XRP price prediction: confidence width on bulls like 250m xrp

A boat may be near you at $1.00, but XRP may be experiencing a very volatile checktop. Data from @ali_chants shows that whales have loaded 190 million XP in the last 48 hours after dropping into a critical support zone.

Today above $2.02 USD and volatility in XRP trend.

The whale's water exits are expected among large owners driven by macro conditions or internal rope weakness. In this case, Solloff interacts with the liquidity of the sector through the market. However, despite the pressure, the structure of the XPP is far from being broken, which will lead to earlier signs of stabilization.

XPN holds the line as you re-enter it

The XRP chart continues to observe a wide spread, which is defined by a wide high above the trend defined in August and below the trend defined in August. This Downtind right has not been found, but the last several sessions are the first meaningful signs of authenticity.

The combination of long low wicks, strong candlesticks, and pot sellers usually emerge when the token starts to dominate.

Near 37 years, the 37-year-old pipes are coming out of the 7th grade service area, creating the ability to replace the former. The price became a new low; Not loving. Historically, XPP has reacted similarly to similar setups, especially when dealing with recent liquidation events such as the one vol default.

If XRP holds $1.81, XRP may start to bounce back to a higher accelerator, the initial level of the sticker. Traders are looking at $2.15-$2.20, with a broader trend line waiting above $2.30. From that level, the daily routine is done by <ወሮች> First structural correction and retraces the path to $2.57 in Q1.

Key technical CLASS support providing stabilization support includes:

Long lows and congested candlesticks with 20mm initial setup on lower timeframes.

XRP/USD price for Q1: could recover if liquidity improves

For new entrants, a clean entry strategy is a converging, converging pattern or a long-term wiggy-doji to converge in the $1.81-$1.90 zone. Confirmation above $2.06 with confirmation at 2.06 confirms that the market is turning into a recovery.

A well-managed combination usually stands below $1.81, $1.30, $2.57, and $3.52, and $3.12 versus $2.57.

Broader liquidity into December and the whales will carry from a bearish trading cycle to a more constructive cycle, creating a market position for the upcoming 2026 video cycle.

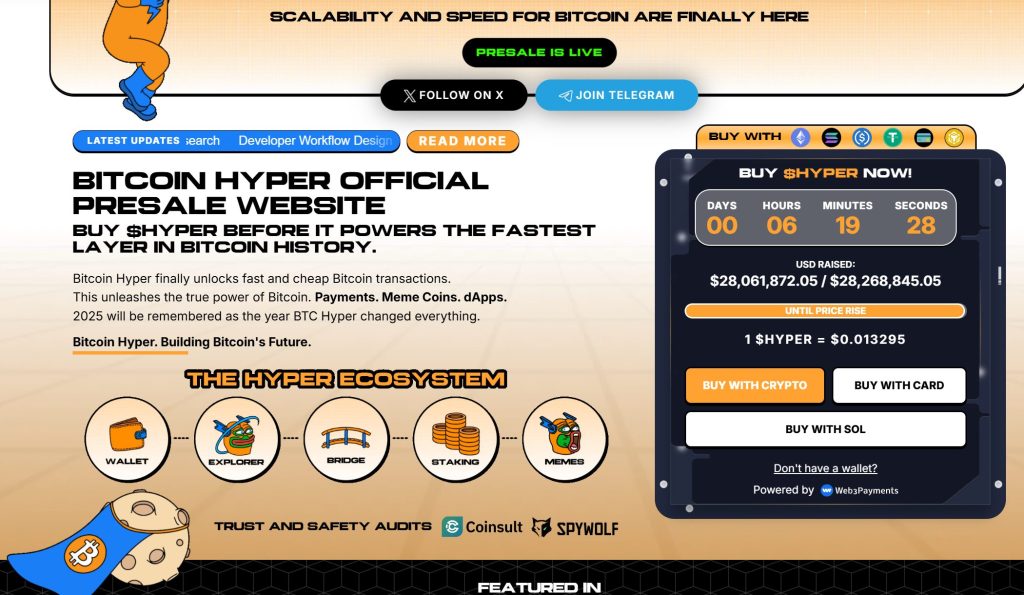

Bitcoin hyper: – The next B.C.

Bitcoin hyper ($Dyper) brings a new level to the Bitcoin ecosystem. If BTC remains the gold standard for security, Bitcoin Hi Perper adds what has always been missing: Solana-level speed. The result – simple-fast, low-cost smart contracts, unusual applications and the creation of Mame Coin Conin, all secured by bitcoin.

Made by a consulting audit, the project reinforces trust and monitors as adoption constructs. And speed is already strong. More than $28 million was paid at $0.0132295 before the next increase.

The events of the Bitcoin movement, the rise and demand for effective BTC-based applications, the Bitcoin hyper remains a bridge that includes the two crypto top ecosystems. If Bitcoin builds the foundation, Bitcoin is hyper fast, flexible and can do it again.

Click here to participate in Prezil

Closing news news analysed, cryptographic predictions