Why nine today? – November 7, 2025

The Cryptocounty market is currently up 0.7% to $3.49 trillion from $3.49 trillion in global market capitalization. Meanwhile, the volume of the 24-hour trade shows an active participation despite the widespread weakness and stands at 180.4 billion dollars.

Tdd:

Global Sysopto Market Cap at $180.4b $180.4b

B.C.C.

Asian Equity Patterns After AI Stock Rally and Weak UBS Data

B.C.C.

Before 24 yesterday and before 62, indicators of fear and greed will go down to 21.

BTC ETFS relaunched with $240m,

Et Etfs added $12.5m;

Traders remain cautious in the U.S. government shutdown, the FARD level – cut estimates.

Crypto winners and sellers

At the time of writing, most of the leading cryptocurrencies are in the last 24 hours.

Bitcoin (BTC) is at $101,553, down 2.0% from $2.02 per trillion.

ETehereum (Enf) fell 0.1% to $3,336 or 96% to $964.83.

XRP (xrp) more than halved to 2.22 to 2.22 to 2.22 to $ 2.22.

Solana (Sol)

Dougcoin (Dogor) gained 1.6%, now at $0.1663 trad.

Despite the overall decline, a few bursts of notable gains were posted.

Drybini (Dai) with 618.7%, Internet Computer (ICEP) Rose 4.4%, and ZCASE (ICCH (zCA (ZCAC).

The highest frequencies are Sudang (+248.4%) and Pumpkin (59.5%) and indicate the renewed activity of the lawyer on small caps.

Appearing on CoinarketSarketcap, the internet computer and zechase reflect the interests of the investor in privacy-oriented projects that reflect in a wonderful business environment.

Tired of investing in risk-adverse data and etf atffles as investors are destroyed

Stock markets opened on Friday to ease global risks weighing on both equities and bonds.

Bitcoin and other digital assets that have weakened and grazed creatures more than the big ones held by them and improved assets have taken control again. The total Crespto market was 2nd to $3.47 trillion to $101,545 and Ether was down 2.5% to $3,320.

Regional equity bases are down 1.75% and Hong Kong's Sung Index SENG index is down 0.74%.

A Wall Street selloff led by tech and AI-related stocks followed. The NASDAQ fell to 1.9%.

In the year Fresh labor data showing 153,074 jobs in October, tied for last year's total, added to the economic slowdown.

Analysts said that if the losses end in the fiscal year and the US government's official economic indicators continue to cloud visibility.

Meanwhile, institutional appetite for Bitcoin is showing signs of cooling. Crack Economist Thomas Thomas Pemmom is interested in such a major exile from the turbulent backyard interest, CRPPO ETFS popular flows.

Despite the trend, analysts believe that the prophets of Federal Reserve support will stay on the ropes if stress increases. Treasury yields were flat at 0.4%, and the U.S. ended at $1.1547, up from $1.1547 on signs of concern for another rate hike later this year.

Stages and events next

At the time of writing, Bitcoin is at $101,440, which is 0.15% on the day. The coin will remain under pressure after repeating to drop from $103,000. Following this week's market-wide decline, it will settle between $100,800 and $102,300, reflecting cautious sentiment and low trading volume.

Strong above $103,000 ($10,000) can open the way from $103,000 to $105,000 – $107,000 to $105,000 $10,000. By bearing down $100,000 support risks from $98,500 and $96,800 dollars, the key zones in which the buyers have previously entered are the deep work zones.

Meanwhile, Exrem (ECD) gained 0.72% at $3,337, down from $0,337. Although there is a small recovery, education will lower the monthly after the corrections given earlier this week.

A recovery above $3,400 can move to $3,600-$3,750, holding above $3,300 can expose you to another fall to $3,150 or $3,000.

Traders are anticipating macroeconomic shocks with the continued US government shutdown and short-term declines in Bitcoin and Ethereum.

Meanwhile, the CMC Crypto Fear and Greed Index points to 21 as the market position worsens, while the market's “fear” index points to 21.

After the index stopped at 24 a month ago, a sharp transition from the “greedy” environment to deep caution.

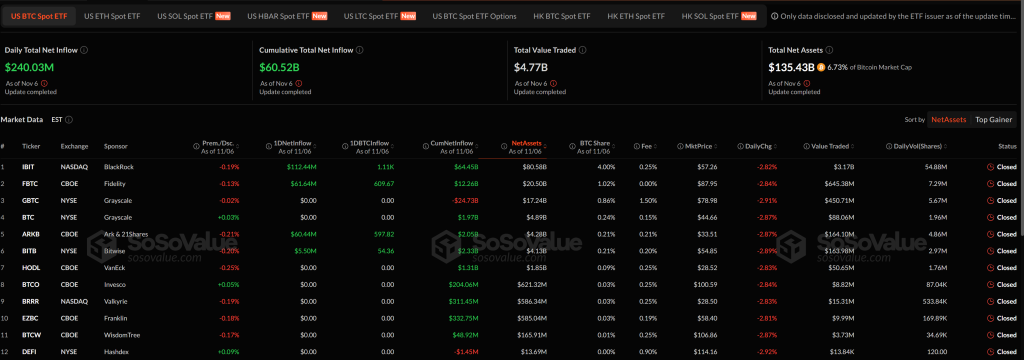

According to Sosovaval, the US Bitcoin market registered a total net worth of $230.03 million.

In total, all Bitcoin ETFs are worth $60.52 billion, representing $6.73 billion of the entire Bitcoin market. The daily trading volume for the day was entered when considering the constant institutional participation.

Among individual funds, Blackrock ibits followed with $112.44 million throughout the day, followed by $61.64 million (ARAK & 21shars' ARKB $60.44 million. <ቦይቢ> 5.5 million dollars were posted in the bookbags, the GRASCEALE GBTC remained flat for the day.

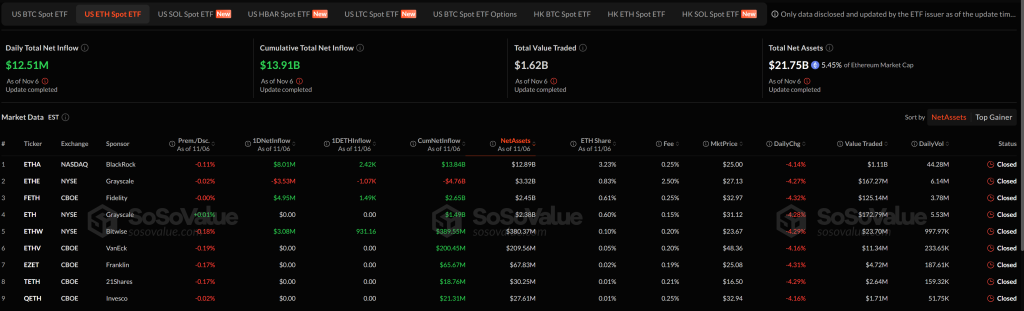

Similarly, the ETERERUME ETFS had a moderate flow on November 6th, due to the smoking of BillRock XN with $4.95 million and $3.08 million.

Established pipelines now stand at $13.91 billion. The total amount of the business of life entered in 1.62 billion dollars, reflecting the constant participation in the main providers.

Closing news news analysed, cryptographic predictions