Why long-term holders of Bitcoin can change the game BTC

Bitcoin (BTC) price may have officially reached a “reset” following a surprising increase in the coin's long-term net position change. Historically, an increase in this measure helps the price recover.

But will it be the same this time? This analysis of the chain examines the possibilities.

20 billion dollars in the bag for Bitcoin HODLers

According to Glassnode, the change in the net position of long-term Bitcoin holdings has been increasing since July 22. However, today, the metric that tracks the change in 30-day supply held by long-term holders reached its highest level since January 2020.

As shown in the image below, long-term holders bought 334,358 BTC today. At the coin's current value, this value is close to $20 billion. Buying such a large amount of Bitcoin suggests that holders are confident in the coin's long-term potential.

For example, the last time holders accumulated such a number, the price of Bitcoin was $10,300 (in 2020). By the end of the same year, the price had increased to $28,988, representing a roughly 300% price increase.

While history never repeats itself, patterns often sing. If the supply of long-term collateral has a similar impact on Bitcoin, a medium- to long-term disruption is likely. However, this increase may not produce the huge 200%-300% gains seen in the past. Bitcoin is currently trading at $58,579, which represents a 11.95% decrease over the past 30 days.

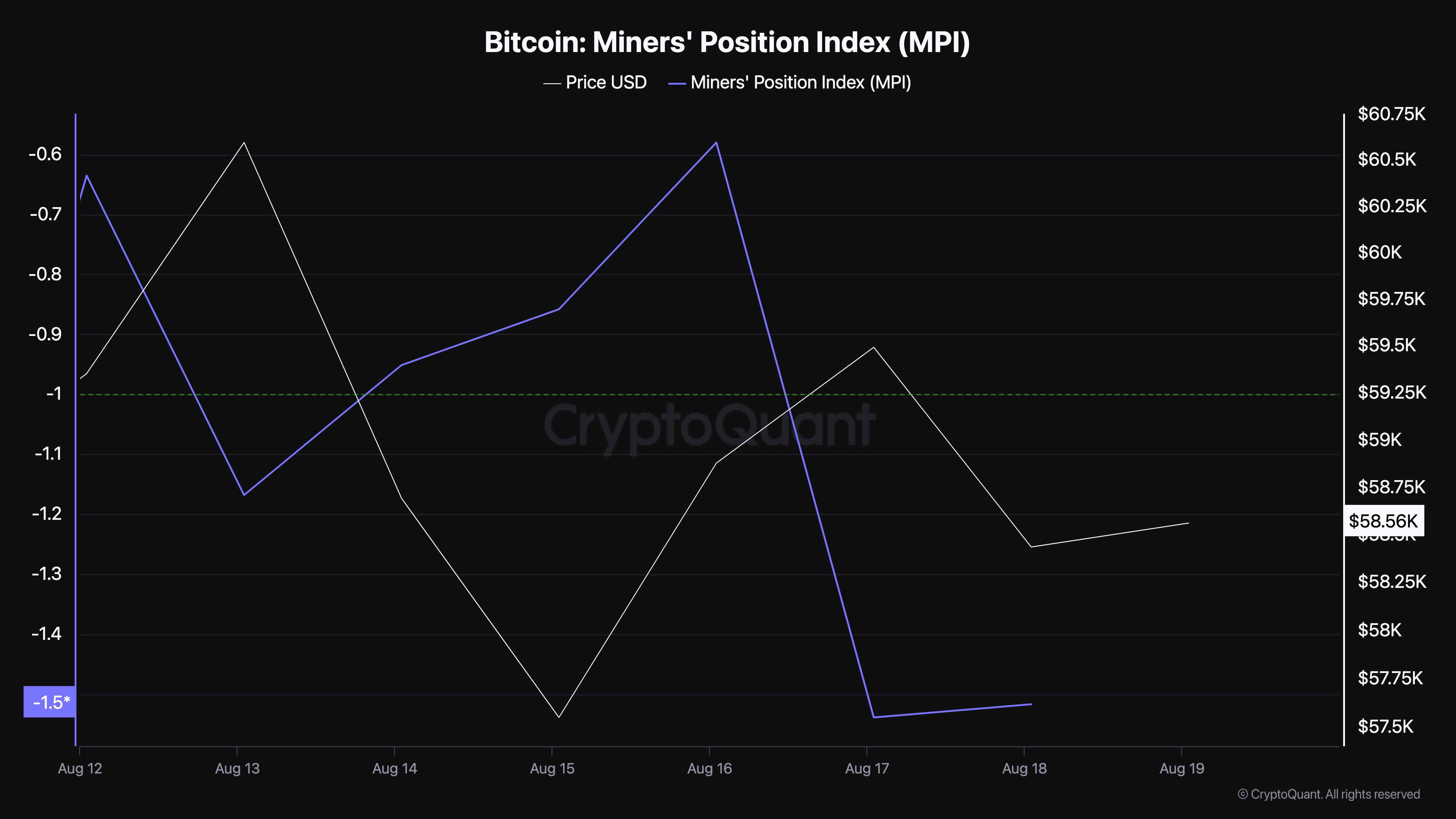

In the short term, Bitcoin can get relief due to mining (MPI). The MPI is the ratio of the total mining flow measured in dollars to the 365-day moving average of the same ratio. Higher values indicate that miners are withdrawing coins from their reserves and selling them.

Usually this results in a price cut. However, according to CryptoQuant, the MPI has dropped to its lowest level since last week.

Read more: Who will have the most Bitcoins in 2024?

The recent offer suggests that miners have refrained from selling. If this situation continues, BTC may avoid another drop. Instead, the price of the cryptocurrency may try to revisit $60,000.

Bulls are ready to pull the trigger on buying.

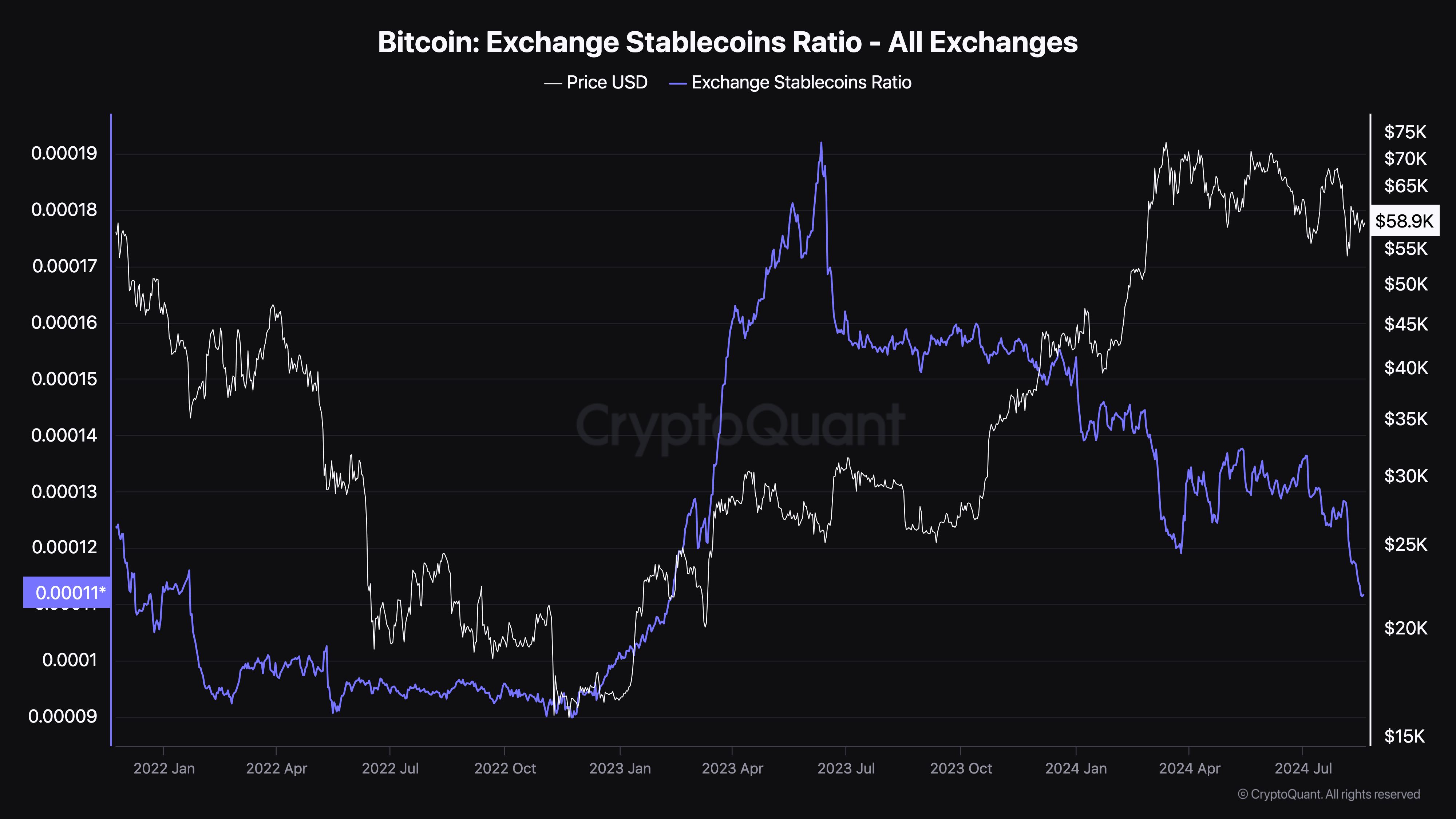

Another measure that supports this is the Exchange Stablecoin ratio, which measures the purchasing power in the market. The higher the Statcoin ratio, the lower the purchasing power, indicating a higher probability of a price drop.

However, at press time, Bitcoin's exchange stablecoin ratio is at its lowest since February 2023. This decline suggests that market participants have more purchasing power to increase prices.

In this regard, CryptoQuant analyst Axel Adler opined that Bitcoin is nearing the end of its consolidation period.

“The current 5-month consolidation looks healthy, with most investors selling their coins at a profit, and no major stress-induced panic selling. Now, realized losses exceed profits, which usually occurs at the end of a consolidation period,” Adler wrote.

BTC Price Prediction: $63,000 may be next

From a technical perspective, Bitcoin is currently trading below the 200-day exponential moving average (EMA). This indicator typically indicates a trend direction, and being below BTC, the outlook indicates a potential bearish trend in the short term.

However, it is also worth noting that a short bull run could send Bitcoin price above the 200 EMA (purple). If this happens, the bulls can push the price higher. If this happens, the price of BTC can reach 60,536 dollars.

Additionally, if the MACD is positive and crosses the 12 EMA (blue) and the 26 EMA (orange), the price may rise. As shown below, the long-term crossing of the short EMA resulted in a significant price increase for BTC.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

For example, the May cross pushed BTC to $72,045, and in July it reached $68,308 after another bullish cross. Currently, EMAs are lined up the same way. If the 12 EMA crosses above the 26 EMA, it confirms a breakout trend, which could push Bitcoin to $63,237.

However, if a bearish crossover occurs, the outlook could be reversed, causing BTC to drop to $54,491.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.