Why Pyth Network (PYTH) Could Fall to New Lows?

PYTH, the symbol that underpins talk-back provider Pyth Network, has seen a steep decline in its primary market. Total open demand is at an all-time low.

This led the token price to close at a low of $0.22 during Monday's trading session amid the overall market decline.

Paiz records new lows on several fronts

According to Sentiment data, PYTH's open interest rose to $113 million on March 17.

However, Monday's widespread cryptocurrency market losses caused many PYTH derivatives traders to close their positions, pushing open interest down to $19 million.

Open interest refers to the total number of outstanding derivative contracts, such as options or futures, that are outstanding. When it goes down, traders are closing their positions and exiting the market without opening new ones.

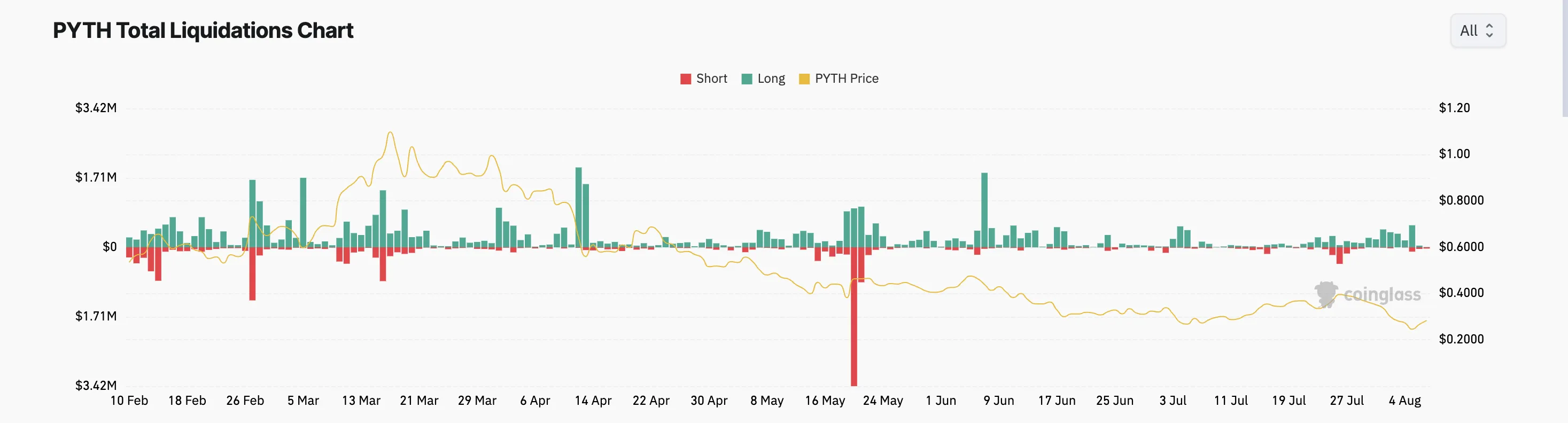

Additionally, due to PYTH's double-digit price decline last week, several long positions were liquidated. According to Coinglass, PYTH's long liquidity has exceeded $1.8 million in the past seven days.

Read more: What is Blockchain Oracle? Entry guide

As expected, market sentiment turned negative as traders requested more short positions from early August. This means that many traders are buying PYTH and hoping to sell it higher, expecting a drop in price from their altcoin stockpiles.

PYTH Price Prediction: Will Price Always Revisit Lows?

The same bullish bias injects altcoins into the space market. Highlighting the decline in interest, PYTH's Relative Strength Index (RS), as assessed on the daily chart, is below the 50-neutral line at 40.35 as of press time.

Asset RSI measures overbought and oversold market conditions. At 40.35, PYTH's RSI indicates that selling pressure is outweighing buying activity.

Additionally, the altcoin's Chaikin Money Flow (CMF), which tracks how money flows in and out of the market, is below the zero line at -0.01. The CMF value is a sign of market weakness as it indicates liquidity outflows. It is a popular prerequisite for sustained price reductions.

If demand remains subdued and capital outflows continue, PYTH price may revisit the all-time low of $0.22. However, if bullish sentiment develops, the token price may rise to a 30-day high of $0.44.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.