Why has Litecoin increased in value today?

Litecoin (LTC) is up roughly 20% in the past 24 hours, topping $120.50 on January 16, as traders piled into the market around Canary Capital's latest update to its Litecoin exchange-traded fund (ETF).

LTC/USD four hour price chart. Source: TradingView

Crypto market debuts Litecoin ETF filing

Canary Capital has filed an amended S-1 form for its proposed Canary Litecoin ETF, positioning LTC as the next cryptocurrency to seek regulatory approval for an ETF in the US.

Bloomberg analysts highlighted the significance of the Jan. 15 filing, which is consistent with industry speculation that the US Securities and Exchange Commission (SEC) is actively reviewing Litecoin-focused ETF applications.

“This development supports the view that Litecoin is a candidate for the next crypto ETF endorsement,” said Bloomberg ETF analyst Eric Balchunas.

However, he cautioned that the upcoming leadership transition at the SEC will introduce “significant volatility” that could affect timing and results.

ETF speculation has fueled sharp rallies in recent weeks in cryptocurrencies such as XRP ( XRP ), Solana ( SOL ), and Cardano ( ADA ).

Related: XRP hits 7-year high as optimism outweighs SEC appeal concerns

Litecoin is experiencing a similar uptrend, driven by hopes that ETF approvals could pave the way for institutional adoption.

Litecoin whales and sharks collect LTC

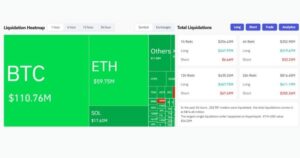

Litecoin's gains are seen today after a week of accumulation by its wealthy traders and investors.

Onchain data from Sentiment shows that wallets holding at least 10,000 LTC have collectively added 250,000 LTC to their holdings in the past six days, showing strong buying interest from influential market participants.

Litecoin Well and Shark Token Holdings vs. LTC Price. Source: Santiment

The stock started on January 9th and has been adjusted to a 25% increase in the price of Litecoin.

This renewed high-volume investor interest underscores growing optimism around Litecoin's potential, especially as ETF speculation continues to dominate headlines, fueling institutional and retail interest in the asset.

Litecoin price eyes 30% profit

Litecoin's gains today are part of an ongoing breakout from a descending triangle pattern.

Descending triangles during highs are typically considered bearish reversal patterns. However, in some cases, if the price breaks above their higher trend lines, they indicate bullish continuation trends.

On January 15, LTC broke above the trendline triangle with rising volumes.

According to technical analysis, the cryptocurrency may rise to the highest height of the current descending triangle, so consider the upside target of $157 in February, or a 32% gain in the coming weeks.

XRP/USD Daily Price Chart. Source: TradingView

Conversely, a pull below the broken trendline will devalue this setup, with immediate support from the 50-day exponential moving average (50-day EMA, red wave) at around $105.

This article does not contain investment advice or recommendations. Every investment and business activity involves risk, and readers should do their own research when making a decision.