AAVE Wales Flood Exchanges,

AAVE, the management symbol of the popular lending protocol Aave, is experiencing downward pressure as large holders, or whales, began a significant sell-off early Tuesday.

This analysis explores potential price targets as AAVE's value responds to intense selling pressure from whales.

Ave Wells Holdings sells

In a post on X on Tuesday, on-chain sleuth Lookonchain AAVE noted that whales are actively selling their holdings, with significant withdrawals seen in recent transactions.

A whale identified as address 0x7634 has withdrawn 25,790 AAVE (around $3.39 million) from the Ave protocol and transferred it to the MEXC exchange. Just three hours ago, another whale, address 0x790c, removed 7,822 AAVE (approximately $1.04 million) from Aave and sent it to Binance. Additionally, crypto trading firm Cumberland deposited 10,000 AAVE into OKX.

The activity of these AAVE whales resulted in a significant increase in the exchange rate balance. At press time, this balance is 53,000 AAVE, representing the highest one-day flow since September 10, according to Sentiment data.

Read more: How to use Aave?

The exchange flow balance measures the net inflow or outflow of a cryptocurrency, calculated by subtracting the total outflow from deposits. An increase in this measure indicates that a large amount of assets are being sent to exchanges. Such high volume flows usually indicate a drop in price, as the increased selling pressure can increase the market's absorbency.

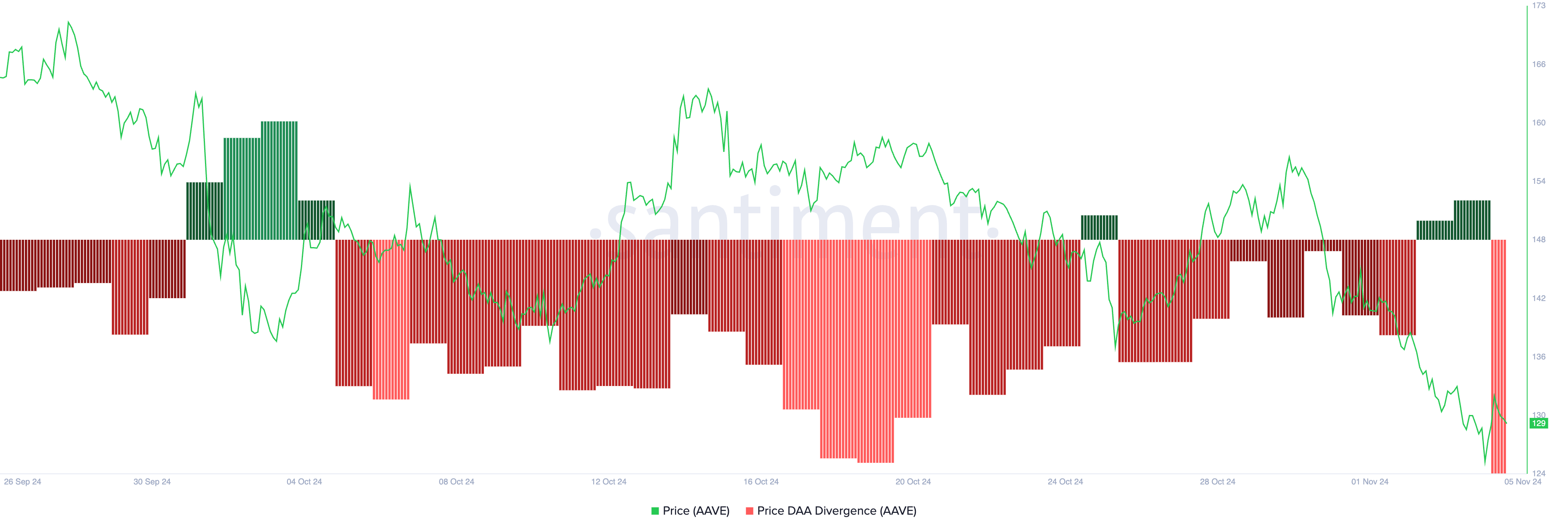

AAVE's negative daily active address (DAA) divergence confirms this increase in selling pressure in the market. At press time, the metric is -39.24%.

This metric compares the price movement of an asset to the changes in daily active addresses. Investors use it to monitor whether price movements are supported by the corresponding network activity. A negative value indicates weakening demand and potential selling pressure.

AAVE Price Forecasting: Where Are the Threats and Opportunities?

AAVE is currently trading at $130.29, hovering slightly above its key support level at $128.45. A decrease in buying speed indicates the risk of falling below this threshold. If the price of AAVE breaks through this support, it could drop further to $116.10.

Read more: 11 best DeFi protocols to watch in 2024

Conversely, if market sentiment turns bullish, AAVE could see a reversal, with the price moving towards the next resistance level at $140.79.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.