With Michael Saylor’s bet paid off in Bitcoin, his BTC holdings have now increased by $1B.

Michael Saylor owns 17,732 BTC and holds $1 billion in Bitcoin. Microstrategy holds 226,500 BTC, worth more than $12 billion, at an average price of $37,000. Saylor views Bitcoin as a superior, safe asset and supports continued investment.

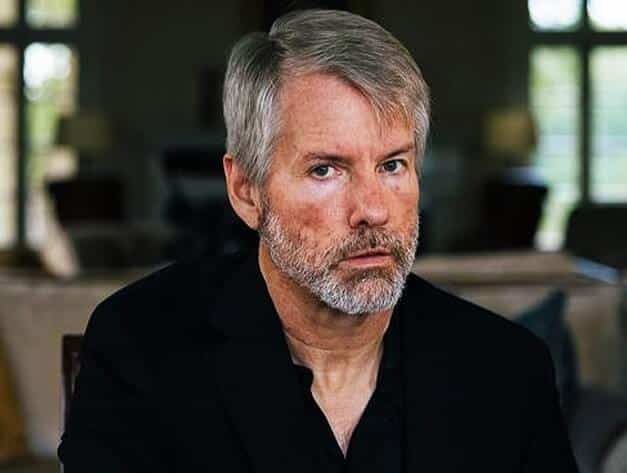

In an interview on Bloomberg Television, MicroStrategy Chairman Michael Saylor revealed that he holds approximately $1 billion worth of Bitcoin.

This makes him one of the most famous BTC owners in the world, joining the ranks of figures such as Binance Founder Changpeng Zhao, the Winklevoss Twins and Satoshi Nakamoto.

Michael Sailer has not sold any of his BTC holdings.

Sayler's endorsement of Bitcoin as a capital investment asset is passionate and unwavering. In an Aug. 7 interview with Bloomberg's Sonali Basak, Saylor confirmed that he has a significant personal stack of Bitcoin, which he first disclosed four years ago.

At that time, he announced ownership of 17,732 BTC, which figure has only grown since then.

Some have asked how much #BTC I have. I personally #hodl 17,732 BTC which I bought at an average of 9,882 each. I reported these holdings to MicroStrategy before the company decided to buy #bitcoin for itself.

— Michael Saylor⚡️ (@saylor) October 28, 2020

Despite Bitcoin's price appreciation over the years, Saylor has not sold any of his holdings, constantly acquiring more of the currency.

Seeing Bitcoin as a generational wealth asset

For Saylor, Bitcoin represents more than a speculative investment. He described it as a revolutionary financial instrument superior to both physical and traditional financial capital.

According to Saylor, Bitcoin is an unparalleled resource that provides generational wealth to individuals, families, corporations, and even nations. The commitment to Bitcoin is based on its perceived stability and security, as well as its ability to maintain value over time.

During the interview, Saylor emphasized his belief that “there is never a bad time to buy Bitcoin.” He likened Bitcoin to “Cyber Manhattan,” suggesting that investing in it is akin to acquiring prime real estate in a highly sought-after location.

This comparison underscores the belief that Bitcoin, as a rare and desirable asset, will always hold a high value despite market fluctuations.

MicroStrategy accumulated 226,500 BTC under Saylor's leadership.

Saylor's investment philosophy extends beyond his personal holdings to his micro-strategy leadership. Under his leadership, the company has amassed a total Bitcoin inventory of 226,500 BTC worth over $12 billion.

This large-scale investment represents a significant portion of the company's balance sheet. MicroStrategy's average cost per Bitcoin is about $37,000, and the company is set to do a 10-for-1 stock split, which could further impact its financial structure and stock performance.

In addition to discussing his personal holdings, Saylor spoke about Bitcoin's broader implications for corporate finance. He asserted that Bitcoin can “fix” corporate balance sheets by providing a safe and stable asset for long-term investment.

Saylor points to Bitcoin's massive computing and electrical power, which he argues makes it “nation-proof” and “nuclear-hard.” The Bitcoin network boasts that it consumes more electricity than the United States Navy, which it credits to its security, reliability, and durability.

However, Saylor's enthusiasm for Bitcoin is not limited to its investment potential. He sees cryptocurrency as a new technological development that has the power to shape financial systems globally.