Will Solana’s price go down? Institute will drop 19.5 million dollars SOL

Market sentiment suggests that Solana (SOL) price may fall to the $80 level. In the year On August 31, 2024, on-chain analytics firm Lookonchain wrote on X (formerly Twitter) that a crypto-well or institution worth $19.5 million dumped 139,532 SOL at a loss of $5.5 million to Binance.

Solana Whale Sale 140K SOL

According to a post on X, the whale's wallet address “FkVrB” initially deposited 139,532 SOL worth $19.5 million without losing it and later deposited it into Binance two days ago. The data shows that the “FkVrB” wallet address traded this valuable SOL at $180 in July 2024, possibly in anticipation of a Solana Exchange Traded Fund (ETF) position in the United States.

Since then, SOL has never revisited the $180 level and currently looks weak.

Solana price forecast

According to expert technical analysis, Solana (SOL) is currently at the critical support level of $127. Additionally, the daily timeframe is trading below the 200 exponential moving average (EMA), indicating a bearish trend.

Based on historical price action, whenever SOL reaches the $127 support level, it tends to see a large reversal rally. At this point, there is a high probability of a 40% rise to the $180 level.

However, if SOL fails to hold this support level and the daily candle closes below $120, there is a high possibility that SOL may fall to the next support level at $80.

SOL's Bearish On-Chain Metrics

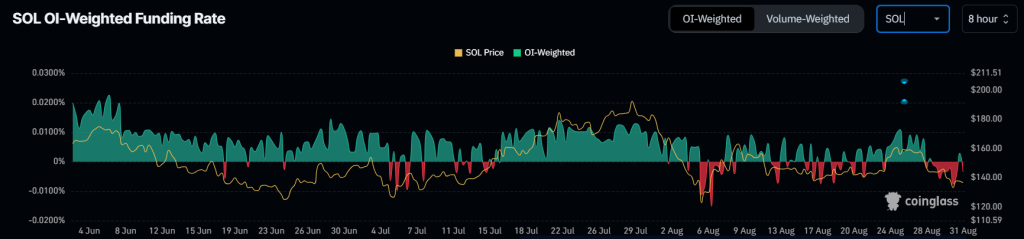

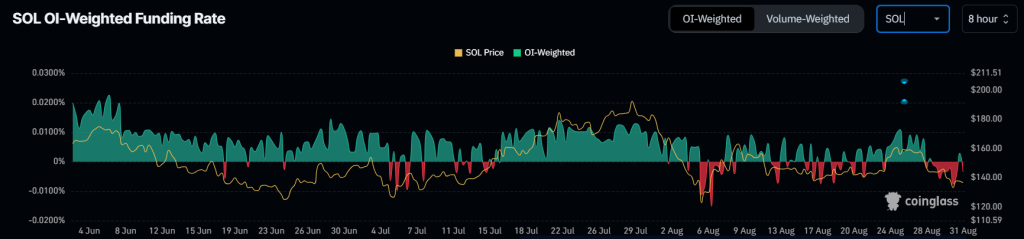

Today's CoinGlass SOL OI-Weighted Funding shows that short sellers are taking over heavily and filling long positions. Currently, SOL's OI-weighted funding rate stands at -0.0034%, indicating bearish sentiment and bearishness in the coming days.

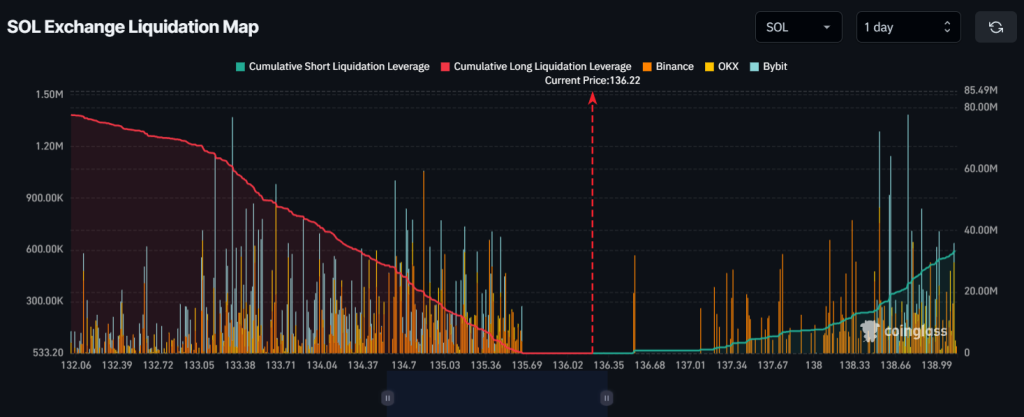

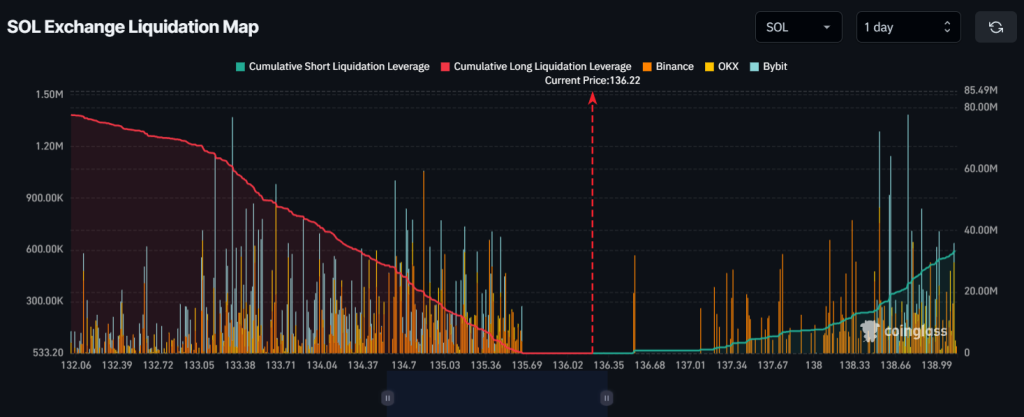

Currently, the main liquidity levels are on the lower side of $133.3 and on the upper side of $139, which indicates that traders are overextended at these levels, according to CoinGlass data.

If sentiment remains weak and SOL falls to the $133.3 level, about $60 million worth of long positions will be lost. Conversely, if sentiment reverses and prices rise to the $139 level, about $21.5 million worth of short positions will be lost.

Solana price analysis

At press time, SOL is trading around $135 and has experienced a modest price increase of over 1% over the past 24 hours. Meanwhile, open interest fell by 2 percent over the same period, indicating lower demand from traders during the market downturn.