Aave took over Defin for $24 million in monthly payments

Decentralized crypto platform Aave (AAVE) has emerged as the leader among the top five lending and borrowing protocols, recording over $24 million in payments in the past 30 days.

Aave allows users to create liquid markets by offering or borrowing assets to earn interest.

Ave Protocol is led by 30-day payments.

In terms of token terminals, Ave leads the lending and borrowing sector, followed by Morpho Labs, Venus, Compound Finance and Moonwell. Michael Nadeau, founder of DeFi Report, noted that Ave commands a 64 percent market share in the lending and borrowing markets.

Ave boasts 4.6 times more active loans than its closest competitor and 6.3 times more TVL than the top two Solana loan/loan applications combined. Loans on Aave have increased 3.6 times since the FTX collapse, although they are below 60% by the end of 2021.

Over the past year, Ave generated $293 million in total fees, with Aave DAO accounting for 13.3%, or $38.9 million. The DAO revenue will peak in June 2024.

Read more: What is Aave?

Nadeau's research shows that Ave has achieved profitability on-chain this cycle, with DAO revenue outpacing token incentives. This shift indicates that the protocol is becoming more dependent on token incentives to attract users.

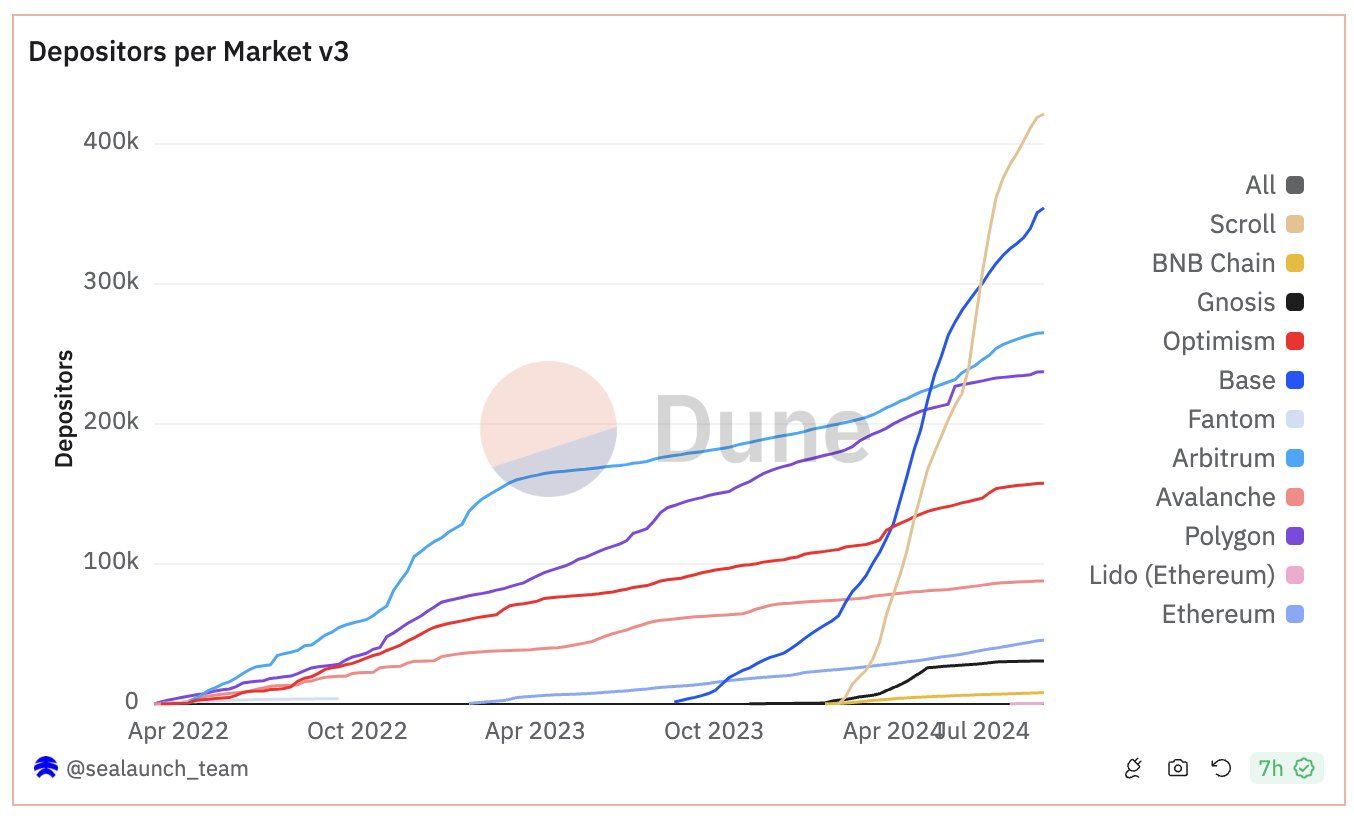

Meanwhile, Ave creator Stani Kulekov spoke of the quiet success of the rollout market on Aave. This is a strategic move that has the potential to shape the sector following the deployment of Aave V3 on the Scroll mainnet.

For Aave, this merger will allow us to take advantage of our higher revenue and reduced gas fees, effectively increasing the scale and reach of our lending service. Additionally, Ave is benefiting from its expanded user base, tapping into the active community that Scroll has developed.

Amid Trump DeFi Venture, Whales Are Interested in AAVE

Amid Aave's positive developments, large owners were expanding their portfolios. BeenCrypto reports that on August 21, one whale bought more than 50,000 AAVE tokens worth $6.65 million, shortly after another whale bought 11,101 tokens worth $1.45 million. Additionally, Lookonchain revealed that two more whales acquired 16,592 AAVE tokens worth $2.2 million on Thursday.

This growing demand is driven by Aave's strategic integrations and Donald Trump's DeFi initiative. Trump's site aims to establish a decentralized financial system using Aave's non-custodial lending platform and Ethereum infrastructure, introducing its supporters to DeFi.

With the launch of Trump's new AAVE partnership protocol, it's surprising to see DeFi at the center of this election. IMO, DeFi is the heart and future of crypto,” wrote Jared Gray, developer at Sushi Labs.

Global Liberty Financial Legal Counsel Gabriel Shapiro described Diffie's venture into Ave as a “lightweight custodial feeder” that allows users to deposit without the need for a fork.

Read More: Aave (AAVE) Price Prediction 2024/2025/2030

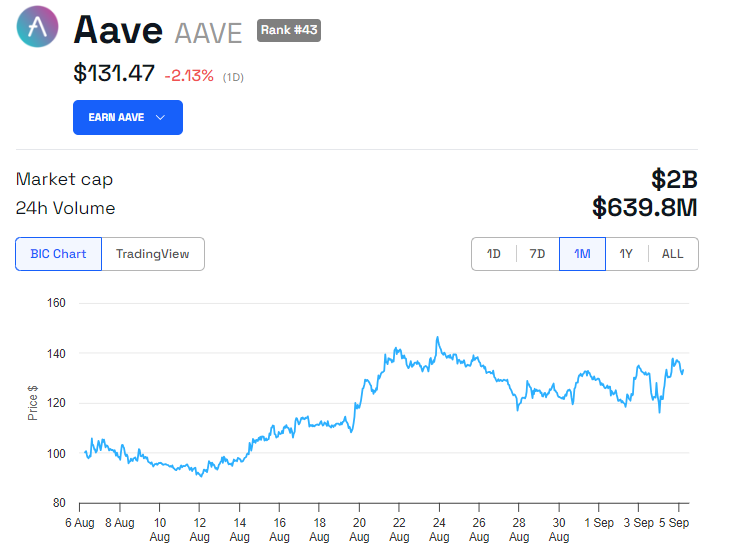

News around the world of Liberty Financial, Aave's mainstream adoption, has increased confidence in AAVE's speculative acquisition potential. Following the news, AAVE rose 10 percent. However, data from BeInCrypto shows that the token has since erased most of its gains and is trading at $131.47.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.