Will Nvidia (NVDA) Break the $500 Fibonacci Barrier?

Four months ago, NVDA shares fell just short of reaching the $500 milestone. Currently, the price of Nvidia is moving towards this significant level again.

The critical question now is whether Nvidia's stock price can successfully break through the crucial Fibonacci (Fib) resistance at the $500 mark. This step is critical, as a successful breach may indicate strong bullying. On the other hand, there is the possibility of another bearish rejection at this threshold, which could lead to a pullback or consolidation in the stock price.

Is Nvidia ready to break the $493 Fibonacci resistance?

If Nvidia's stock price successfully overcomes the Fibonacci (Fib) resistance level around $493, it could surpass its previous high of $505.

However, technical indicators present a mixed view. The moving average converging divergence (MACD) histogram has been trending lower for the past four months, although the MACD lines are still at bullish intersections. Significantly, the Relative Strength Index (RSI) is showing a large bearish divergence, a sign reflected in the stock's performance four months ago.

In September and October, Nvidia stock fell nearly 21 percent. It then found support in the $403 to $410 range, leading to a recovery and bringing the price to Fib resistance around $493.

If Nvidia can break through this resistance level at a faster pace, the stock could be poised to hit an all-time high. This remains favorable to market conditions and company fundamentals. This situation shows the dynamic nature of stock market movements. This is influenced by a mix of technical indicators and broader market conditions.

Nvidia's weekly chart shows a bearish divergence in the RSI

There is a mix of bullish and bearish signals on Nvidia's weekly chart. On the bearish side, the Moving Average Convergence Divergence (MACD) lines are in the hidden crossover, and the Relative Strength Index (RSI) shows bearish divergence.

However, there are also indicators of strength. In particular, the MACD histogram has started to hit an upward trend since last week, and the exponential moving averages (EMAs) have shown a golden crossing. These signals suggest that Nvidia's medium-term trend is still strong.

If Nvidia experiences a rejection of Fibonacci (Fib) resistance below the $500 mark and breaks through the support zone between $403 and $410, it may find the next significant support at the 50-week EMA, around $378.

If the price falls further, the next known Fib support levels are expected to be around $354 and, more importantly, around $255. These levels can be critical moments for potential reversals or further price adjustments.

Nivea's daily chart shows an emerging price pattern

For Nvidia's daily chart, technical indicators mostly indicate bullish momentum. The Relative Strength Index (RSI) is neutral, indicating balanced market conditions without strong overbought or oversold signals. The Moving Average Convergence Divergence (MACD) lines are approaching a bullish crossover. While the MACD histogram is showing an upward trend, both indicate bullish momentum.

Read more: 9 Best AI Crypto Trading Bots to Maximize Your Profits

Additionally, the golden crossing of the Exponential Moving Averages (EMAs) further confirms a bullish trend in the short to medium term. This crossover occurs when the short-term EMA (such as the 50-day EMA) crosses over the long-term EMA (such as the 200-day EMA). This is often interpreted as a shout signal.

An interesting development in the daily chart is the emergence of a price pattern. In other words, it is an “inverted head and shoulders” design. This pattern is commonly seen as a bullish reversal indicator. If Nvidia's stock price rises above $540, it could confirm a major breakout from this pattern. This may lead to higher price movements.

The inverse head and shoulders pattern combined with other bullish indicators suggests a positive outlook for Nvidia in the short to medium term. However, this is based on the stock's ability to breach the key price level of $540.

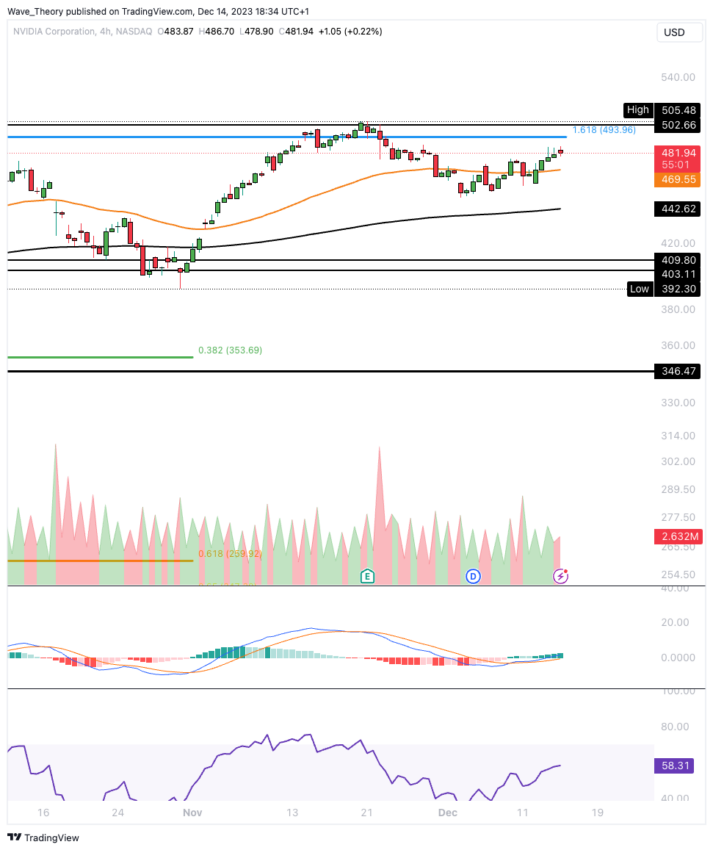

Nvidia's 4H Chart Analysis: Indicators point to a bullish trend

On the 4-hour (4H) chart for Nvidia, the trend is mostly bullish, as seen by several key indicators. The golden crossing of the Exponential Moving Averages (EMAs) is a significant bullish signal. This crossover occurs when the short-term EMA (such as the 50-period EMA) crosses above the long-term EMA (such as the 200-period EMA), indicating an uptrend.

Additionally, the moving average converging divergence (MACD) histogram is trending upward. Further bullish momentum indicates an increase, and the MACD lines are in a bullish cross section, reinforcing this positive trend.

Read more: Best 9 Telegram Channels for Crypto Signals in 2023

The Relative Strength Index (RSI) on the other hand is in neutral range. This neutrality refers to the balance in the market. But in the absence of any strong overbought or oversold conditions, it does not give any particular bullish or bearish signals at this time.

Overall, the combination of bullish MACD and golden cross in EMAs, along with neutral RSI, generally presents an optimistic outlook for Nvidia on the 4H chart, indicating a favorable short-term trend.

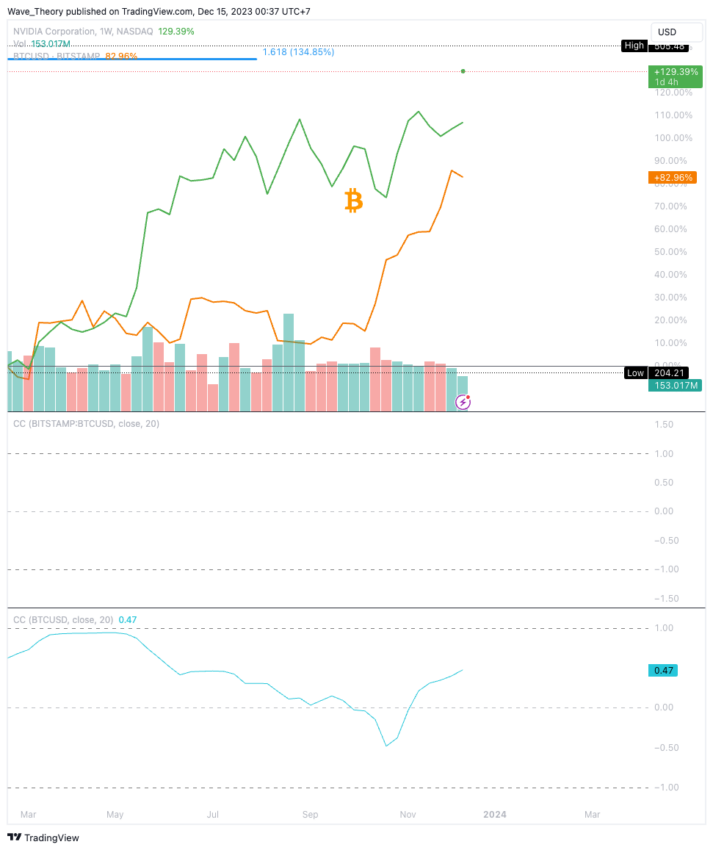

A growing relationship between Bitcoin and Nvidia has been noticed.

Currently, the correlation between Bitcoin and Nvidia stock prices is moderate, but has seen a significant increase in recent weeks. It currently stands at approximately 0.47. This positive correlation indicates that the price movements of Bitcoin and Nvidia are somewhat coordinated. Both have been moving in the same direction to some degree.

It is important to note that the correlation coefficient of 0.47 is significant but does not indicate a very strong relationship. It suggests that there is some degree of synchronization in their price movements. However, they are not very dependent on each other.

Historically, there have been times when the connection between Bitcoin and Nvidia was more obvious. This strong correlation in the past can be attributed to a variety of factors, including market sentiment, technological developments, or investment patterns, linking cryptocurrency markets, particularly Bitcoin, to tech stocks such as Nvidia.

However, correlation levels may change over time due to market dynamics, economic conditions and investor behavior.

Read more: Best Crypto Signup Bonuses in 2023

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions.