Why This Altcoin Is Up 80% In 24 Hours

The bullishness in the crypto market is having a major impact on all digital assets. Lesser-known cryptocurrencies like OKT, the native token of the layer-1 blockchain network OKT Chain (OKTC), have surged 80% in the past 24 hours.

According to data from BeInCrypto, the price of OKT rose from $14.7 to a 9-month high of $30. However, this price has returned to $25 at the time of writing.

Why did the price of OKT skyrocket?

The dramatic increase in the price of OKT may be due to higher demand for the opening text-mining event hosted on the OKT Chain.

Scripts on layer-1 blockchain networks like OKT Chain are made by storing metadata in blockchain transaction call data. These tokens are similar to Bitcoin Ordinals in that they essentially create non-fungible tokens (NFTs) based on smart contracts.

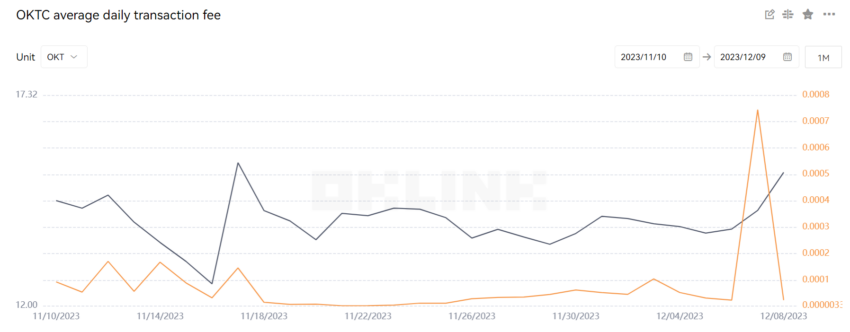

According to on-chain data, transactions on OKT Chain grew by more than 18,000% last week, reaching 7.2 million on December 8.

However, the increased network activity has caused significant network congestion for the lesser-known blockchain network. As of this writing, there are nearly 100,000 pending transactions. The OKX Web3 wallet experienced an outage due to increased traffic from the OKT Chain.

Furthermore, the network's average transaction fee increased to 0.00074 OKT at the peak of these transactions.

Read more: 7 must-have cryptocurrencies for your portfolio before the next bull run

OKT Chain is an Ethereum Virtual Machine (EVM) and Inter-Blockchain Communication Protocol (IBC) Layer-1 network built on Cosmos and supported by crypto exchange OKX.

Adoption of written texts will grow

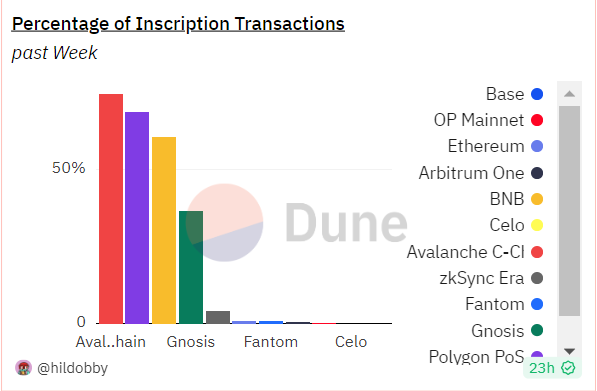

Meanwhile, scripts are driving transactions to unprecedented highs on several EVM-compatible blockchains, including Ton, NearProtocol, and Polygon. For context, scripts accounted for more than 50% of all transactions on Polygon, Avalanche and BNB chains last week.

But they have drawn criticism from many community members who point to network congestion and rising transaction fees.

Read More: 10 Best Cryptocurrencies to Invest in December 2023

According to venture capital firm Dragonfly, gas fees for text transactions were more than $800,000 two weeks ago. However, the transactions consistently attracted over $500,000 in fees.

“Literature can skew basic metrics like transaction volume…Literature contradicts every EVM design decision, the only benefits of gas costs are indexing, compatibility, integration challenges,” Hildobby said.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content.