ZILICA (ZIL) bears hovered as the price fell below critical levels.

The price of permissionless blockchain utility token ZIL has fallen by 37.29% this year. While holders are hoping for a recovery, analysis suggests the decline could continue for some time.

In March, the token reached an annual high of $0.040. But revisiting the region can be a daunting task, and here's why.

Zilica Bears control despite increasing attention

As of this writing, Zill's price is $0.016. On the daily chart, it trades below the 20 EMA. EMA stands for Exponential Moving Average and is a technical indicator that tracks price changes over a period of time.

Simply put, when the price of a cryptocurrency is above the EMA, the trend is bullish. Conversely, if the price is below the EMA, the trend is weak. The ZIL/USD chart shows that the price remained above the 20 EMA until July 30.

The situation at the time improved the prospects of recovery. Now that it's below him, that hope may be dashed as Ziel can continue to go down.

Read more: ZIL Staking: A step-by-step guide for beginners

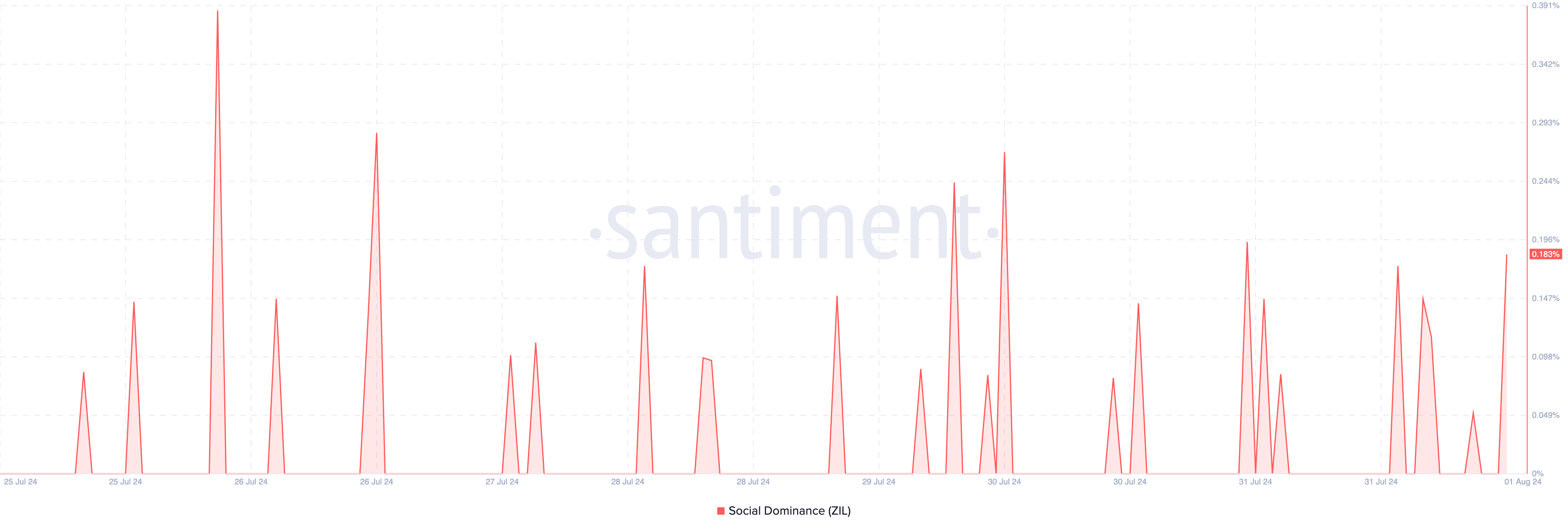

Zlaika's social dominance increased. The social dominance measure compares the amount of discussion around cryptocurrency to other projects.

The rise of social dominance means that crypto is getting good media coverage. On the other hand, the decline shows that other cryptocurrencies are gaining more recognition.

Therefore, the current status of Ziel corresponds to the increase of messages and posts. Although ZIL is getting relatively good market attention, this does not justify a price increase.

ZIL Price Forecast: Further correction ahead

Further review of ZIL's price action suggests that the token may experience consolidation over time. One reason for this theory is the Awesome Oscillator (AO). AO compares long-term and short-term price movements to determine momentum.

When the pointer is above the midpoint, it means that the speed is increasing. However, if the reading is in the red range, it indicates that it has increased to the bottom. The latter is the case of Zill, especially in the form of a red histogram bar.

In addition, ZIL may struggle to get out of bankruptcy. If selling pressure increases, the price may drop to $0.015. Failure to defend this point could force a correction to $0.012, especially if the price of Bitcoin (BTC) continues to decline.

Read more: Zilica (ZIL) Price Forecast 2024/2025/2030

However, if buying pressure increases, the token may miss reaching these targets. If that's the case, Zill's price could drop to $0.17.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.