Will Telegram Coin Survive?

PAAL AI (PAAL), the Telegram coin built on the Ethereum blockchain, has seen its price drop by 10 percent in 24 hours. At press time, it trades at $0.19.

The price shows a decline of 77.50% from its March high. This analysis of the chain examines the reasons for the recent decline and the subsequent movement.

Crypto Wells Ditch PAAL AI

BeInCrypto's findings show that PAAL suffered from a perceived selling pressure due to the decision of one of its prominent shareholders. Investors involved in this decline are the key group whose actions and inactions can have a significant impact on prices.

According to IntoTheBlock, PAAL AI's In the last seven days, the net flow of large holders has decreased by 72 percent And it has been this way for the last 30 to 90 days. The net flow of large holders is the difference between them. Getting in and out.

When this difference increases, it means that whales collect more coins than they distribute. In most cases, this increase in purchased coins indicates an increase in price.

However, it indicates that the net negative distribution in this regard is high. As this is the case for PAAL, the price has extended its losses.

Read more: What are Telegram Mini Apps? A guide for Crypto beginners

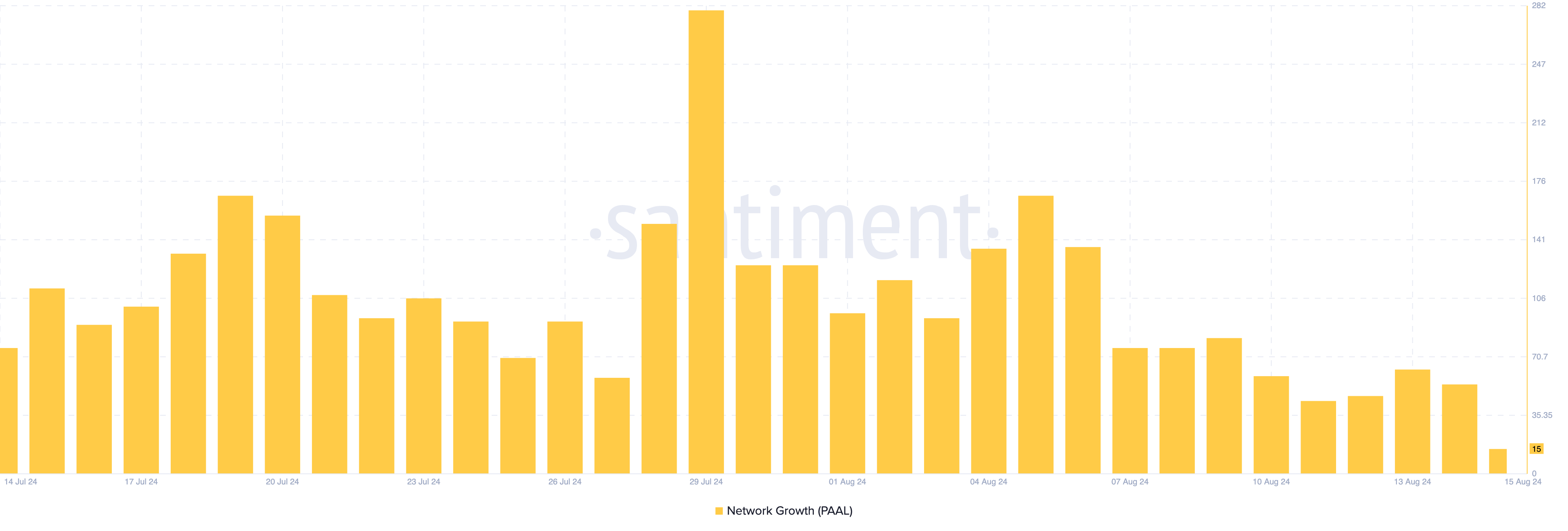

If cryptowells continue to liquidate their PAAL holdings, the price may continue to decline. Beyond this sales pressure, on-chain data from Santiment showed a significant drop in the project's network growth.

Network growth measures new addresses connecting to cryptocurrency for the first time.

As this number increases, it indicates an influx of new participants making their first successful transaction. However, a decrease in lack of traction and lack of adoption points to a tipping point.

For PAAL AI, the recent decline shows that the crypto is currently lacking in demand for its price to recover. If it continues, the PAAL price may drop again as mentioned earlier.

PAAL Price Prediction: Coin Struggles Continue.

Based on the daily chart, PAAL has formed a converging top pattern. Also known as an inverted rounding bottom, this pattern is characterized by an initial upswing, after which the rally loses steam and the price declines.

A bearish confirmation usually occurs when the price drops below the neckline shown on the chart. From the chart below, PAAL is pegged at $0.1965. However, the price has fallen below the range, which suggests that the continuation of the fight is likely to continue.

This bias is further reinforced by Bull Bear Power (BBP), which is used to measure the strength of buyers relative to sellers. Usually, if BBP is positive, bulls are in control, and prices are likely to rise.

However, the PAAL indicator reading is negative, suggesting that the bears may continue to push the price further down. In this case, PAAL price may drop to $0.1724, but if bulls fail to defend this range, it may slip to $0.1499.

Read more: Top 7 Telegram tap-getting games to play in 2024

On the contrary, if whale stocks and buying volume increase in the spot market, the price of cryptocurrency may change upwards. If this is the case, PAAL may retry $0.2037. If it continues, the price may extend to $0.2462.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.