XRP price is firm when whales accumulate big.

XRP's price is up 17% over the past seven days and over 3% over the past 24 hours, indicating strong recent performance. As the third largest cryptocurrency behind Bitcoin (BTC) and Ethereum (ETH), XRP boasts a market capitalization of nearly $185 billion.

Despite this growth, the trading volume has decreased by 55% in the last 24 hours, now reaching 7.55 billion dollars. This mixed activity highlights the importance of examining key indicators such as RSI, whale movements and EMA to assess XRP's continued potential price direction.

XRP RSI is neutral for 5 days.

The XRP relative strength index is currently at 52.3, holding a neutral position since January 17, five days ago. For the past two days, the RSI has been close to the 50 level, indicating a balanced market with no strong buying or selling pressure.

This neutral reading shows that the XRP price is in a consolidation phase, the price is neither up nor down significantly, waiting for potential creators to reveal its next move.

RSI is a widely used momentum indicator that assesses the strength and speed of price changes on a scale of 0 to 100. An RSI below 30 indicates oversold conditions, which could indicate a price reversal, while an RSI above 70 indicates overbought levels and a potential downside move. corrections.

XRP's RSI sits at 52.3, the sentiment is neutral, showing no signs of excessive bullish or bearish activity. If the RSI begins to rise above 60 or falls below 40, it may indicate that the momentum is changing, which may indicate the beginning of a new trend for XRP.

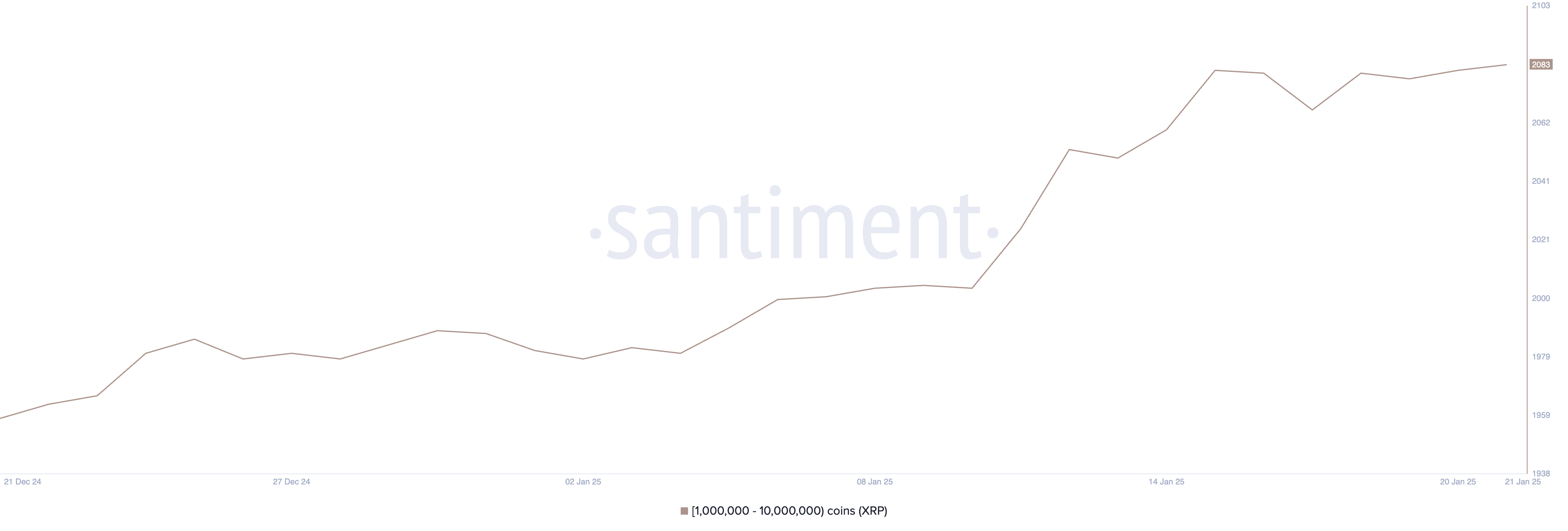

XRP whales are reaching an all-time high.

XRP whales, defined as addresses with between 1 million and 10 million XRP, hit an all-time high of 2,083. This represents a milestone in the stockpiling, as the count has been steadily increasing since late December.

As of December 21, there were 1,958 such addresses, showing a significant upward trend over the previous month.

Tracking whale movements is important because these addresses often have the ability to influence market trends. Larger stocks of whales may indicate higher sentiment as their buying activity may reduce existing supply and support price increases.

While the current whale count is at an all-time high, it points to high demand and potential ahead of a major market move. If this trend continues, it may indicate an increase in interest and long-term confidence in the price of XRP.

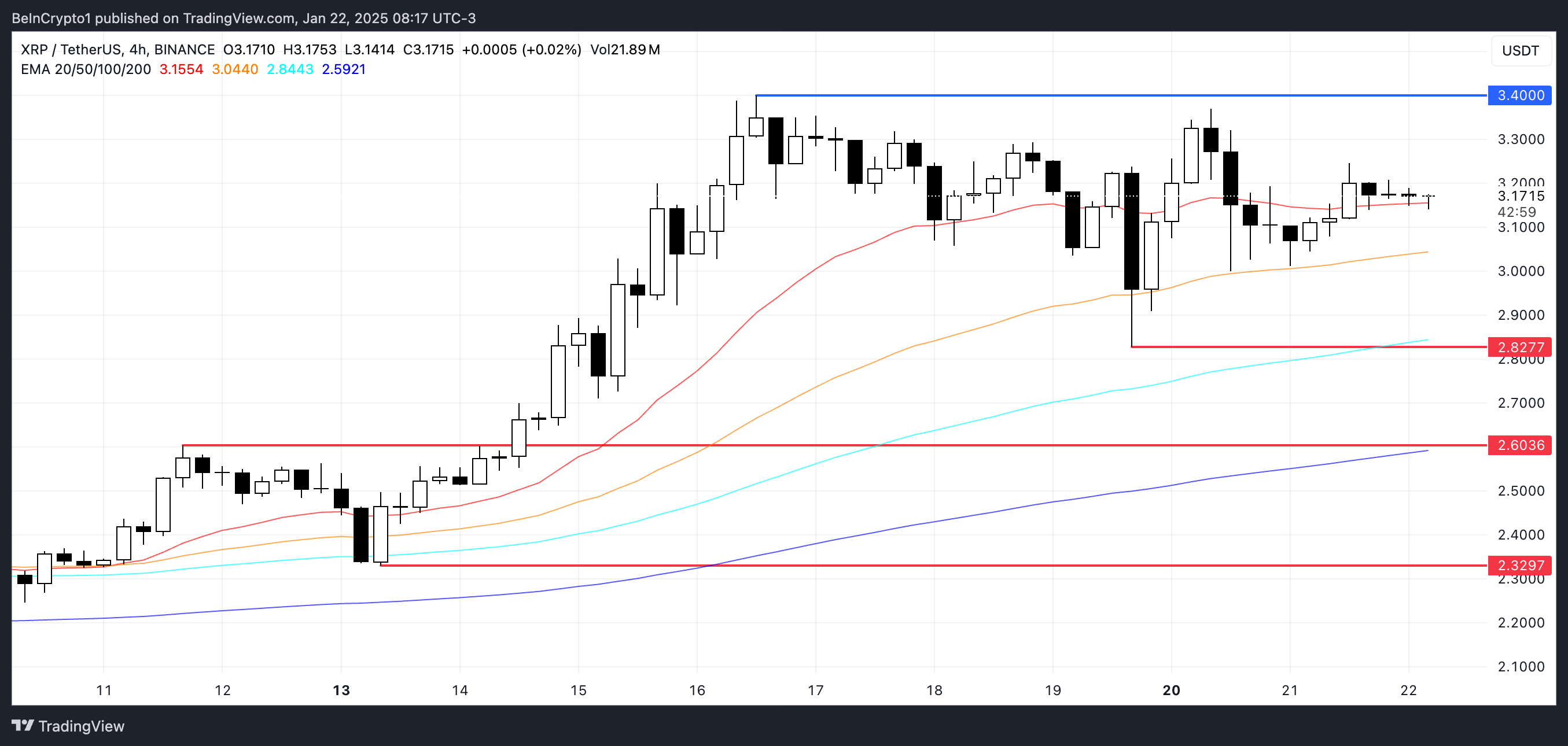

XRP Price Prediction: Will it Correct by 26.8%?

The XRP EMA lines remain bearish, with the short-term lines set above the long-term, indicating an overall uptrend. However, the lack of upward movement in recent days indicates a period of consolidation in the market.

This pause in momentum reflects a more balanced situation, where neither buyer nor seller is currently dominant.

If the price of XRP can recover its growth, it may test the resistance at $3.40, a key level that may indicate renewed strength. Conversely, if the trend reverses, the price may first test the support at $2.82.

A break below this level could lead to further declines, with possible lower targets at $2.60 and $2.32. Missing the $2.32 support represents a significant decline of 26.8%.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.