Why is the price of Bitcoin above $31,000 making the micro strategy profitable?

The crypto market is buzzing with excitement as Bitcoin breaks above $31,000, marking the first since July, and micro-strategies are once again pushing towards profitability.

This change is not just a figure, but a proof of growing confidence in the approval of the spot Bitcoin ETF (Exchange Traded Fund).

Bitcoin breaks $31,000 on ETF speculation

At dawn on Monday, Bitcoin rose, continuing its rally into a second week. This surge of more than 4% in the last 24 hours has seen Bitcoin cross the all-important $31,000 threshold. This is a picture that hasn't been seen since the summer rays of July shone down.

At the time of writing, Bitcoin was trading at $31,300, a figure that reflects the strength of the individual and led to a 3.7% increase in the global cryptocurrency market capitalization to a high of $1.22 trillion.

Read more: How to buy Bitcoin (BTC) and everything you need to know

This rally, analysts say, is fueled by several signs of bullying. Among them, the shrinking GBTC discount has now reached -11 percent.

According to BlackRock CEO Larry Fink, this represents a consensus on the accepted position of the Bitcoin ETF in Q1 2024, which is expected to trigger significant capital inflows. Moreover, the withdrawal of Bitcoin from altcoins by Michael Dunn of Bitnomial Exchange, especially the eyes of the market are set on the approval of the ETF.

“With the adoption of ETFs expected by the market as the digital gold standard, we are seeing Bitcoin share with altcoins. As of the end of 2022, Bitcoin's rising dominance metric shows its superiority compared to other cryptocurrencies, Dunn said.

Micro strategy is back to profit

This Bitcoin rally only brings market volatility to the table. Microstrategy's multi-billion-dollar bet on bitcoin has fueled it. With the largest cryptocurrency above $31,000, MicroStrategy's average purchase price of $29,582 is now profitable.

This winning round follows a cautious and aggressive Bitcoin buying strategy. Its co-founder Michael Saylor has led acquisitions since 2020.

Read more: 11 Top Public Companies Investing in Bitcoin

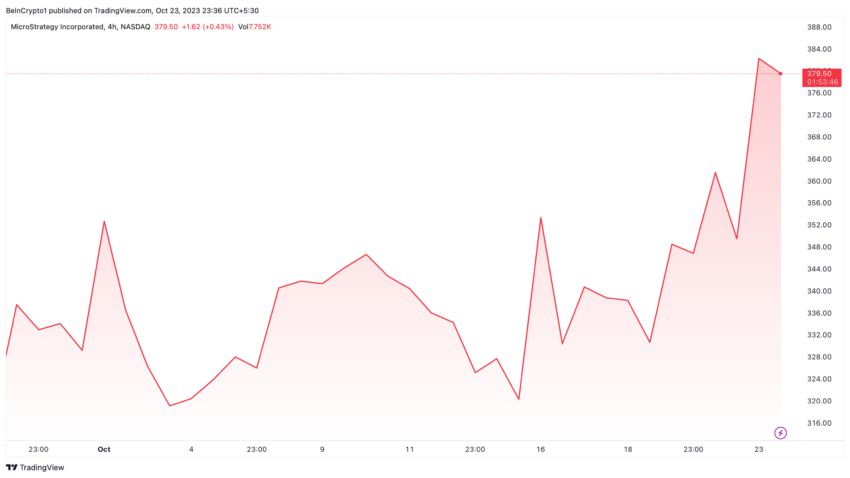

MicroStrategy shares have mirrored this victory, rising 160% this year. This reversal is the result of Bitcoin's 85% growth this year, compared to the bleak 2022 peak when the stock plunged 74%.

Stéphane Ouellette, CEO of FRNT Financial, emphasized that MicroStrategy Treasury's upward trajectory reflects a strong quarterly report.

“Given the level at which MicroStrategy Treasury has bought Bitcoin, their stock should trade well or at least report a stronger quarter on the back of the gains. As they try to build around space services, they could clearly see demand for their services increase,” Ouellette said.

As Bitcoin soars, it's renewed optimism for stakeholders like MicroStrategy. And as the crypto giant continues to climb, all eyes are fixed on how high Bitcoin can go.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content.