Why This Bitcoin Bull Run Is Different

The current Bitcoin bull run exhibits unique characteristics that distinguish it from previous cycles.

Despite the inherent volatility of crypto markets, a combination of regulatory shifts, technological advances and macroeconomic factors suggest that the industry is entering a period that has the potential to shape the future of digital assets.

Unprecedented demand forces behind Bitcoin

At the heart of this change is the impact of Bitcoin's expected halving. Historically, a halving is a precursor to Bitcoin's massive price appreciation, leading to massive market rallies. This event, which is related to the reduction of the new supply of Bitcoin, has already triggered periods of high speculation and investment.

However, the current cycle differs in key ways. Unlike past bull runs, Bitcoin's price swings are becoming more extreme. This indicates the maturity of the market and may indicate stable growth in the future.

Despite the price appreciation, Peter Brandt, CEO of Factor LLC, and Tom Lee, managing partner at Fundstrat, believe bitcoin can still go above $150,000. For this reason, Matthew Howells-Barbie, Kraken's VP of Development, believes that the new pricing trend will strengthen Bitcoin's value proposition.

“Despite the decline in overall volatility, Bitcoin is still in the category of risky assets, and investors of all sizes see this as a potentially high-return investment. The more cycles Bitcoin survives and performs, the more confidence it breeds in long-term investors,” he said. Howells-Barbie told BeinCrip.

Read more: Bitcoin price prediction for 2024/2025/2030

This trend, coupled with the success of the space's Bitcoin exchange-traded funds (ETFs), reflects growing investor confidence and institutional acceptance of cryptocurrencies as a legitimate asset class. In fact, Spot Bitcoin ETFs have attracted over $7.4 billion in net inflows in just 7 trading weeks. Popular products like Blackrock's IBIT ETF have quickly moved up the ranks of top ETFs.

Together, the recently launched spot Bitcoin spot ETFs have more than $50 billion in assets under management, according to Will Clement, co-founder of Reflexivity Research. Therefore, prominent industry experts such as Laiah Heilpern believe that Spot Bitcoin ETFs have changed the structure of the market and that “no one knows what will happen next”.

What is certain is that this increase in institutional interest, which was expected by market watchers, will finally materialize. According to Howells-Barbie, this development lays a strong foundation for the next Bitcoin bull run. It has the potential to gain momentum as new entrants enter the market.

“What's even more encouraging is that many RIA networks and prime brokers have yet to list Bitcoin ETFs. This is coming and will create another wave of buying from demand,” Howells-Barbie added.

Additionally, the crypto market will benefit from a more positive macroeconomic outlook. Analysts believe inflation has peaked and expect lower interest rates, which could lead to higher liquidity.

US Federal Reserve Chairman Jerome Powell recently told lawmakers that he and his colleagues are committed to that goal. He also reiterated the possibility of lowering interest rates in the coming months.

“[Rate cuts] It really depends on the economy. Our focus is on maximum employment and price stability, and when and where the earnings data will impact sentiment, those are the things we will be looking at. “We will keep our heads down and try to do our job and deliver what the people expect from us,” Powell said.

Howells-Barbie believes the improving economic climate is conducive to further investments in digital assets. He expects retail and institutional investors to seek higher returns in a low interest rate environment.

“It's easy to forget that much of the recent price action in both crypto and equities occurred before any fiscal easing. As rates go down, more liquidity enters the markets and this can only be positive for assets like Bitcoin,” Howells-Barbie emphasized.

Altcoins are ready for reform and regulatory transparency.

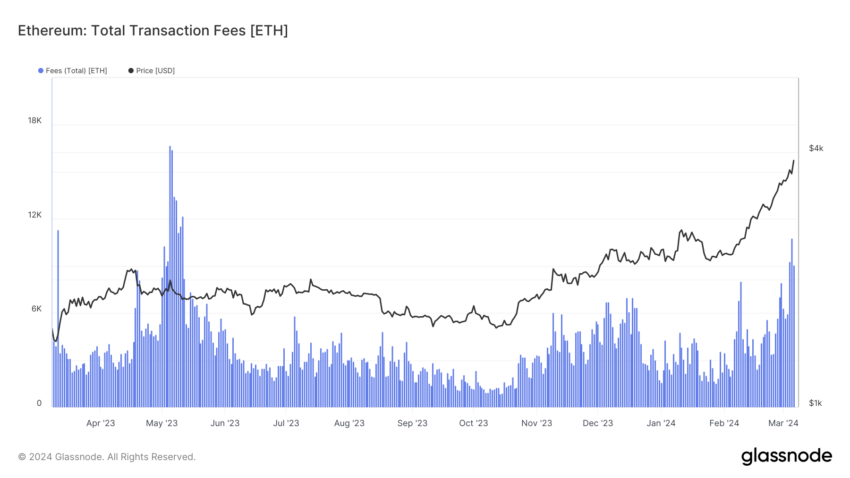

Technological innovations in the crypto ecosystem also play a crucial role in this particular bull run. The Ethereum network's upcoming blockchain promises to reduce costs and increase the efficiency of Layer 2 packet operations. It focuses on bringing the concept of blob bearer transactions forward and extending them through proto-dansharding.

This innovative method greatly reduces data storage requirements at the protocol layer. It defragments the data store and uses a hash for reference, streamlining the transaction verification process. In turn, this significantly reduces the storage load because the stains are temporary and expire after three weeks.

These developments are significant, especially for Ethereum's Layer 2 (L2) solutions. Ethereum's upgrade promises to reduce transaction fees by at least 10 times, marking a major advance in the network's scalability and cost-effectiveness.

“The long-awaited upgrade is predicted to reduce costs for Ethereum L2s by at least 10x, making Ethereum more scalable and efficient. By using coils and temporary blob storage, developers aim to increase throughput and reduce user fees, said IntoTheBlock head of research Lucas Outumuro.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Denkun's upgrade, along with advances in parallelization and modularization with protocols like Sei and Celestia, is expected to bring a new wave of interest and investment in crypto.

“The recent demand for modular scalability, led by the likes of Celestia, Avail, EigenLayer and others, has offered new options to lower end-user costs and create fertile ground for developers to build on. The upcoming Denkun upgrade is another milestone in the journey towards proto-danksharding, but there's still a long way to go.” Howells-Barbie said.

Additionally, the crypto industry is witnessing unprecedented regulatory transparency and involvement. Efforts to establish frameworks such as Markets in Crypto-Assets (MiCA) in the European Union represent a more regulated and safer environment.

Such regulatory developments provide certainty and confidence that has previously been lacking. Thus, it paves the way for the widespread and integration of cryptocurrencies into the global financial system.

The current crypto bull run is characterized by reduced volatility, institutional adoption, technological advances and favorable macroeconomic backdrops. These factors, along with increasing regulatory transparency, signal a critical moment that could define the future direction of digital assets.

“Many sovereign governments have begun to accumulate crypto assets and integrate them into their financial systems. As clearer regulatory frameworks emerge around the world, this will only increase. Additionally, 130 countries around the world – representing 98% of global GDP – are exploring the development of a central bank digital currency (CBCC). All of this comes as traditional financial institutions are trying to chase the flood of capital coming through Bitcoin spot ETFs,” said Howells-Barbie.

The unique combination of these elements reflects the unique nature of this Bitcoin bull run, which may be unlike anything seen before.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action taken by the reader on the information found on our website is at their own risk.