Why Jeremy Allaire, QCP, Matt Hougan Remain Bullish on Crypto

Recent industry insights suggest that the future of crypto is bleak. Continued advances in blockchain technology and favorable regulatory developments contribute to this optimism.

Analysts are realizing the huge potential for cryptocurrencies to change economic and social structures on a global scale.

Experts stay bullish on Crypto

Circle CEO Jeremy Allaire expressed his optimism about the future of crypto. This confidence, he said, is the continued development of open Internet protocols that have historically transformed industries and economies.

He believes that crypto represents the next evolution in Internet infrastructure, which provides the critical need for a layer of trust.

The emergence of Bitcoin marked the beginning of change, introducing the potential of digital tokens, public blockchains, and smart contracts to transform economic and social structures. He pointed out that there has been rapid progress in blockchain technology, showing the proliferation of third-generation public blockchains capable of supporting large-scale applications.

“Digital tokens, issued on public blockchains, exchanged between smart contracts can release a trusted environment on a global scale, which will be the basis for almost all the building blocks of society and economy to become native to the Internet,” Allaire said.

The global adoption of digital assets further fuels Allair's bullish attitude. In fact, governments around the world are establishing regulatory frameworks for cryptocurrencies, and major financial institutions are integrating blockchain technology into their services.

Analysts at QCP Capital echoed Allair's optimism. They highlighted the recent rebound in Ethereum prices and the positive impact of regulatory developments. The decision of the SEC to close the investigation on Ethereum 2.0 and the launch of Ethereum exchange-traded funds (ETFs) strengthened the market sentiment.

Analysts have noted increased activity in the options market, suggesting strong investor confidence in ETH's future performance.

“The options market has reflected this optimism, with the desk seeing activity in buying high-side calls on various tenants. While there is uncertainty around Ethereum ETF uptake, capturing 10% to 20% of Bitcoin ETF flows could propel ETH above $4,000,” QCP Capital analysts wrote.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

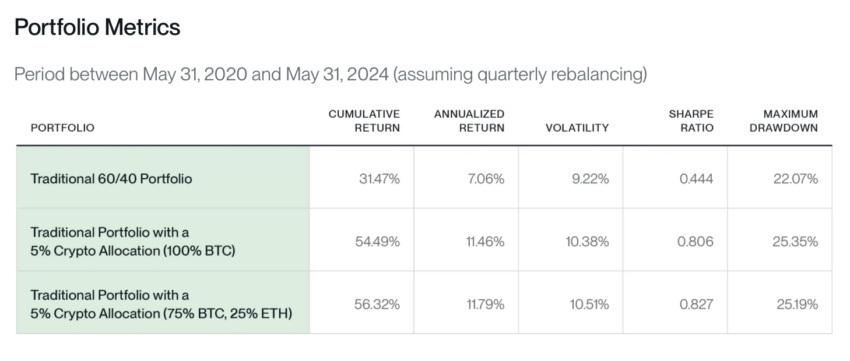

Bitwise Chief Investment Officer Matt Hogan also shared a positive outlook. He highlighted the importance of adding Ethereum exposure to investment portfolios. He then offered three compelling reasons for this strategy: diversity, diverse use cases, and historical performance.

Hugan acknowledged that some investors may prefer a Bitcoin-only approach, particularly those concerned about fiat currency destruction and inflation. Bitcoin's established marketplace and regulatory transparency make it a strong choice for such strategies.

However, for other investors, the introduction of the Ethereum ETF provides an opportunity to expand their investment in crypto.

“Today, the market value of ETH, the crypto asset that powers the Ethereum blockchain, is about $420 billion. This is about a third of Bitcoin's $1.3 trillion. The starting point should therefore be 75% Bitcoin and 25% ETH,” Hougan explained.

These insights point to the next wave of innovation and adoption in the financial system for Bitcoin and Ethereum, despite recent price action.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.