XRP reached the $100 billion market cap for the first time since 2018

Key receivers

The market capitalization of XRP exceeded 100 billion dollars for the first time in six years. The price of XRP increased due to market optimism following pro-crypto political developments.

Share this article

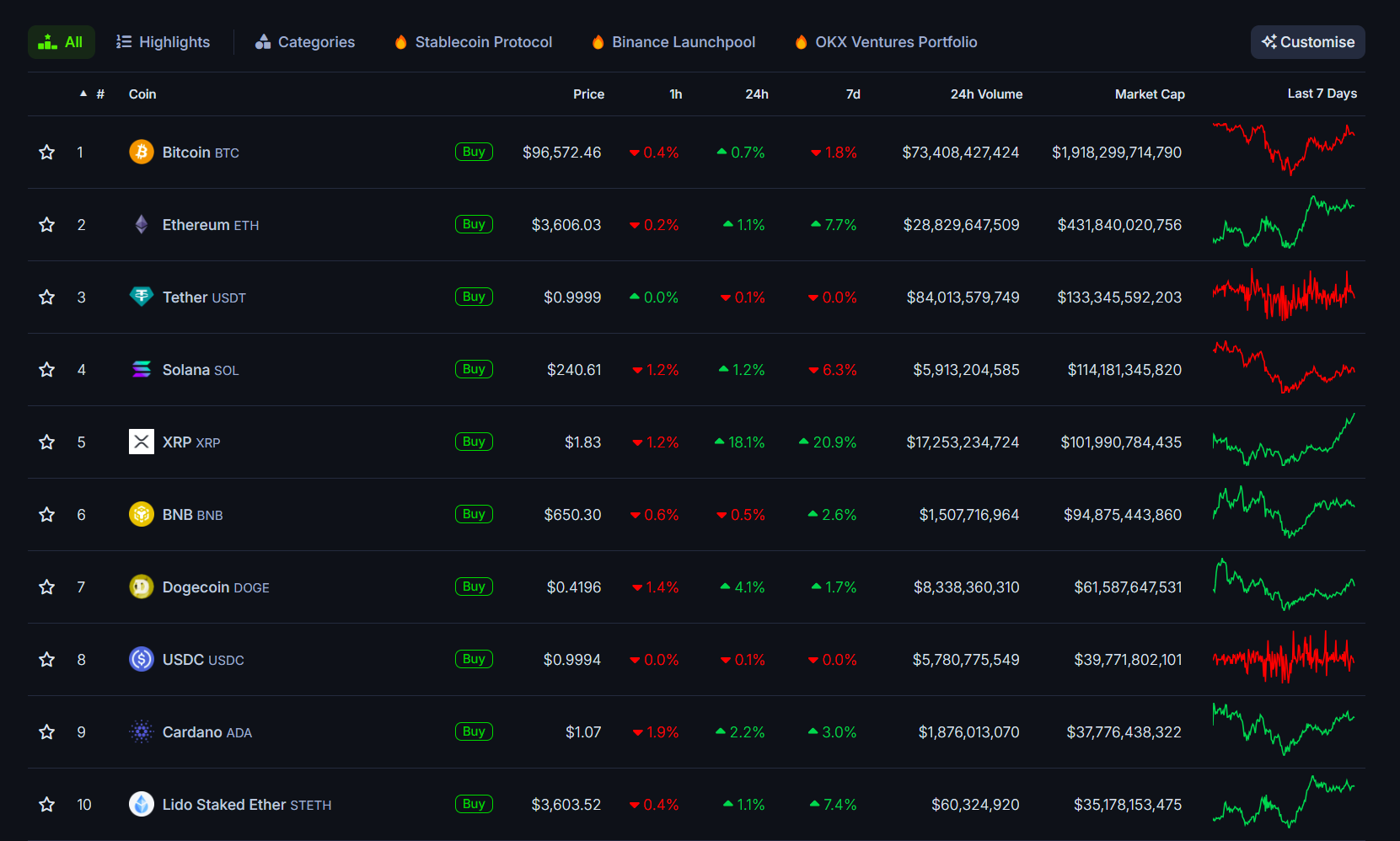

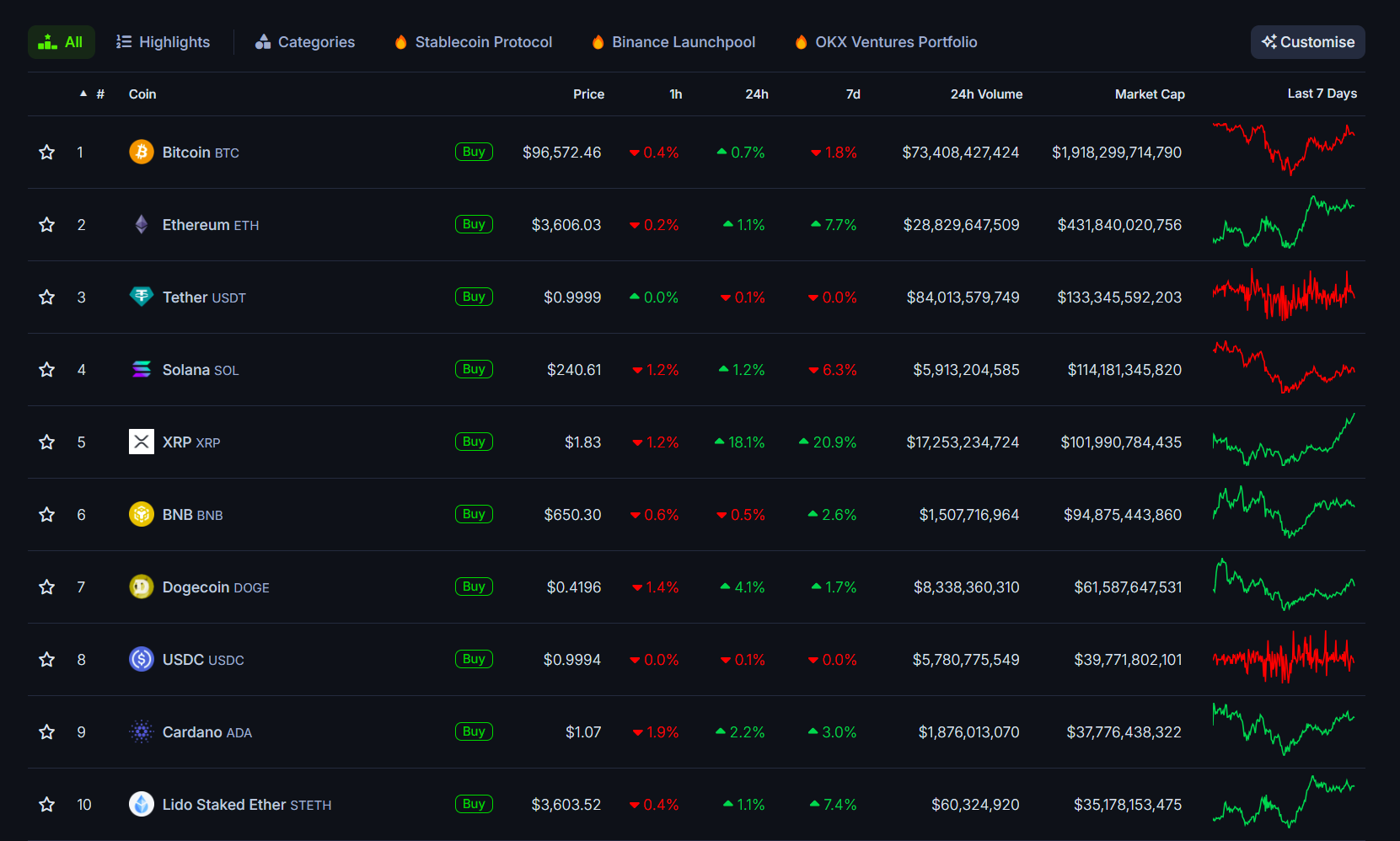

XRP's market capitalization surpassed $100 billion on Friday, reaching its highest level since January 2018 and overtaking BNB to become the fifth largest crypto asset by market value, according to CoinGecko data.

The token's price rose 18 percent to $1.8 in the last 24 hours, a weekly gain of 22 percent. XRP has gained 193% since the beginning of the year. The asset currently trails only Bitcoin, Ethereum, Tether, and Solana, with SOL's market cap estimated at $114 billion compared to XRP's $101 billion.

After Donald Trump won the presidency, XRP started its upward trend. Trump's pro-crypto stance raises hopes that the sector will grow in his second term. This led to optimism among investors and a massive rally in the market.

While Trump's re-election had a positive effect on XRP, the biggest gain was mainly related to the resignation of SEC Chairman Gary Gensler.

After Gensler hinted at his resignation, it is above $1 for the first time since November 2021, and has since risen 25% to $1.4 after the official announcement.

Gensler's resignation is seen as a major shift in Ripple's legal status. Experts believe that ongoing SEC cases against crypto companies, including Ripple, may be dismissed or resolved.

Positive developments in the stablecoin roadmap, coupled with Ripple's continued business expansion and institutional adoption, are fueling XRP's price increase.

Asset managers such as Bitwise and Canary Capital are actively pursuing SEC approval to launch XRP ETFs.

The blockchain company is expected to receive approval from the New York Department of Financial Services to launch the RLUSD stablecoin.

XRP's bullish run is facing a short-term correction

XRP could reach $1.90 or even $2 if the bulls continue to take charge. However, Maruton, an analyst at CryptoQuant Community, warned that the recent price increase was largely due to a flurry of transactions, which could lead to significant price inflation. In the past, the same event resulted in a 17% correction.

🚨 $XRP Is Experiencing a Leverage-Driven Pump!

Open interest is already up 37%—see volatility. The last similar event brought it down to -17%.

Stay safe, manage risk accordingly. #XRP #Crypto #Ripple #Onchain #Futurepic.twitter.com/Femb2xQKDH

— Maartun (@JA_Maartun) November 29, 2024

Additionally, XRP's Relative Strength Index (RSI) currently sits at 89. An RSI above 70 indicates overbought conditions, suggesting that the asset may be due for a pullback.

However, it should be noted that the RSI can remain in the overbought territory for longer periods in strong bullish trends without causing a price correction. Traders are advised to exercise caution and control their risk as they can cause volatility in the short term.

Share this article