Will Bitcoin Reach New Highs? Analyzing the surprising trends of September

September has never been a good month for Bitcoin returns. Since 2017, only once has the Bitcoin market given a positive return; It was last year when the market made the smallest return of +3.99%. If current market conditions remain stable, this September will be different. Over the past 30 days, the market has seen a 10.1 percent gain. Wonder how?

What will falling interest rates mean for Bitcoin?

At the beginning of the month, the market expected something positive, as the chairman of the Federal Reserve, Jerome Power, hinted at the possibility of a 50-basis interest rate cut in September. Buyers have been active in the market since September 7, when the price of Bitcoin rose.

On September 18, the US Federal Reserve officially announced interest rates. Prior to this big announcement, the market experienced a downturn between September 14th and 16th when the price briefly dropped from $60,477 to $58,259. However, buyers regained control a day before the big announcement. Since then, the price is constantly increasing. On the day of the announcement, the price opened at $60,309. After the reduction, the price increased by at least 8 percent.

Not only did the US Federal Reserve cut rates, but many major central banks, such as the European Central Bank and the People's Bank of China, did similar rate cuts.

Undoubtedly, among rate cuts, the announcement by the US Fed has had the biggest impact on the BTC market due to Bitcoin's strong correlation with US monetary policy.

Analyzing Bitcoin's extraordinary September performance

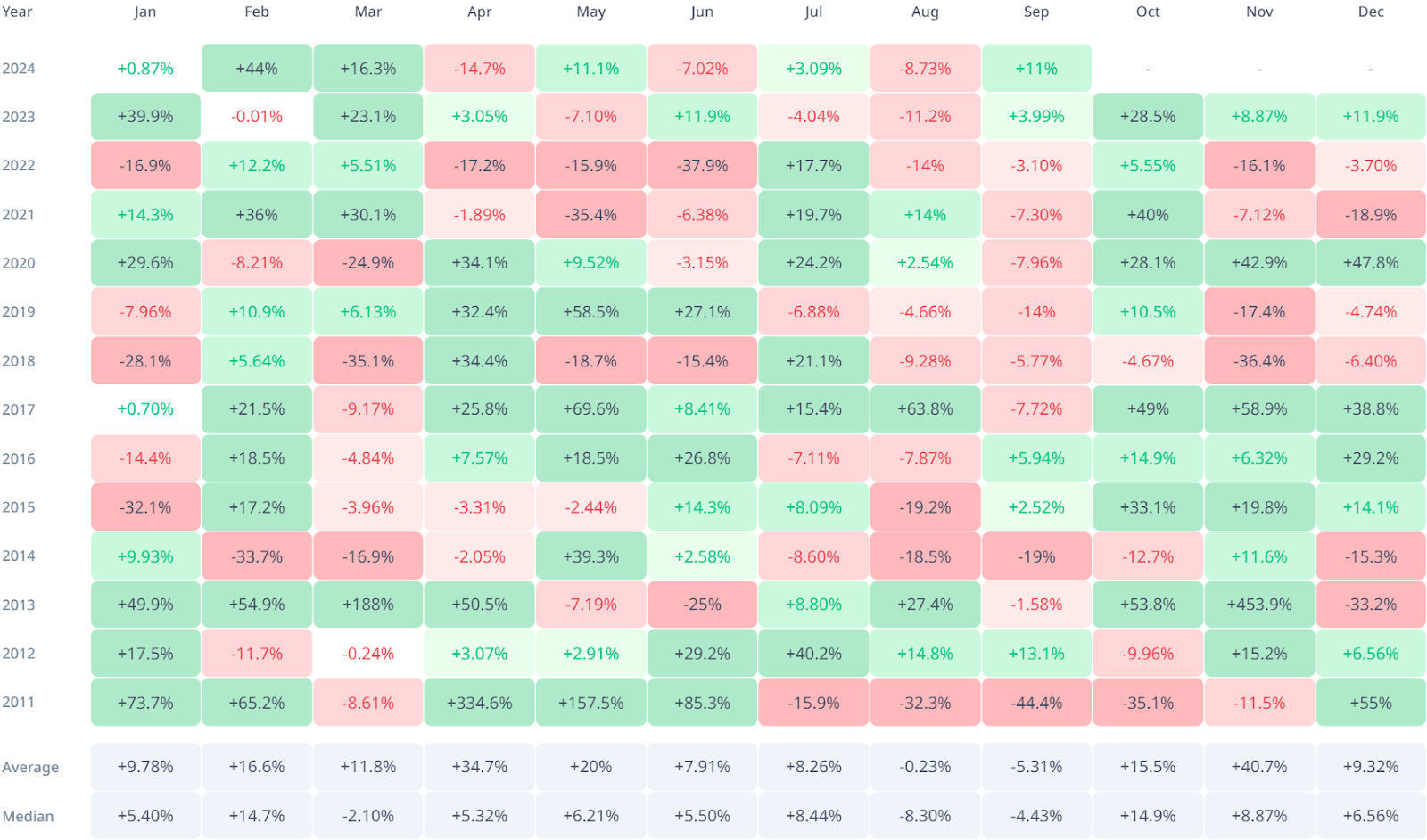

Last September, the Bitcoin market presented a monthly return of +3.99%. However, as mentioned earlier, the market historically struggled in September. With the exception of 2023, the market has not performed positively even once in September since 2017. If we examine the overall monthly return history, the market has made positive returns only four times.

If the market turns positive this month, it will not only change the monthly return trend, but also change the quarterly return trend. Although the market reported an impressive return of +3.09% in the first month of this quarter, August returned an impressive -8.73%. If current optimism holds, 2024 Q3 could end on a positive note.

Also read: XRP Price Prediction: Ripple Price Hints A 2X Surge, If This Happens? ,

Will Bitcoin hit a new high after the US election?

At the beginning of the year, the price of Bitcoin was at 44,164 dollars. By mid-March, it had surpassed an all-time high of $73,000. Currently, the price is 65,510 dollars. This year, the BTC market has shown a growth of at least 48.33%. However, the current price of Bitcoin is at least 11% below its all-time high.

In conclusion, the crypto community seems to be very confident in the current speed of the Bitcoin market. Many believe that the next US government will have no choice but to launch crypto-friendly policies as cryptocurrency has been a key topic during the current US election campaign. If things go as expected, it may not take long for BTC to close this 11% gap and break above the 73,000 level.

What is your view on this? Are you someone who expects good crypto policy after the US November presidential election?