Will Bitcoin Disappear Without Urgent Green Blockchain Reform?

Debate over the environmental impact of cryptocurrencies has intensified as governments, corporations and investors focus on environmental, social and governance (ESG) concerns. Bitcoin, the world's most popular cryptocurrency, is leading the charge with its power-intensive proof-of-work (PoW) consensus mechanism.

While innovations to address environmental concerns are emerging in the crypto industry, Bitcoin's contribution to global carbon emissions remains a major point of contention.

The environmental problem of Bitcoin

Bitcoin's PoW mechanism relies on miners solving complex cryptographic problems, with huge amounts of computing power and labor.

According to Cambridge University estimates, Bitcoin's annual energy consumption rivals that of countries like Argentina or Norway. Moreover, Bitcoin's environmental footprint is exacerbated in regions where mining operations are powered by non-renewable energy sources.

“Bitcoin mining may be responsible for 65.4 megatons of CO2 (MtCO2) per year, equivalent to the national emissions in Greece (56.6 MtCO2 in 2019) and representing 0.19% of global emissions.” .

Critics argue that this consumption is disproportionate and unsustainable, especially in light of international climate commitments. While alternative cryptocurrencies are exploring more environmentally friendly methods, Bitcoin's slow adoption of such technologies has raised concerns.

“Everyone understands that Bitcoin is not environmentally sound, but any major changes to the Bitcoin protocol are very successful because you have to get all the miners to agree on it,” said Hannah Halaburda, associate professor of data at NYU's Stern School of Business.

If environmental sustainability is a primary concern of investors and regulators, Bitcoin may soon face significant pressure to improve.

Green transition in Crypto

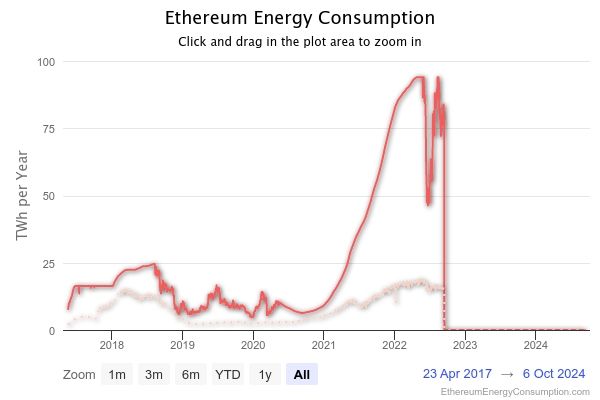

Unlike Bitcoin, other blockchain platforms have taken steps to reduce their environmental impact. For example, Ethereum By 2022, it has made headlines by moving from PoW to Proof-of-Stake (PoS) by reducing its energy consumption by more than 99 percent. PoS replaces power-hungry mining with validators that lock tokens to secure the network.

This transformation is exemplary for the industry, showing that environmentally friendly improvements can be made even in established networks.

Read More: Proof of Work and Proof of Stock Explained.

Other platforms like Hedera, Cardano and Tezos also boast PoS mechanisms and focus on sustainability. Hedera's involvement in carbon offset projects and collaboration with the Global Blockchain Business Council (GBBC) to promote environmental standards are further steps to reduce blockchain's ecosystem footprint.

Wes Geisenberger, Vice President of Sustainability at HBAR, highlighted the importance of the GBBC InterWork Alliance's Carbon Emission Token (CET) Task Force in an exclusive interview with BeinCrypto. Established to address carbon accounting at a technical level, this task force is helping companies navigate these regulations.

“CET is a positive contribution, the changes coming from governments and companies looking for solutions to reliably address their environmental impact,” said Geisenberger.

This kind of technical development emphasizes the growing blockchain and local governance. The crypto industry is increasingly partnering with government bodies and international organizations to find solutions that meet regulatory needs while leveraging blockchain innovation.

Investors are paying attention.

Investor sentiment is increasingly aligned with global ESG priorities. Climate-conscious investors are urging industries, including crypto, to be responsible for their environmental impact. In response, some blockchain ecosystems are leading climate-focused efforts through technological innovation and funding of sustainable projects.

According to Geisenberger, the HBAR Foundation's Sustainable Impact Fund is the first grant-based fund aimed at advancing blockchain's role in sustainability. This fund supports initiatives such as Hedera Guardian's public ledger platform to improve transparency in carbon credit markets.

By enabling institutions and startups to track and verify their carbon offsetting efforts, Hedera demonstrated how blockchain can facilitate responsible environmental practices.

“Hedera Guardian has 500 million metric tonnes of carbon credits on board. “We see these tools helping to answer challenges by measuring the externalities of our planet and giving agency to people involved in environmental and biodiversity projects,” Geisenberger said.

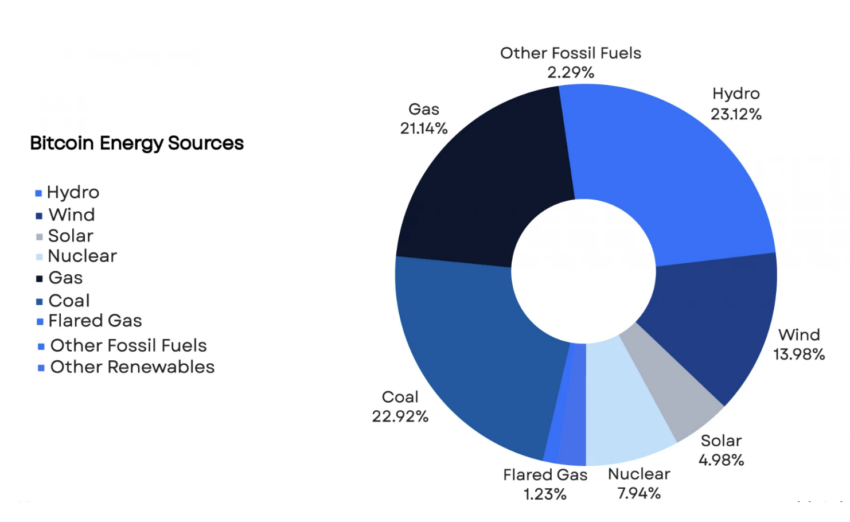

Despite these positive developments in the wider blockchain ecosystem, Bitcoin's reliance on PoW has not changed. Bitcoin advocates argue that its decentralized nature and security features are unparalleled, and that any change to its consensus mechanism could jeopardize its integrity. As an alternative solution to the environmental challenges, Bitcoin miners point to the adoption of renewable energy.

Some mining operations are moving to regions with more hydroelectric, wind and solar power. However, these efforts are still fragmented and lack industry-wide coordination.

“Many bitcoin mining companies have set up contracts with renewable energy companies. The argument is that having these mining facilities as customers means that when the energy supply is high, it can make it more profitable for the renewable energy plants,” Halaburda added.

Read More: 5 Best Platforms to Buy Bitcoin Mining Shares After the 2024 Halving

The question, then, is whether Bitcoin can thrive in an increasingly ESG-driven world. The industry's focus on renewable energy and carbon offset projects offers some promise, but may not be enough if regulatory frameworks impose stricter environmental requirements.

Challenges to standardizing ESG metrics

While some crypto platforms have made strides towards sustainability, the challenge of standardizing ESG metrics in the industry continues. The decentralized and often opaque nature of blockchain technology complicates the task of measuring environmental impact consistently and relatively.

Efforts such as the CET Protocol are helping to fill this gap, but broader industry-wide adoption is necessary for meaningful change. Without standardization, it is difficult to gauge which platforms are truly sustainable and based on face-to-face commitment.

There is the challenge of balancing the interests of investors, users and environmental advocates, each with different expectations for the future of blockchain technology.

As regulations tighten and the global push for sustainability accelerates, Bitcoin's environmental footprint will be hard to ignore. The crypto industry has proven to be innovative and adaptable, but Bitcoin faces an uphill battle as the dominant and most influential cryptocurrency. Finally, it will require an improvement in the agreement strategy or a significant investment in renewable energy solutions.

Disclaimer

Following Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is committed to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its employees. Readers should independently verify information and consult with a professional before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.