Why XRP Token Price May Struggle Above $2

Ripple's XRP has seen its price plummet in recent weeks following a meteoric rise of nearly 500% between November 6 and December 3. After hitting a multi-year high of $2.90 on December 3, the altcoin has been in a downtrend.

With bullish momentum intensifying, the cryptocurrency is set to fall below the $2 support mark in the near term. This analysis explains why this can happen.

Ripple Token Sees Increase in Selloffs

A chart review of XRP/USD shows that since reaching $2.90 on December 3, the cryptocurrency has been trapped in a descending triangle, a bearish technical pattern.

This pattern appears when the asset price forms a series of lows and holds a horizontal support level. This pattern indicates an increase in selling pressure and is usually likely to occur if the price breaks below support.

For XRP, this support will form at a critical price level of $2. However, with the selling pressure intensifying, the bulls may find it challenging to defend the price point at this time. One of the reasons for this is the low stock of XRP whales in recent weeks.

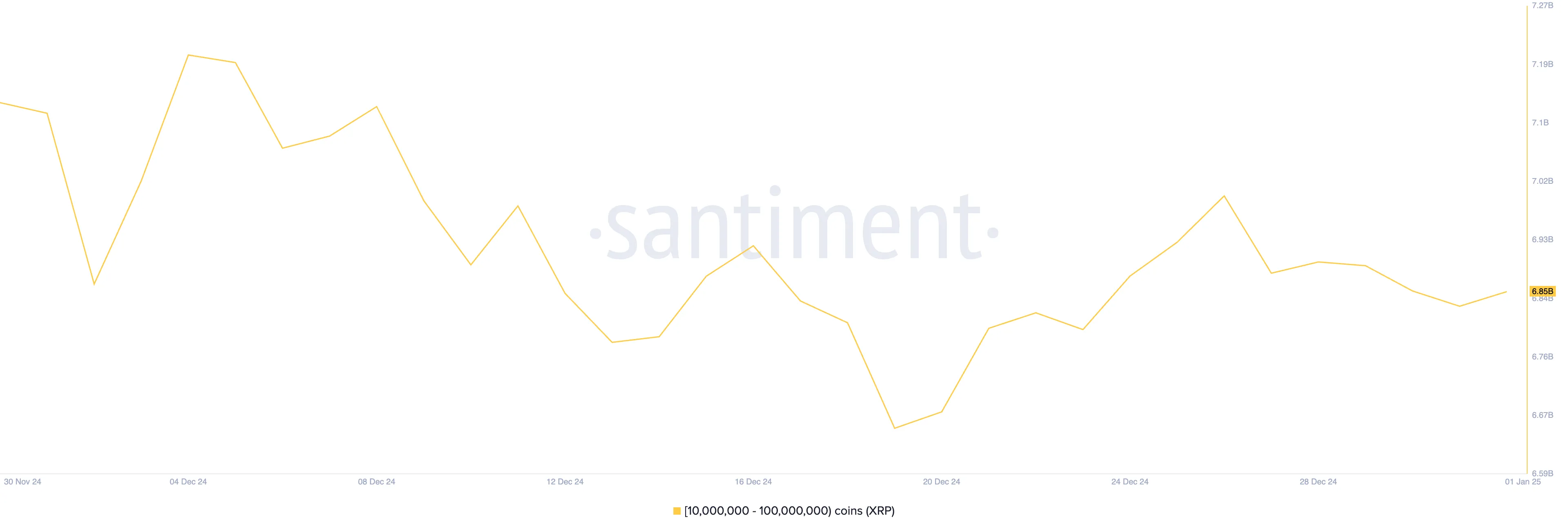

According to Sentiment, XRP whales who control between 10,000,000 and 100,000,000 tokens have reduced their holdings by 350 million XRP since December 4th. This means that this group of XRP investors sold $746 million worth of tokens during the evaluation period, leading to a downward trend. Pressure on the price.

The decline in whale stocks is a concern because these large holders hold large amounts of tokens and provide stability to the market. Their selling activity can cause panic among small investors, exacerbating price declines and increasing market volatility.

XRP Price Prediction: Holds $2?

On the daily chart, XRP is currently trading below the 20-day exponential moving average (EMA), which calculates the average price of the asset over the past 20 days, giving more weight to recent prices to better capture short-term trends.

When an asset's price falls below this key moving average, it establishes bearish sentiment, indicating a decrease or increase in short-term selling pressure.

If the selling pressure strengthens, the XRP token price may break below the $2 support provided by the lower line of the descending triangle. In that case, the token price will drop to $1.88. If this level fails to hold, the price of XRP may drop to $1.34.

On the other hand, if sentiment turns from bearish to bullish, XRP price will break above the 20-day EMA, which will provide a volatile barrier or resistance at $2.18. A successful breach above this level could push the price of the XRP token to a multi-year high of $2.90.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.