Will the APT cross above these key moving averages?

Aptos (APT) saw a significant increase in interest last week, indicating that it may be reversing market trends. This increase is reflected in the cryptocurrency's attempts to trade above the 20-day moving average (EMA) and the 50-day simple moving average (SMA).

The bullish momentum suggests that APT may soon pass these key levels.

Aptos Bulls fight for supremacy

At press time, Aptos (APT) is trading at $6, representing a 25% increase over the past seven days. The one-day chart shows that APT's price action is in line with the potential advance of the 20-day EMA, and it looks set to test the 50-day SMA.

The 20-day EMA measures the average price of an asset over the last 20 trading days. The 50-day SMA, on the other hand, calculates the average closing price over the past 50 days.

When the price of the asset rises above the 20-day EMA, it indicates the beginning of a short-term bullish trend. If the price closes and breaks from the 50-day SMA, the uptrend may extend beyond the short term.

At the time of writing, Aptos (APT)'s 20-day EMA is set at $6.04, and its 50-day SMA is at $6.45. To break above the 20-day EMA, APT needs a 1% rise, while an 8% rise is necessary to break above the 50-day SMA.

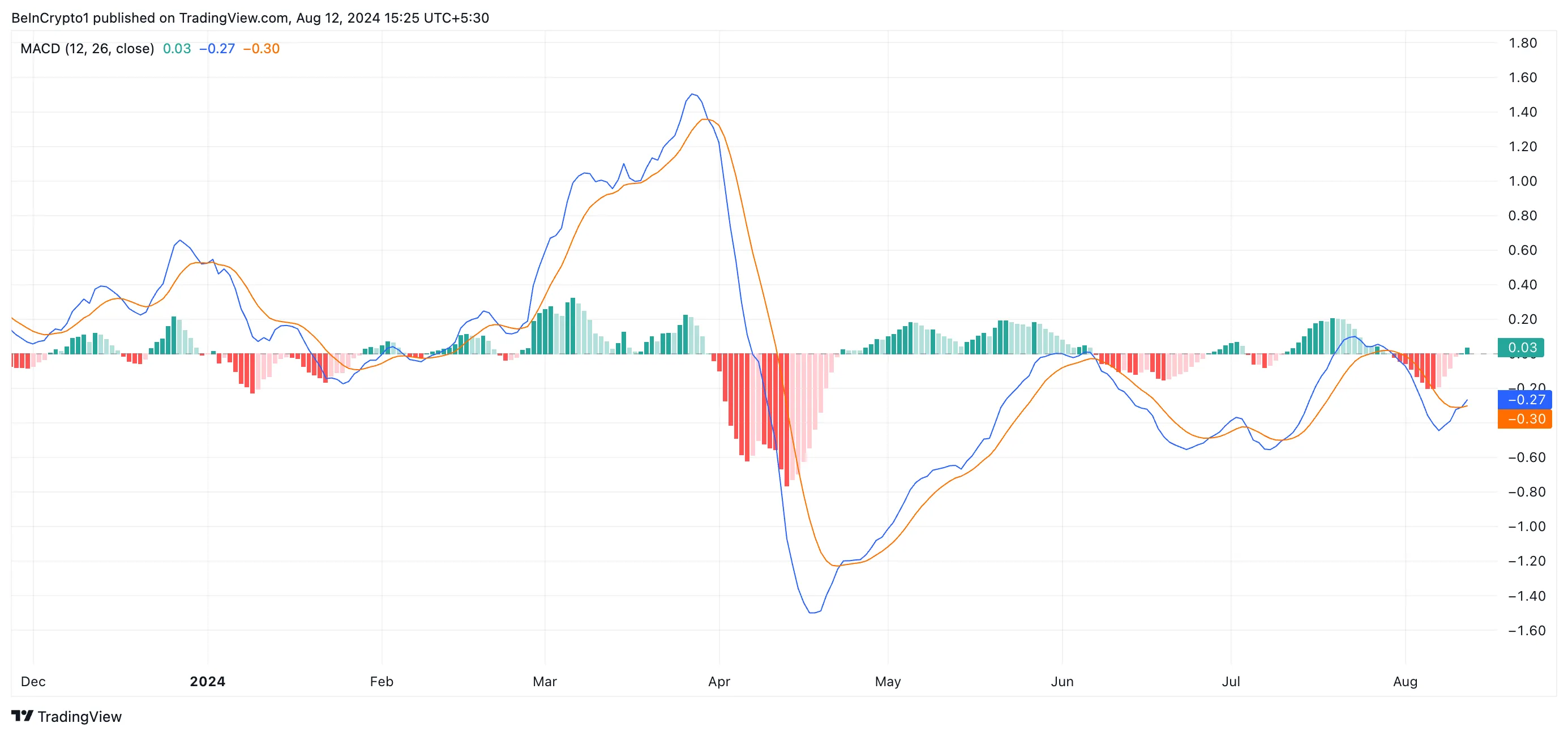

Readings from the Aptos (APT) Moving Average Convergence/Divergence (MACD) point to the possibility of an upcoming rally. The MACD line (blue) recently crossed above the signal line (orange), indicating that APT's short-term momentum is outperforming its long-term trend. This bullish crossover signal indicates that APT may continue its upward trend as bullish sentiment strengthens, allowing the coin to regain market control.

Read more: Where to buy Aptos (APT): 5 best platforms for 2024

Additionally, the position of the dots that comprise APT's Parabolic Stop and Reverse (SAR) indicator confirms its strong bias for the altcoin. At the time of publication, these points are below the APT price.

Parabolic SAR tracks an asset's price trend and identifies reversal points. When the points are placed below the price, the market is at a high level. It is a bullish sign that indicates an increase in buying activity.

APT Price Forecast: A negative divergence emerges.

Despite a significant shift in market sentiment, APT's Chaikin Money Flow (CMF) suggests that the altcoin is at risk of erasing recent gains. While APT's price rose last week, its CMF remained below the zero line, creating a divergence of opinion.

This difference occurs when the value of an asset increases when its CMF returns negative values. This indicates that the buying pressure behind the rally is weakening and is about to undergo a correction.

Read more: 5 Best Aptos (APT) Wallets in 2024

If Aptos (APT) experiences a price correction, the price may drop to $4.32. On the other hand, if liquidity flows in and demand for APT increases, the price may rise to a two-month high of $7.28.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.