Why investors should turn to Altcoins

The cryptocurrency market, especially Bitcoin, goes through a transformation process known as the “halving” every four years, when the reward for mining is cut in half, greatly affecting the flow of new BTC.

This much-anticipated event will reduce the supply, which has traditionally increased the value of Bitcoin. As the 2024 halving takes place, industry leaders share critical insights. They highlight the impact of this event on business strategies and the broader investment landscape.

Post-half quick results

John Patrick Mullin, CEO of Real-World Assets (RWA) Layer 1, spoke to BeInCrypto about the immediate impact of the Bitcoin halving. Market volatility is predicted to increase due to the sudden decrease in block rewards.

“After the halving, short-term traders should be prepared for increased volatility. A reduced block reward can cause immediate market reaction, and traders should monitor potential price changes for quick profits or offset losses,” Mullin explained.

This period of volatility presents opportunities and risks, requiring investors to be very active and responsive to market signals.

Mullin mentions the importance of monitoring hash rate and miner activity after halving. A decrease in hash rate after the halving could indicate that miners are catching up, which could exacerbate a short-term decline in Bitcoin's price. This situation provides strategic entry points for investors or can serve as a warning sign to delay further investments.

While the halving spurred a flurry of activity and speculation among short-term traders, Mullin advocates a different approach for long-term investors. As the newly limited supply of Bitcoin interacts with steady or rising demand, he says, focusing on the potential for price appreciation to last, “suggests that you may consider holding more Bitcoin or slowly accumulating it.”

Likewise, Nash Lee, co-founder of decentralized exchange (DEX) Merlinswap, believes long-term investors should look beyond immediate volatility, noting the large price gains that have historically followed halving events.

“A reduction in the supply of Bitcoin may lead to an increase in price, which should be a long-term consideration for increasing Bitcoin holdings. Compared to other altcoins, Bitcoin exhibits less price volatility, coupled with silver news this year such as Bitcoin exchange-traded funds (ETFs), making it worth considering increasing your BTC holdings relative to other assets.

A look at historical data around supply and price volatility during previous Bitcoin halvings provides useful context.

In the year In the first breakout event on November 28, 2012, the price of Bitcoin was $12, rising to $1,242. Similarly, on July 16, 2016, the price of the second stripping event was seen at $664, and finally reached the peak of $19,804, which shows an increase of 2,903%. The most recent halving on May 11, 2020 saw a price of 8,571 and the subsequent high hit $68,997, representing an increase of 705%.

Read more: What Happened in the Last Half of Bitcoin? Predictions for 2024

According to Christian Haralampiev, head of products at crypto platform Nexo, these historical trends indicate the possibility of significant price inflation following halving events.

“Bitcoin's deflationary nature, highlighted by the reduction in newly minted supply during halving events, increases the need to hedge against global inflation. This feature reinforces its status as a desirable asset, especially in times of economic uncertainty. As a result, the focus on halving events will intensify, further strengthening Bitcoin's reputation as a store of value.

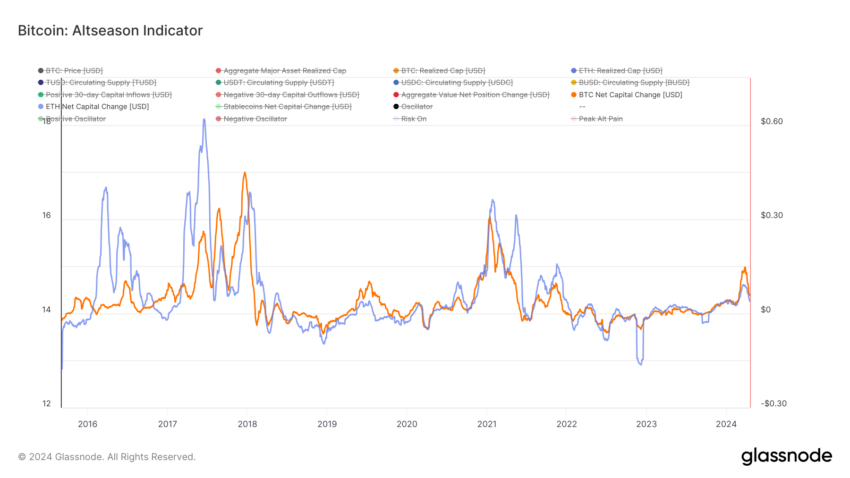

When the Altcoin season begins

The discussion extends beyond Bitcoin. Mullin suggests that after the halving, the cryptocurrency market will often see a shift in investor focus towards altcoins.

“The increased attention and influx of capital could lead to the market's so-called ‘altcoin season,' when altcoins experience significant price increases after Bitcoin's initial surge. Once the hype surrounding Bitcoin's halving fades, investors may want to diversify. This strategy should be especially relevant if investors are looking for the ‘next big thing' following Bitcoin's bull run, Mullin asserts.

This extended view is critical as the market adjusts and recalibrates following the halving. Historically, when the price of Bitcoin stabilizes after the initial half-life increase, altcoins begin to gain attention.

In fact, the parabolic altcoin period usually opens when the price of bitcoin stabilizes after the initial half-life surge, prompting investors to seek higher returns. If the price of Bitcoin increases significantly and its market dominance increases, the next change in this dominance may cause investors to start taking profits and shift funds to altcoins.

This pattern was seen when Bitcoin's dominance increased by 73% after the 2020 halving. If similar trends repeat in 2024, a shift from Bitcoin to altcoins is expected.

Read more: Which are the best Altcoins to invest in April 2024?

Investors considering such activities should carefully evaluate altcoins based on their use cases, technology base, development teams, community support, and marketplaces. In addition, altcoins tend to rally when the market is buzzing about new technologies or projects, so keeping track of market sentiments and trends is critical.

However, due to their higher volatility and risk compared to Bitcoin, investors should carefully assess their risk exposure and consider diversifying their portfolios to effectively manage these risks. Lee explains the importance of doing thorough research to avoid succumbing to fear of missing out (FOMO) and reducing the risks of investing in lesser-known altcoins.

“After Bitcoin's halving, some people believe that altcoins offer more attractive investment opportunities. However, altcoins are known for their high volatility compared to Bitcoin, which require careful evaluation. It is important to thoroughly research the projects and their backgrounds to understand the investment value and potential returns,” emphasized Lee.

Looking ahead, the implications of the halving will extend to the broader financial ecosystem. Insights from Mullin, Haralampiev, and Lee suggest that the halving will strengthen Bitcoin's legitimacy as a leader. It also serves as an incentive to increase market dominance and further investment into altcoins.

These dynamics point to the need for a well-rounded investment strategy that addresses Bitcoin's halving and long-term effects on market behavior and investor sentiment.

Disclaimer

Following Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is committed to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its employees. Readers should independently verify information and consult with a professional before making decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.