Will the price of bitcoin crash? $5.64 billion in profits.

Bitcoin (BTC), the world's largest cryptocurrency by market cap, is poised for a sharp drop in value as investors reaped billions in profits over the past 24 hours. Additionally, BTC has developed a price action pattern that further supports this negative outlook.

5.64 billion dollar profit booking

In the year October 10, 2024 A prominent crypto analyst on X (formerly Twitter) has recorded over $5.64 billion in confirmed Bitcoin gains in the past 24 hours. This high profit in the short term indicates a significant decline in prices in the coming days.

Current price momentum

As of now, BTC is trading near $60,730 and has recorded a price decrease of more than 2.75% in the last 24 hours. At the same time, the trading volume decreased by 8 percent, which shows that the participation of traders and investors is lower compared to the previous days. This recent price decline appears to have been driven by significant profit-taking.

Bitcoin technical analysis and upcoming levels

However, CoinPedia's technical analysis looks bearish as BTC has formed a bearish inverted cup and is experiencing price action on the daily time frame. When an asset forms this bearish pattern, it is often seen as a sign of a bearish trend.

BTC is currently near the neckline of this pattern, with critical support at $60,200, supported by the 200 Exponential Moving Average (EMA). If BTC breaks this level and closes a daily candle below $60,000, it may drop to $58,000 or below.

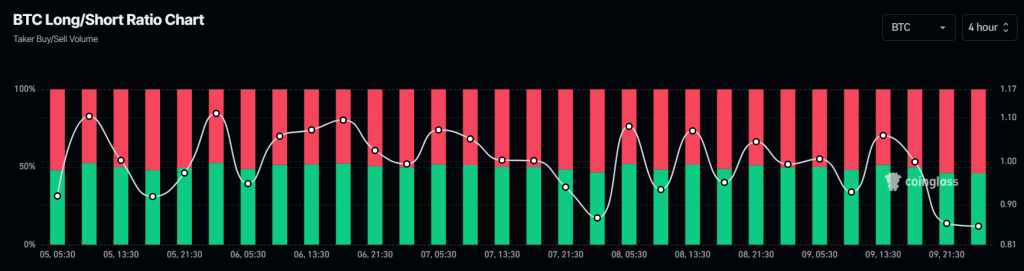

BTC Long/Short Ratio

This negative view is further supported by chain parameters. According to on-chain analytics firm Coinglass, BTC's long/short ratio currently stands at 0.931, indicating strong bearish market sentiment among traders. Meanwhile, 54.05% of top traders hold short positions, while 45.95% hold long positions.

Combining this long/short ratio with technical analysis and recent profit-taking suggests that bears are currently in control of the asset, which could result in significant price declines.