Will prices see a Christmas rally?

Friday is the expiration date for crypto options. Nearly $3 billion worth of Bitcoin (BTC) and Ethereum (ETH) contracts are set to settle or reset today. Crypto markets have been on a roll for the past several weeks, but can they keep up?

Expiration of crypto options often leads to notable price volatility, prompting traders and investors to closely monitor today's developments.

$2.72 billion Bitcoin and Ethereum options are expiring.

Deribit reports that 20,815 bitcoin contracts, with an estimated value of $2.077 billion, will expire today. The call ratio stands at 0.83, which indicates that traders continue to sell more calls (long contracts) than short contracts.

The maximum pain point (the price at which the property would cause the largest number of owners financial loss) is $98,000. Notably, this is slightly less than the current spot market price of $99,758.

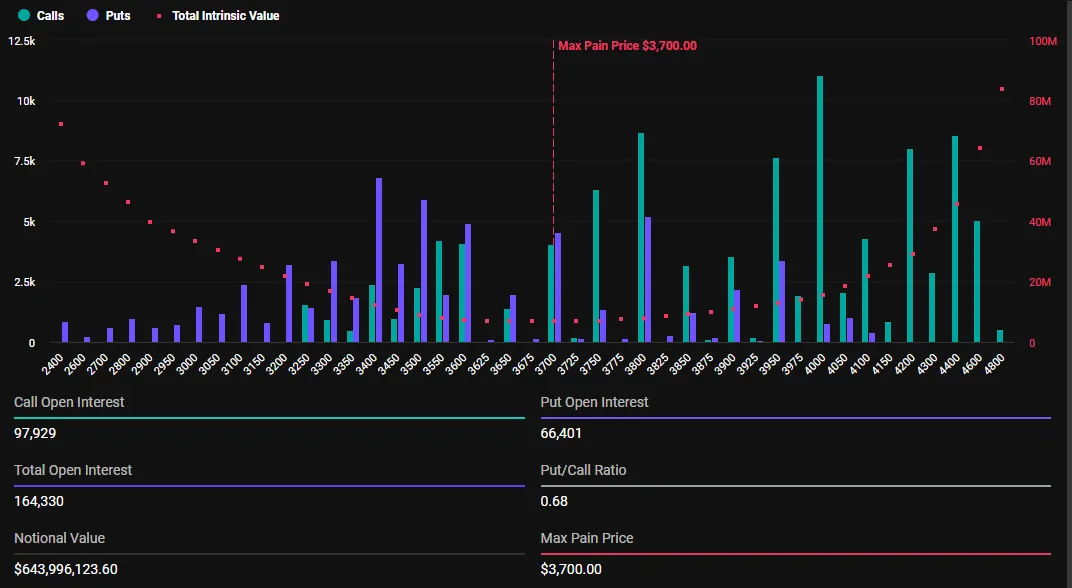

Meanwhile, 164,330 Ethereum options contracts worth nearly $644 million also expire today. The call ratio is 0.68, indicating that, like Bitcoin, traders are selling more long contracts than short contracts.

Greece Live commented that this week the market is dominated by corrections, unlike last week, which was a small correction for Bitcoin and a strong correction for altcoins. But as Christmas and the annual handover approaches, market makers are starting to move.

“Recent block options trading volume is high, and the daily average is more than 30%. In previous years, the Christmas season in Europe and the American business temperature will decrease significantly. This year, the influence of US stocks on crypto will increase, and this phenomenon will become more obvious. It can,” Greeks Live said.

This raises the question of whether the Christmas rally will take place this month, because the market is coming back to a strong divergence. BTC is currently hovering below $100,000, while ETH is hovering just shy of $4,000.

The last two weeks of options market data are showing that market makers are becoming more cautious. The high volatility in the market was mainly due to small increases in implied volatility (IV). Against this background, Greece.Live analysts say options are currently the most suitable for short-term games.

“…the cost-effective way to buy options is still very high,” he added.

Meanwhile, these expired options come after a wild week in terms of US economic data. US inflation rose to 2.7% in November, while core CPI stuck at 0.3%. While the Fed's rate cut is widely expected, stubborn inflation complicates the path to further monetary easing.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.