Why Ethereum Price Could Fall Below $3,000

Ethereum (ETH) is currently experiencing significant downward pressure, its price has dropped by 3% in the last 24 hours. This bearish trend could push the price of ETH below the critical $3,000 price level.

This analysis examines the factors that contribute to this possibility.

Ethereum sellers have re-emerged.

A review of the ETH/USD one-day chart has confirmed that the coin's moving average converging divergence (MACD) indicator is forming a death cross. As of this writing, the coin's MACD line (blue) is trying to fall below its signal line (orange).

This indicator measures the price trend and momentum of the asset and identifies buy or sell signals. A MACD death cross occurs when the MACD line (short-term moving average) crosses below the signal line (long-term moving average), indicating a trend reversal or momentum reversal. This signal indicates that selling pressure is increasing, and the value of the property may decrease further.

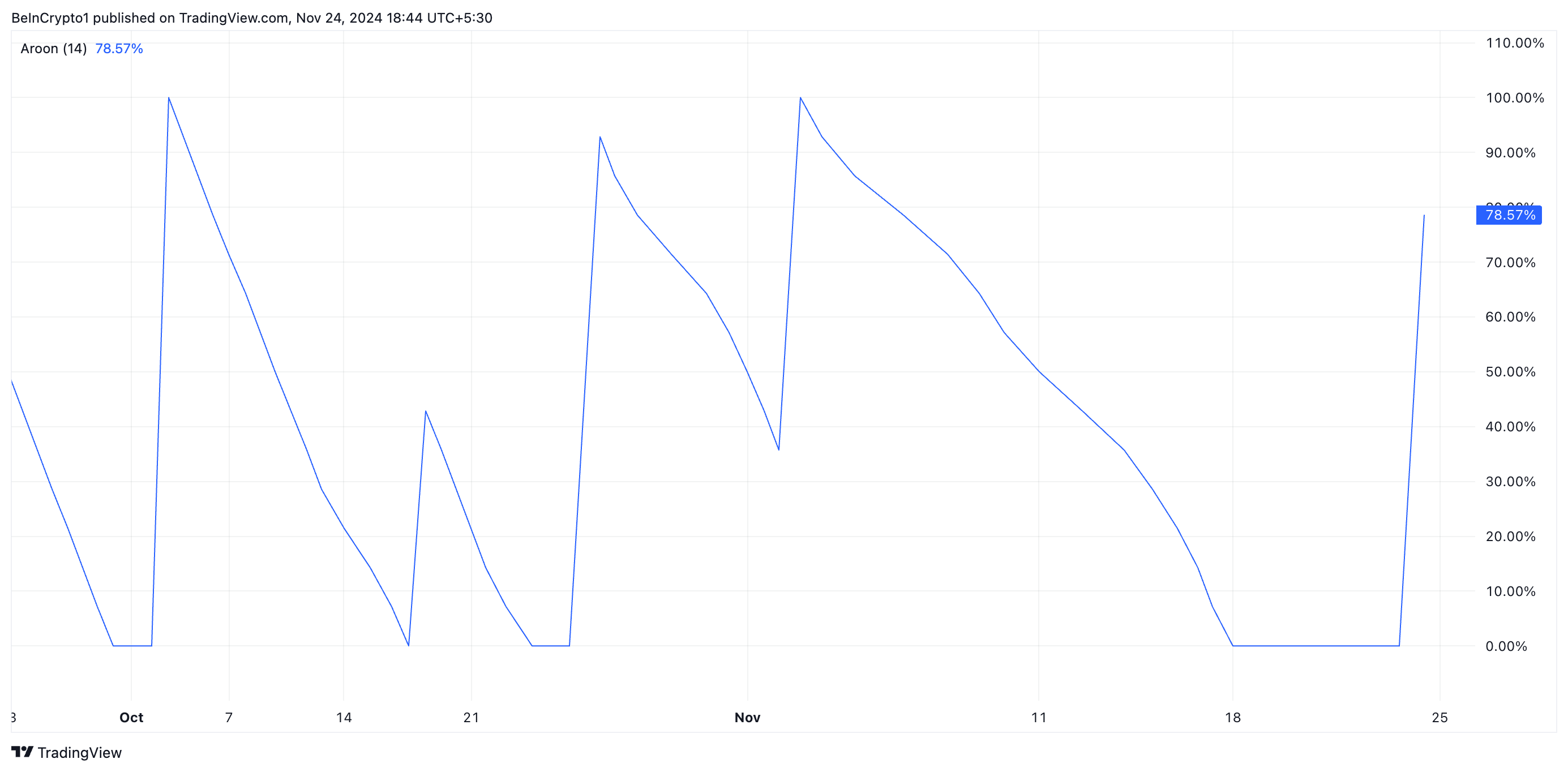

ETH's rising Aroon Down Line confirms this strengthening bearish pressure. It is currently sitting at 78.57%, which confirms that the decline in the price of ETH is increasing.

Aaron's indicator evaluates the strength of an asset's price trend with two components: the Aaron's Up line, which reflects bullish strength, and the Aaron's Down line, which reflects bearish strength. A rising Aaron's Down line shows that recent lows are occurring repeatedly, indicating growing bearish pressure or a bearish trend.

ETH Price Prediction: Key support level to watch

ETH is currently trading at $3,333, resting above the support created at $3,203. This level is critical because a drop below it will cause ETH to change hands below $3000. Readings from the coin's Fibonacci Retracement tool show that if this happens, Ethereum's price will drop to $2,970.

However, the resurgence of demand for the leading altcoin disproves this bearish theory. If this happens, Ethereum will rise to $3,500.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.