Will Alts price still go up?

On December 4, the Altcoin Season Index hit 88, suggesting that non-Bitcoin cryptocurrencies may be doing better than the number one coin. However, the prospects of the altcoin season may have suffered a major blow.

Still, it looks like the highly-anticipated season may be back. Here are three indicators that suggest many of the top 50 cryptos could see significant hikes soon.

Alts push again

Altcoin period refers to the period when altcoins outperform Bitcoin in terms of market capitalization growth. The Altcoin Season Index measures this trend, determining whether 75% of the top 50 cryptocurrencies outperformed Bitcoin.

Typically, an index value above 75 indicates the beginning of the altcoin era, while a value above 25 indicates the dominance of Bitcoin. However, now, the index has dropped to 49, which indicates a fall for altcoins as Bitcoin gains a strong position in the market.

But despite the ups and downs, Alt's season doesn't seem to be over. One indicator of this is the dominance of Bitcoin.

Bitcoin's rise in dominance often indicates a preference for Bitcoin over altcoins, especially in times of market uncertainty. This trend suggests that investors view Bitcoin as a safe option given its relative stability and established market place.

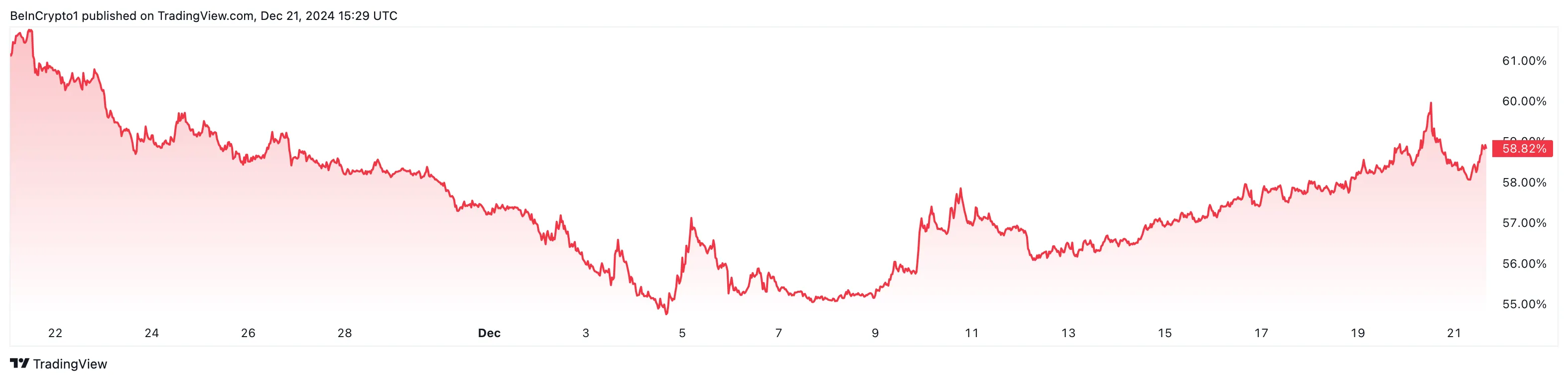

As its dominance increases, demand for smaller cryptocurrencies may decrease, potentially leading to less capital flows into altcoins. A few weeks ago, Bitcoin's dominance rose to 62%, suggesting that altcoins may not continue to play second-string.

But at the time of writing, it has dropped to 58.82%, which shows that altcoins have taken some control. If the decline continues, the value of BTC may fall while the value of altcoins may rise.

Altcoin Market Cap Still On Rally Line.

The market capitalization of TOTAL2, which tracks the top 125 altcoins, recently dropped to $1.35 trillion, suggesting that non-Bitcoin assets are underperforming. This fall often indicates that the altcoin season may be delayed, with Bitcoin dominating the market.

However, there is a silver lining: TOTAL2 broke above the descending triangle, indicating a possible reversal trend. While the altcoin season may be facing setbacks for now, this crash indicates that altcoins could rise if volume begins to increase.

If this amount increases, TOTAL2's market cap could rise to $1.65 trillion, indicating that the opportunities of the altcoin season could boost momentum and value.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.