$110 Million in Liquidations in 24 Hours: What’s Next for Bitcoin?

Bitcoin (BTC)'s rally to $40,000 has seen short sellers lose more than $100 million in the past 24 hours.

Notably, these benefits have not translated into bundled Bitcoin (wBTC) on Ethereum, despite the crypto market enjoying a green run.

Short sellers lost more than $100 million.

The recent surge in the cryptos market caught many market participants off guard as traders endured over $140 million in liquidations, while short sellers alone suffered over $110 million in losses. This is the second largest amount of short liquidity in any day since mid-November.

Bitcoin traders faced massive outflows totaling $36 million, mainly affecting those who had taken short positions. On the other hand, Ethereum traders experienced a liquidation of about 32 million dollars. And, Solana traders faced more than $6 million in liquidity as SOL prices briefly rose above $65, marking the highest price point since May 2022.

Crypto exchange Binance recorded the biggest loss among its peers with $53.44 million, followed by OKX with $51 million.

Read more: How to prepare for a Bitcoin ETF: A step-by-step approach

The outflows come as Bitcoin continues its year-long rally. Technical analyst Koroush AK said that Bitcoin has found new resistance at $40,000 and built strong support around $38,000, hinting at a possible altseason on the horizon.

“[Bitcoin’s] New resistance is $40,000, and new support is $38,000. It's time to rotate to altcoins again, especially those that break local highs… We haven't had a red weekly candle for almost 2 months,” Korush AK said.

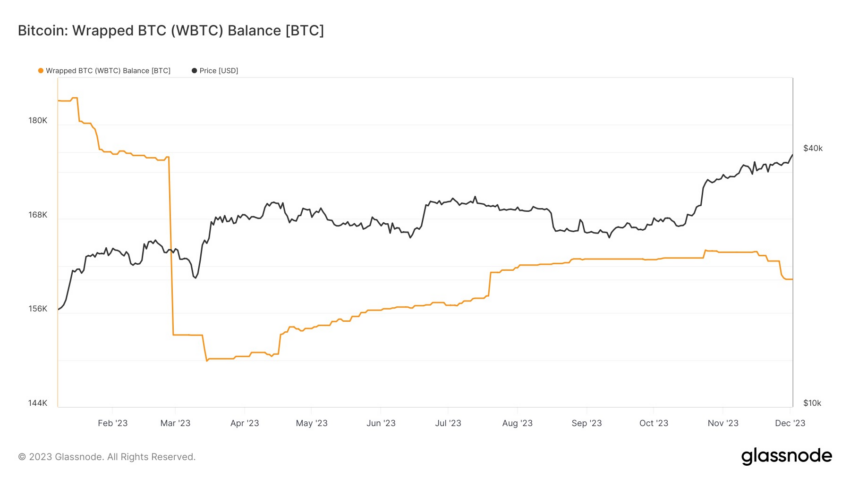

November supply of wBTC discount

The supply of Bitcoin (wBTC) on Ethereum fell by 2% or more than 3,000 BTC in November. This shows that demand for BTC on the ETH blockchain has remained muted despite the rising price of the underlying asset.

The wBTC order book shows that the digital asset has been burning more than creating in the past month. Currently, 160,286 wBTC are held against 160,293 BTC.

Read More: How to Trade Bitcoin Futures and Options Like a Pro

Tom Wan, a research analyst at 21co, explained that the decline in the balance could be linked to the decrease in appetite for DeFi and the emergence of BRC-20 on the blockchain network. At the peak of supply, demand for wBTC was relatively high as investors took advantage of their DeFi activity.

However, as several DeFi protocols struggle to reach their previous heights, demand for wBTC has waned.

“Despite the increase in BTC price (+10.8%) in November, wBTC supply decreased by 3,456 (-2.16%). DeFi appetite has not yet fully picked up. TVL on Ethereum is still down 75% compared to ATH. Wan added.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content.