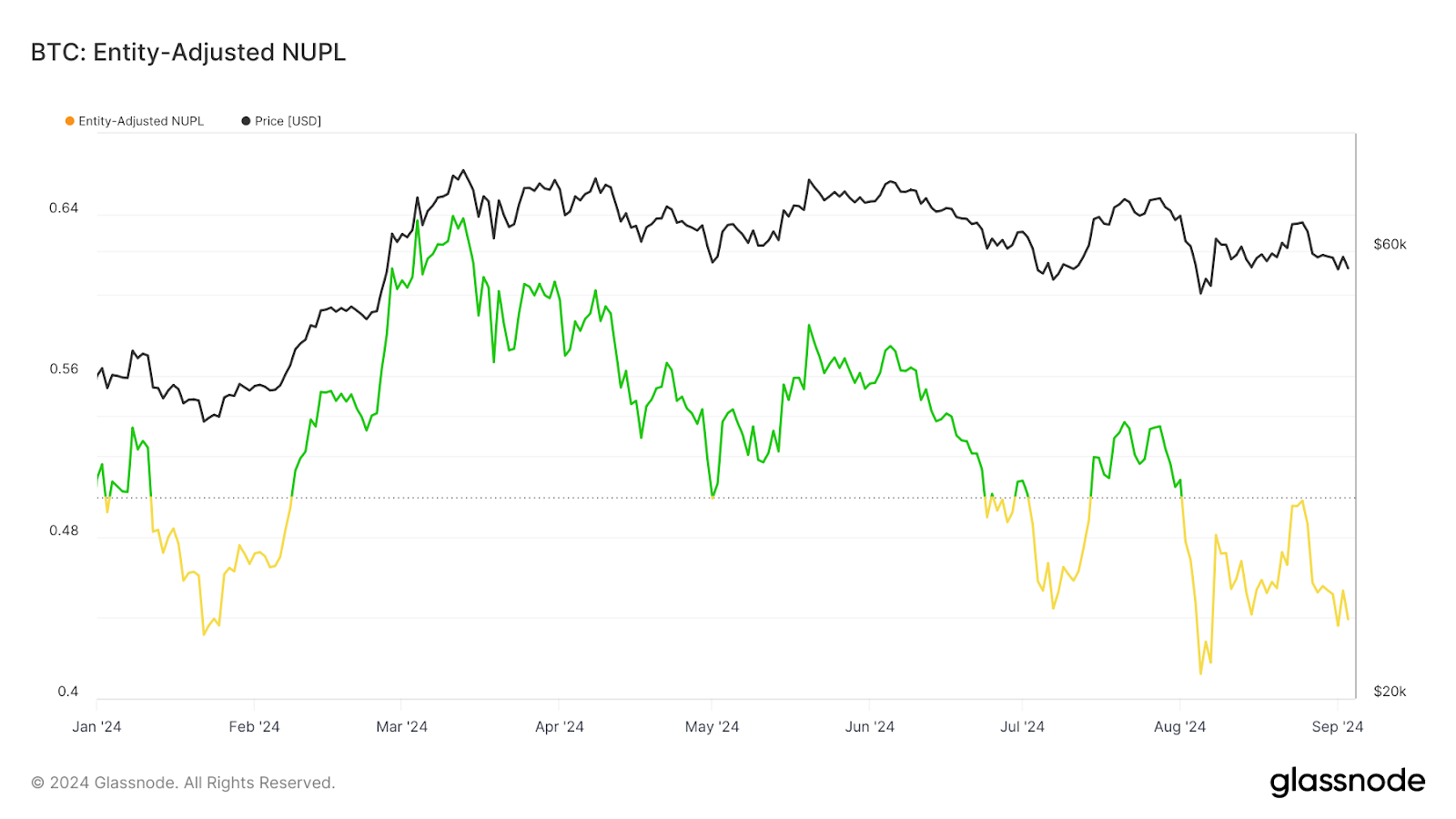

Why the NUPL metric suggests market distress is coming up.

The entity-adjusted net unrealized profit/loss measure exposes the unpredictable nature of market sentiment in the Bitcoin market. According to the indicator, the BTC market has slipped from a positive view to a negative one. Here's what you need to know about the current state of Bitcoin market sentiment.

Bitcoin NUPL shows growing market volatility

Before we go any further, let me give you an idea of what this NUPL measure actually means. It's nothing complicated, but just a simple metric to help keep track of how much profit and loss Bitcoin owners are keeping.

The NUPL adjusted by the legal entity is a variant of the above measure. What makes it stand out is that it focuses only on external economic activity, excluding internal transactions.

Bitcoin's component-adjusted NUPL chart published on CryptoSlate shows that the benchmark has been steadily declining since mid-2024.

What we can interpret from the chart is simple: Bitcoin market sentiment has weakened significantly over the past two months.

Bitcoin Component-Adjusted NUPL Chart: Overview

In the year At the beginning of 2024, the scale was in positive territory, indicating that most BTC holders were in profit at that stage. Since then, the market has changed. Currently, the measure is very close to the loss levels. It clearly indicates that many investors are suffering from the risk of declining profitability.

What's Next for Bitcoin?

The market has experienced similar situations in the past. In most cases, it served as the first sign of an upcoming consolidation phase. In 2017 and 2021, he saw how bad the market could be.

In conclusion, we can say that the current market sentiment is not completely favorable for the Bitcoin market. The NUPL gauge, adjusted by the entity, shows that this is enough to cause confusion among BTC investors who expect strong bullishness in the market this month.

Also Read: Kamala Harris Caught In Crypto Donation Scam? Shocking Coinbase Claim Exposed!