Will XRP Bulls Pay Off, Price Reaches $0.65?

Despite the price consolidating in a tight range of support levels, XRP bulls seem to have entered the market as trading volume increased. On October 7, 2024, most of the top cryptocurrencies experienced significant price increases, but the price of XRP remained stable over the past 24 hours.

XRP current price momentum

Currently, XRP is trading near $0.538 and has experienced a modest price increase of 0.75% in the last 24 hours. During the same period, the trading volume increased by 90%, which shows strong participation from investors and traders, which is a positive sign for XRP owners.

XRP technical analysis and upcoming levels

According to expert technical analysis, XRP looks bearish but stuck in the consolidation zone between $0.512 and $0.545 for the last five trading days. Based on recent performance, XRP price tends to experience a 20% rally every time it reaches this level.

However, if XRP breaks out of this consolidation zone and closes the daily candle above the $0.55 level, there is a strong possibility that it may rise by 20% to reach the $0.65 level in the coming days.

This bullish outlook is supported by XRP's Relative Strength Index (RSI), which is currently in oversold territory, indicating the possibility of significant price reversals in the coming days. However, it is still trading below the 200 exponential moving average (EMA) on the daily time frame, indicating a bearish trend.

Bullish On-Chain Indicators

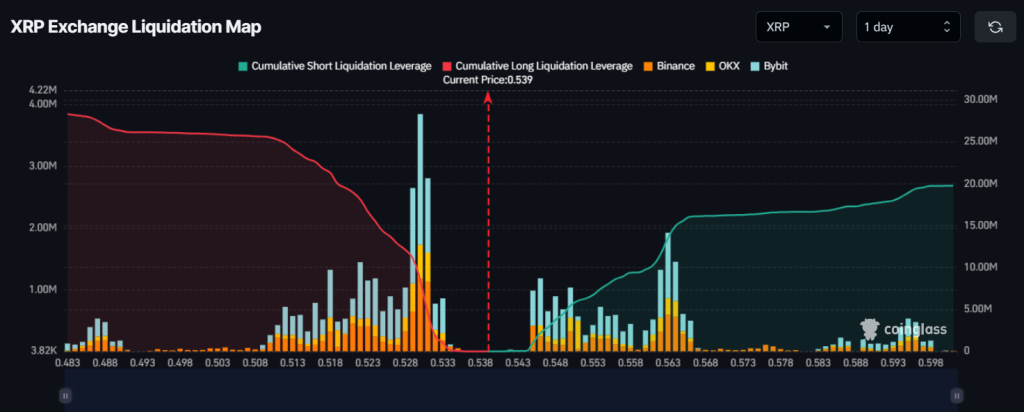

In addition to technical analysis, XRP's on-chain metrics also support this bullish view. According to on-chain analytics firm Coinglass, the main liquidity levels are at $0.53 and $0.563 as traders are overextended at these levels.

However, bulls believed that the market would not fall below $0.53 and took long positions worth more than $8.45 million, data shows.

Additionally, XRP futures open interest increased by 3.75% in the last 24 hours and has been trending upward, indicating growing trader interest.