XRP Whale Drops 18 Million Tokens, Price Drops?

XRP whales seem frustrated by the current bearish market sentiment. Today, September 19, 2024, blockchain transaction tracker Well Alert revealed that an XRP well on X (formerly Twitter) had converted 18.03 million tokens worth $10.39 million to the Bitstamp cryptocurrency. However, the wallet address is not known.

XRP Whale will load millions of tokens.

This significant XRP dump has the potential to generate selling pressure during a rally. At the time of press release, XRP is trading near $0.578 and has lost more than 1.8% in the last 24 hours. During the same period, the transaction volume increased by 15 percent.

XRP technical analysis and upcoming levels

For the past six days, the price of XRP has continued to strengthen between $0.56 and $0.59. According to expert technical analysis, in spite of the huge dump and continuous consolidation, XRP is trading above the 200 Exponential Moving Average (EMA). The 200 EMA is a technical indicator that traders and investors use to determine whether an asset is in an uptrend or downtrend.

Based on the price momentum, it looks like XRP may experience an inverted rally after breaking out of the consolidation zone. If XRP closes the daily candle above the $0.60 level, there is a strong possibility that it will rise by 20% to $0.75 in the coming days.

However, during this rally, XRP may face resistance around the $0.65 level, where it will face perceived selling pressure. This bullish view remains valid only if XRP closes a daily candle above the $0.60 level, otherwise it may fail.

Bearish On-chain parameters

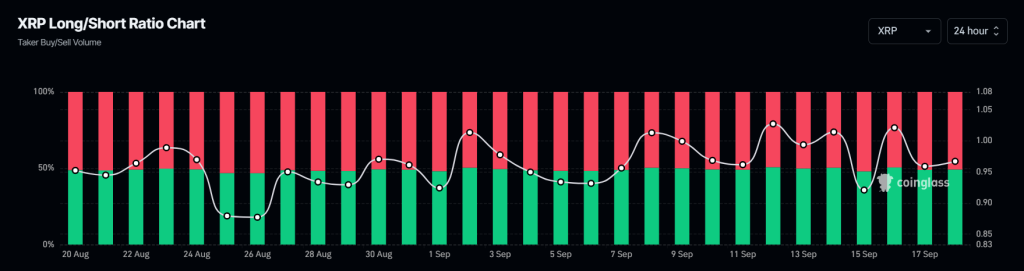

Currently, XRP's on-chain metrics are showing a bearish trend. Coinglass XRP's Long/Short ratio is currently at 0.96, indicating bearish market sentiment among traders. Additionally, the futures open demand has decreased by 5.5% in the last 24 hours.

According to the data, 50.85% of the main traders hold short positions, while 49.16% hold long positions, indicating that the bears dominate the asset.