Why is the price of Bitcoin rising today? the reason

Bitcoin (BTC), the world's largest by market capitalization, has been receiving a lot of attention from the crypto community for its dramatic price increase after 24 hours. With an increase of more than 6%, BTC regained the $66,000 level for the second time since July 2024.

The reason why the value of Bitcoin is increasing

The reason for this massive upheaval is the upcoming United States presidential election. According to data shared by trading firm QCP Capital, Bitcoin's current price action is similar to that seen before the 2016 and 2020 US elections. BTC experienced a significant upside rally during that period.

“Looking back to 2016, BTC traded in a very tight range for over 3 months,” QCP Traders said. BTC started its rally at $600 and eventually doubled its price in the first week of January, three weeks before the US election day.

He added, “Similarly, in 2020, BTC was stuck in a boring range for half a year and started collecting from 11 thousand dollars only three weeks before the US election day, and reached 42 thousand dollars in January.”

While traders add to October's historical pattern and positive performance, “Today's rally certainly gave the market a glimmer of hope as the optimism of October faded.”

Bitcoin technical analysis and upcoming levels

According to expert technical analysis, Bitcoin looks bullish but is currently facing a strong rejection at the critical resistance level of $66,200. The last time BTC reached this level, it experienced a sudden price drop of more than 10%. If BTC breaks this barrier and closes the candle above $68,000 on a daily basis, there is a strong possibility that it will reach an all-time high.

Currently, BTC is trading above the 200-day Exponential Moving Average (EMA), indicating an uptrend. Traders and investors use this indicator to determine whether an asset is in an uptrend or downtrend.

Bullish gauges on the chain

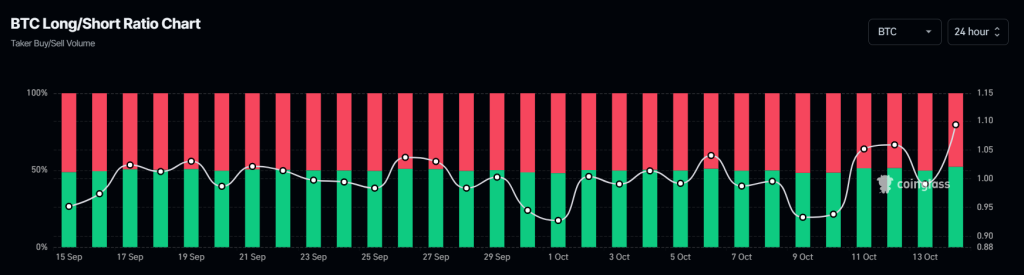

Bitcoin's positive outlook is further supported by on-chain metrics as bulls return to the market and may continue this inverted rally. According to on-chain analytics firm Coinglass, BTC's long/short ratio currently stands at 1.10, the highest since September 2024. A jump in this ratio indicates a strong bullish sentiment among traders.

Additionally, open demand for BTC futures has increased by 10 percent in the past 24 hours and 3.7 percent in the past four hours. This open demand shows that the demand from investors and traders is growing, which can be driven by the upcoming elections.

Combining these on-chain metrics with technical analysis, it seems bulls are dominating the asset at the moment and as per historical trends, the rally could continue in the coming days.