Will Ethereum price break above $4,000?

Ethereum price has struggled to break above the $4,000 psychological barrier after recovering from a year-to-date high of $4,093 on December 6.

However, market participants continue to stockpile the leading altcoin despite its extensive market correlation. This increases the possibility of a break above the $4,000 price level in the near term. This analysis explains why in detail.

Adding an Ethereum purchase order

Ethereum's receiver buy-sell ratio rose to 1.033 on a monthly basis, indicating an increase in buy orders in the coin derivatives market.

This measure provides an asset's market sentiment and potential price direction by comparing the volume of buy orders filled by market makers to the volume of sales filled.

A ratio greater than 1 indicates bullishness, as buyers are willing to pay the asking price, indicating an increase in demand for the property. This means strong buying pressure, which can indicate a price trend in the property.

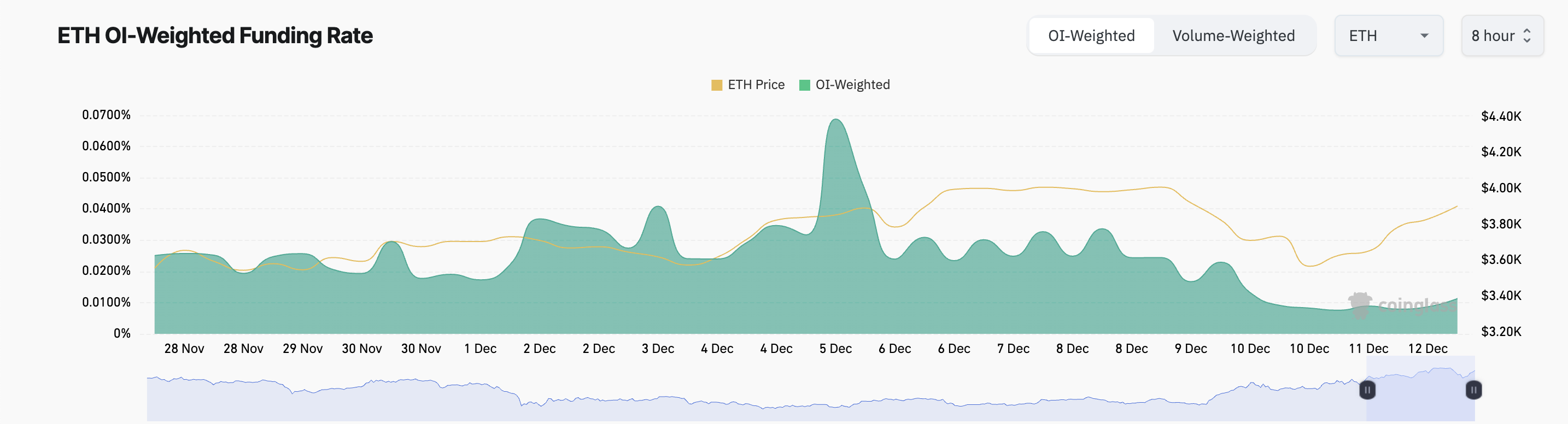

In particular, the coin's positive funding rate supports this bullish view. At the time of press release, the total funding rate of ETH in cryptocurrency exchanges is 0.011%.

The fund rate is a periodic payment between traders in a perpetual futures contract designed to align the contract's price with the spot price of the underlying asset. Positive funding means that long traders are paying short traders, indicating a strong demand for long positions. This typically indicates bearish sentiment in the market as traders are willing to pay a premium to hold long positions.

ETH Price Prediction: The bulls will strengthen control

On the daily chart, ETH's increasing balance confirms the coin's steady growth. As of this writing, the speed indicator is 26.06 million.

This indicator uses volume flow to predict changes in asset prices. When an asset's OBV is released, it indicates strong buying pressure, indicating that volume is largely buyer-driven, which is often a strong signal for further price increases.

If buyers of ETH take control, the price could rise above $4,000 to $4,093, which is a year-to-date high. However, if the current trend reverses, the price of ETH could drop to $3,673, undermining the bullish thesis.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.