Will Ethereum Rally? Metalpha throws in another $51M in ETH

Hong Kong-based asset management giant Metalpha is getting a lot of attention from crypto enthusiasts due to its ongoing dumping of Ethereum (ETH). On September 11, 2024, on-chain analyst firm TheDataNerd posted on X (formerly Twitter) that Metalpha dumped another 22,000 ETH worth $51.16 million to Binance.

Investors and traders are curious about Metalfa's recent transactions, as they moved a lot of ETH last week. According to the data, the firm has downloaded 56,188 ETH worth $130.81 million to Binance.

Current price momentum

However, the recent dump by Metalalpha did not affect the price of ETH. Currently, it is trading around the $2,360 level and has shown a modest price increase of 0.30% in the last 24 hours. Meanwhile, the trading volume of ETH increased by 20%, indicating the high participation of investors and traders in the market turmoil.

Ethereum price prediction

According to expert technical analysis, ETH looks bullish and is poised for a nice rally in the coming days. Following the opening of a descending trendline on the four-hour time frame, ETH is currently testing the $2,320 breakout level. Additionally, there is a barrier near $2,400, and if ETH closes the four-hour candle above that level, there is a high possibility that it could rise to the $2,570 and $2,800 levels.

So far, ETH's Relative Strength Index (RSI) is in oversold territory, indicating a possible trend reversal from a downtrend to an uptrend.

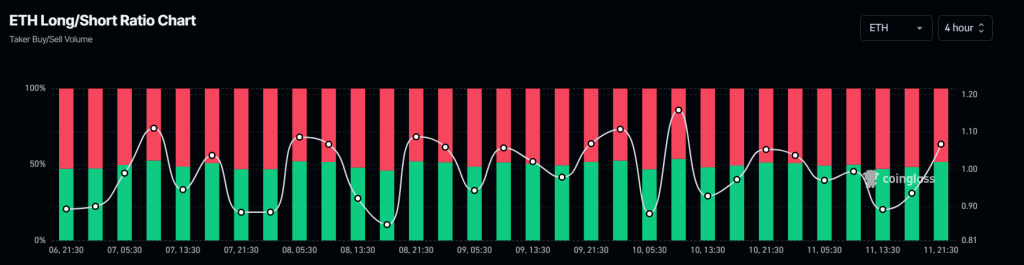

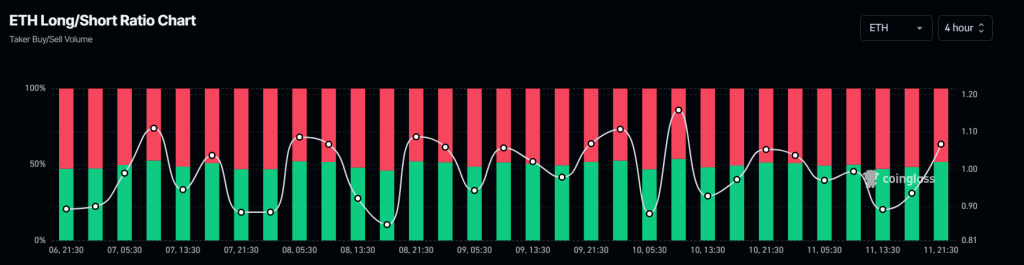

Bullish gauges on the chain

This bullish attitude is further supported by chain measurements. Coinglass's ETH Long/Short ratio stands at 1.067 in the four-hour period, indicating strong market sentiment. However, 51.84% of top ETH traders hold long positions, while 48.16% hold short positions.

Currently, this data indicates that bulls dominate the assets and have the potential to eliminate short positions.