic run.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.