Will ORDI’s 23% price increase attract buyers or trigger selling?

ORDI's price recorded a significant increase earlier in the week as the broader crypto market experienced a modest recovery.

However, apart from general market trends, steady support from investors has kept Amald green.

Bullish view of ORDI investors

ORDI's recent price increase can be attributed to a number of factors, with investor persistence being a key component. The Chaikin Money Flow (CMF) indicator shows that the altcoin has seen a consistent flow since late June. These income streams have been critical in maintaining ORDIA's resilience against recent bearish trends in the broader market.

If these flows continue, ORDI could be well positioned for further gains in the near term. The continued movement of capital into the altcoin suggests that investors are confident in its potential, which could lead to further price appreciation, provided broader market conditions remain favorable.

Read more: Bitcoin NFTs: Everything you need to know about the tokens

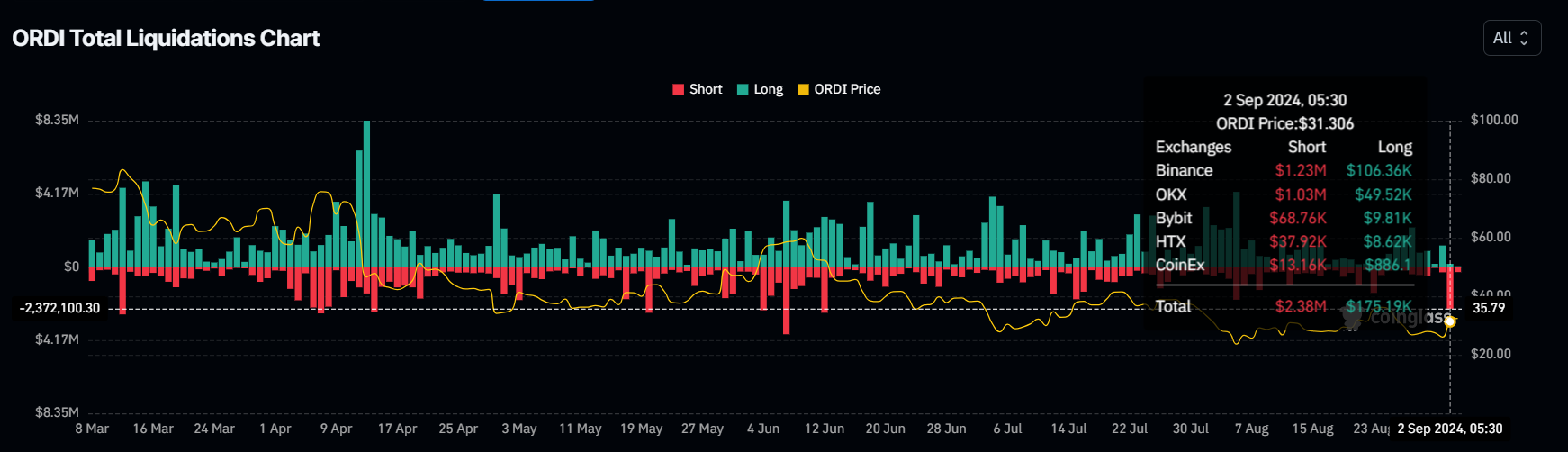

Conversely, short-term traders, especially those holding short positions, may need to re-evaluate their strategies in light of recent developments. Yesterday, ORDI experienced $2.38 million worth of short liquidity, the largest since mid-June. This significant liquidity event may cause short traders to reconsider their positions.

Historically, short-term flushes have often followed recovery periods for ORDI. This pattern suggests that the altcoin may be on the upside as short sellers are forced to exit their positions, easing downward pressure on the price and paving the way for potential gains.

ORDI Price Prediction: Breaking the Pattern

ORDI's price, currently at $32.40, is up 23% in the last 24 hours after coming close to breaking the $25.55 support level. If positive factors continue, the altcoin may breach the $35.56 resistance level. Once this level becomes a support, ORDI can increase significantly.

Historically, $35.56 has served as a strong support level, and departure from this point can push the altcoin to $40 and above. The next highest resistance is at $46.53, and reaching this point will require strong and consistent bullish signals.

Read more: Top 5 BRC-20 systems to trade in 2024

However, if ORDI fails to breach $35.56, it may face a downside as investors may sell to regain its recent gains. This could lead to a drop to $30.00, and any further declines could undermine the bullish outlook.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.