Why is Bitcoin up today? Michael Saylor Happened!

It fell in the danger zone between $56,600 and $52,500 on September 5. This happened last time Bitcoin touched $49,000 twice in one day on August 5th. The recent fall of BTC at $56,600 has caused a lot of tension in the market, as September is very popular. A red month for the biggest cryptocurrency. However, on September 9, it took a sudden jump and shocked the market. Let's examine all the answers to why this happened.

Momentum chart

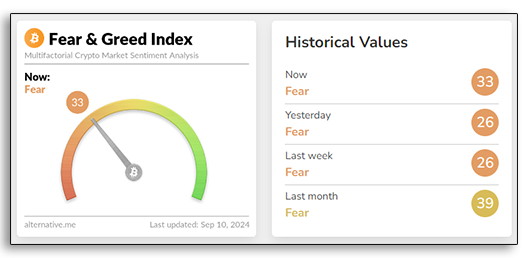

In the last 24 hours, the cryptocurrency ecosystem's market cap increased by 2.51% and reached $2.09T. The price of BTC suddenly rose to 6.52% and passed the 20 and 50 moving averages, but did not allow MA 100 to pass; It fell 2.5% to test the support zone around $56,600. RSI is showing bullish momentum and is recorded at 61 points. The Fear and Greed Index, at 26 marks, is at 33 with fear peaking and showing a decline in market fear.

Looking at the chart, it looks like BTC is trying to strengthen the support at $56,600 but the fear of September still gives an advantage to the bears. A close above this support level is critical for Bitcoin or there is a chance to look towards $50,000 for support and recovery.

Other market parameters

Data from IntoTheBlock shows that at current prices, most Bitcoin investors are in the money. This clearly shows that 79% of BTC investors bought the coin below $56,960. This 13% of the funds are still in losses, and 8% of investors have bought at the current price.

A total of 2.26 million BTC addresses with 4.55 million BTC addresses bought the assets between the price range of $55,507 and $61,396, with an average purchase price of $58,690. The main resistance is before $60,000. 6.93 million addresses with 3.14m BTC with a minimum purchase price of $61,396 and a maximum purchase price of $72,500. This $11,000 price difference created significant resistance.

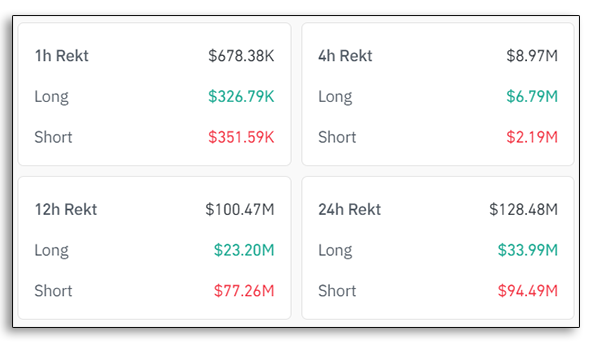

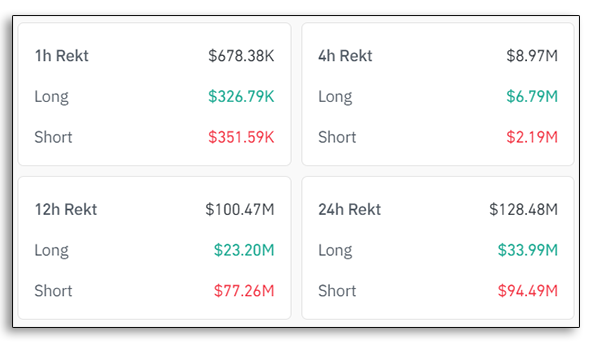

Liquid data

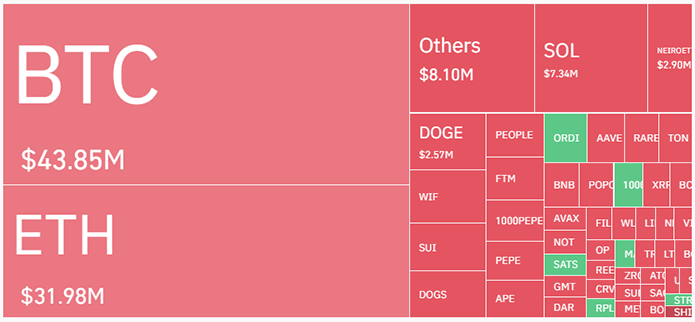

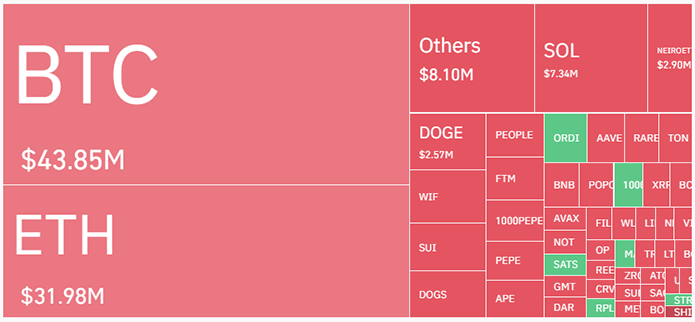

In the last 24 hours, 39,647 trades were canceled and the total amount transacted was $128.42 million. Interestingly, two days ago, the liquidity data included long transactions. However, current data shows that in the last 24 hours, the market has given a big signal by liquidating short trades.

Bitcoin had the largest short liquidation to $43.85M last year at $31.98M. Interestingly, Dogecoin, which closely tracks Bitcoin's price movements, also has short $2.57M in liquidation.

How did Michael Saylor grow Bitcoin today?

Michael Saylor, founder and chairman of the popular MicroStrategy, was invited to a discussion on Bitcoin on CNBC on September 9. When asked about his opinion on the profits generated by Bitcoin, he didn't hold back and openly shared the company's profits with BTC. As of August 2020, MicroStrategy says it has bought nearly $8.3 billion worth of bitcoin. He said: “We optimized Bitcoin and it increased 825%, 1 stock in the S&P is 821%. So we beat every company in the S&P using our Bitcoin strategy.

When asked about the recent $1.2 billion outflow from the Bitcoin Spot ETF, Salor responded by saying that he thought that was generally a good thing because it created more interest. Bitcoin is smart money and the most liquid and volatile free market in the world.

Bitcoin price prediction

When Andres Ross talked about Bitcoin, the so-called digital gold, he asked Saylor about the behavior of Bitcoin in times of panic. Saylor countered that if you're a long-term holder, you're profitable because bitcoin moves 44 percent annually. And even if you are a short-term trader, the market offers many arbitrage opportunities.

In Seiler's words

If you can hold Bitcoin for more than 4 years, you are going to get an outperformance due to its volatility. Currently, Bitcoin is only 0.1% of the global market value and will be 7%.

He shared his prediction of the price of Bitcoin in the next 21 years. According to him, Bitcoin will be worth 13 million dollars in 21 years, and all you have to do is hold a little bit of Bitcoin.

The result

After the release of this interview, Bitcoin began to show positive momentum. If Michael Saylor is too confident in Bitcoin, the market will follow. Bitcoin's remarkable move of nearly 7% in the month of September is a sign that BTC has improved over the course of a decade. We have seen over the last few years that whenever there is a shock in the market, it creates buying opportunities. This is how bitcoin whales accumulate assets and fill their wallets.