Why meme coins can create a legitimate mining field for celebrities

6 months ago Benito Santiago

Table of Contents

ToggleAbout the author

Carlo D'Angelo is a lawyer, former law professor and crypto and NFT enthusiast. Carlo's practice focuses on advising clients on all aspects of blockchain technology. Carlo is the host of Lex Line, a weekly crypto and blockchain law podcast.

The views expressed here are his own and do not necessarily represent those of Decrypt.

With over 500,000 tokens launched in May alone, there has been a significant increase in meme coin offerings. Thanks in part to sites like this Pump. Fun, anyone can now easily spin a token, upload an image and launch a meme coin. And thanks to social media and trading bots, it's easier than ever for meme coins to go viral and make huge profits.

With all that in mind, it's no surprise that we're now seeing a new wave of celebrities entering the crypto space under their own brand. And with this massive new influx of celebrity meme coins comes a myriad of legal risks.

Just last week, the crypto space was hotly debated over whether Donald Trump's son Barron was behind it. DJT meme coin on Solana. The creator of this token – the famous “Pharma Bro” Martin Shkreli – marathoned Twitter sites that this meme coin is the official Donald Trump token. But still there is no concrete confirmation on this front.

Celebrities in crypto are not new. We saw dozens of A-list celebrities in the last cycle Receive lucrative sponsorship deals From crypto projects and platforms. Due to the failure of FTX and other platforms, many celebrities have experienced a A tsunami of lawsuits They allege that they used their influence to mislead consumers about the dangers of crypto.

This cycle, a new celebrity meme coin meta emerged, with low-level celebrities using meme coins to grow their audience, earn big profits, and arm themselves. A little recapture is relevant They follow years away from the spotlight.

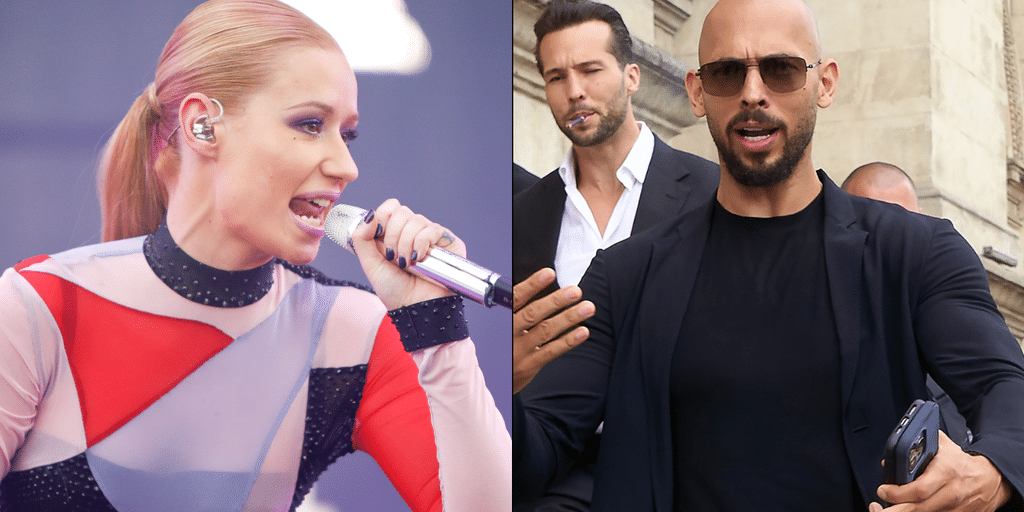

And celebrity meme coins aren't just being started by celebrities like the “B-List.” Caitlyn Jenner And Iggy Azalea– Now we're seeing celebrities on this list drop the meme coin.

During the most beautiful market cycles, both pump-and-dump scammers and well-intentioned celebrities can slip past their skis and throw away their tokens on promises they have no realistic chance of delivering. As a result, crypto newbies and overzealous crypto-natives can fall victim to fraudulent token drops and suffer huge losses.

Crypto tokens provide an amazing vehicle for uniting large communities around a viral meme, and can give holders the chance to make life-changing fortunes in the process. So it's no surprise that celebrities are turning to meme coins as a way to increase their reach and wallets.

But for all the potential of meme coins to “simulate attention” – as recently demonstrated by a crypto influencer. Order– Meme coins can be misused to manipulate markets and execute fraud.

Posted by Investor Love We are about to enter. Raul Pal This crypto cycle is like the “banana zone” – the point where anything and everything has the potential to go parabolic. In the year As we learned in the late 2021/2022 NFT market cycle, this is the stage where scammers and opportunists race to the crypto community to dump and dump tokens for huge profits. Unfortunately, there is a huge incentive for fraudsters to take advantage of this phase of the market cycle and prey on consumers for a quick and easy profit.

At the height of the moose zone, founders can be blinded by the legal risks of dumping meme coins. In their quest to make bigger and bigger profits, founders forget or willfully ignore the fact that they can be sued and criminally prosecuted for the outrageous promises they make in connection with meme coin giveaways.

As we dive deeper into the banana zone, it's a good time to remind influencers and celebrities about the legal pitfalls that can come with promoting and promoting meme coins. An important point to emphasize is that while a celebrity meme coin project is considered a commodity or security, its founders are open to civil or criminal liability if they make fraudulent claims about the token to boost sales.

Celebrities who promote or launch meme coins can face significant civil legal liability if their actions are found to have manipulated the markets. Celebrities who promote or establish meme coins can also face charges of fraud and perjury if they are found to have made false or misleading claims in a court of law.

In a fraud civil claim, consumers typically must prove that a celebrity made a false statement about their token—knowing that the statement was false or intended to deceive—and that the consumer relied on that statement to their detriment.

Celebrities promoting meme coins can be held liable under securities laws that impose strict rules to protect investors from fraud and market manipulation. Whether a MemCoin is considered a security or a commodity depends on many factors that are beyond the scope of this article. But regardless of whether a meme coin is an SEC-governed security case or a commodity under CFTC administration, counterfeiting scam coins can subject founders to significant regulatory, civil, and criminal penalties.

When evaluating whether a token drop is a fraudulent pump-and-dump scheme, regulators and prosecutors generally look at the following factors: (1) the unique characteristics of the token – including the idea behind the meme coin launch; (2) how the token will be marketed, including promises of potential returns, and (3) what the group has represented about the future use of the token.

Clearly, the greater the promise and the greater the undelivered benefits and future benefits, the more vulnerable these signs will be to regulatory and law enforcement scrutiny.

Although meme coins present new and uncharted waters for regulators, prosecutors coldly and subtly evaluate these token offerings under existing criminal fraud laws. If a celebrity meme is a coin and pump and dump, chances are good that a prosecutor will be able to prove the essential elements of a scheme to defraud consumers.

In a successful meme coin pump and dump scheme, the government must prove that: (1) the celebrity created a scheme to defraud investors; (2) The celebrity has specific intent to defraud investors of money or property. (3) the celebrity used interstate wires, such as telephone lines and Internet connections, to carry out the scheme; and (4) the alleged scheme to defraud the affected interstate or foreign commerce.

It may be easier for prosecutors to prove these elements, for example if a celebrity makes a false statement about the token's roadmap, or in order to generate an estimated profit and attract buyers. Creating a market manipulation through concerted efforts to increase the price or demonstrate high demand for tokens can also be indicative of a fraudulent scheme.

This may be further evidence of a fraudulent scheme if celebrities or founders sell their shares after the price has been artificially inflated – thereby causing the price to drop rapidly, and such market manipulation results in significant losses for other owners.

It should also be noted that the founders' willful ignorance or willful misconduct is not a defense to a fraud claim regarding the illegality of their conduct.

While meme tokens can attract attention, connect communities, and create opportunities for financial gain, they also open the door to widespread fraud and swindling. The ease of launching meme coins, combined with the viral nature of social media, makes it critical that consumers are vigilant and that A-to-Z-list celebrities understand the legal implications of their actions.

Disclaimer: The information provided in this op-ed is for informational purposes only and should not be considered legal or financial advice. Readers should consult their own legal and financial advisors to understand the specific implications and regulations applicable to their circumstances. The opinions expressed in this article are those of the author and do not necessarily reflect the views of any affiliated organizations, celebrities, tokens or brands.

Edited by Andrew Hayward.

Daily Debrief Newspaper

Start every day with top news stories, plus original features, podcasts, videos and more.